- United States

- /

- Insurance

- /

- NasdaqGS:ROOT

Root (ROOT): Assessing Valuation After Mixed Third Quarter Earnings and Market Response

Reviewed by Simply Wall St

Root (ROOT) just released its third quarter earnings, catching the market’s attention with a jump in revenue and record policy growth. However, the release also sparked some immediate investor anxiety following a quarterly net loss and shrinking margins.

See our latest analysis for Root.

ROOT’s latest earnings beat did not stop its share price from sliding 6.66% the following day. This highlights how much investors are focusing on margin pressure and competitive headwinds rather than recent growth wins. Despite recent volatility, Root’s shares still show an 11.9% year-to-date return and a truly staggering 1,021% total shareholder return over three years. This confirms both the company’s comeback potential and the rollercoaster journey for longer-term holders.

If the rapid rise and recent swings in ROOT’s story have piqued your curiosity, now is a great chance to expand your search and discover fast growing stocks with high insider ownership

The conflicting signals in Root’s recent results set up a key question for investors: does the company’s current valuation reflect lingering risks, or might recent volatility reveal a window to buy before anticipated growth is fully priced in?

Most Popular Narrative: 33.9% Undervalued

Root’s most widely followed narrative values the stock at $124.40 per share, a notable premium to its last close of $82.20. This sizable gap reflects confidence in the company’s strategic growth, even as its recent results have sparked debate about future earnings potential.

The rapid iteration and deployment of Root's next-generation AI and machine learning pricing models have materially improved risk segmentation and increased customer lifetime value by over 20%, positioning the company to enhance future gross margins and net income as loss ratios improve.

What’s the secret behind this bullish price target? The narrative doubles down on forecasts tied to next-gen tech, expanding markets, and a dramatic financial turnaround, but the biggest surprises are hidden in the financial projections shaping that lofty valuation. Will these big expectations stand up to market reality? Find out in the full breakdown.

Result: Fair Value of $124.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition in digital channels and heavy reliance on ongoing investment could present real challenges to Root’s ambitious growth trajectory.

Find out about the key risks to this Root narrative.

Another View: Is the Market Too Optimistic?

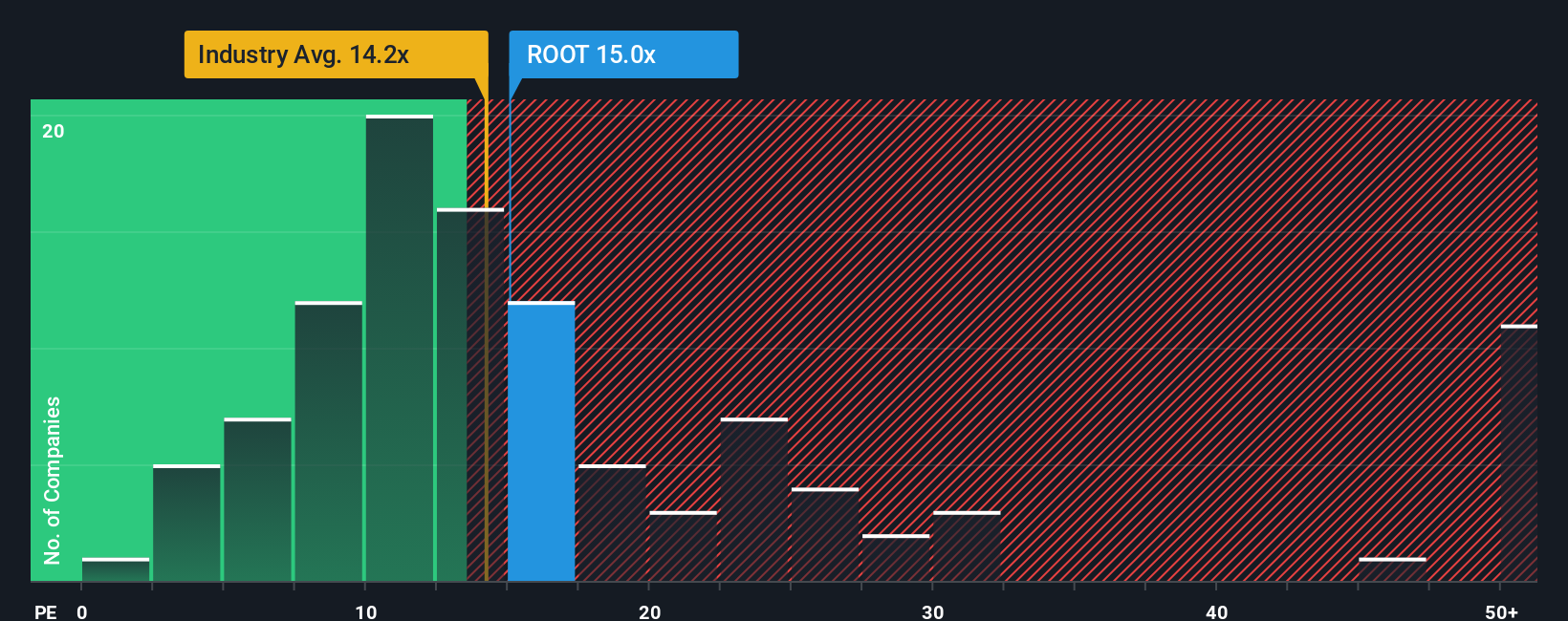

Looking at Root’s valuation through its price-to-earnings ratio paints a very different picture. The current ratio sits at 23.6x, far above the US Insurance industry average of 13.2x, the peer average of 12.5x, and the fair ratio of 10.4x the market could move toward. This gap suggests investors are paying a premium, which leaves little margin for error if growth stalls. How long will the market keep believing in the turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Root Narrative

If you’re inclined to challenge these narratives or prefer to dive into the numbers on your own terms, you can craft a personalized perspective in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Root.

Looking for More Smart Investment Opportunities?

Great investors know there is always another promising stock around the corner. Act now to spot tomorrow’s winners; otherwise, you might regret missing these standout ideas.

- Target higher yields and put your cash to work with these 15 dividend stocks with yields > 3% that consistently deliver robust dividends above 3%.

- Tap into future innovation by following these 27 quantum computing stocks, spotlighting companies at the forefront of quantum computing breakthroughs.

- Power up your watchlist by scanning these 26 AI penny stocks blazing trails in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROOT

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives