- United States

- /

- Insurance

- /

- NasdaqGS:ROOT

Not Many Are Piling Into Root, Inc. (NASDAQ:ROOT) Stock Yet As It Plummets 32%

The Root, Inc. (NASDAQ:ROOT) share price has softened a substantial 32% over the previous 30 days, handing back much of the gains the stock has made lately. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 958%.

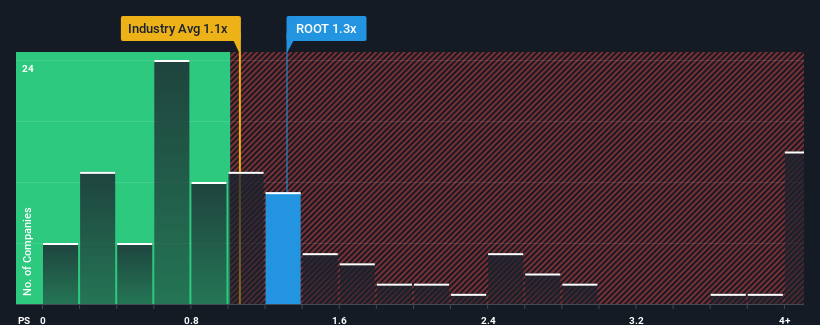

In spite of the heavy fall in price, it's still not a stretch to say that Root's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Insurance industry in the United States, where the median P/S ratio is around 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Root

What Does Root's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Root has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Root's future stacks up against the industry? In that case, our free report is a great place to start.How Is Root's Revenue Growth Trending?

Root's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 117% gain to the company's top line. Pleasingly, revenue has also lifted 120% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 35% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 3.7% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Root's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Root's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Root looks to be in line with the rest of the Insurance industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Root's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Root (1 is a bit unpleasant!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ROOT

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives