- United States

- /

- Insurance

- /

- NasdaqGS:PLMR

Could Analyst Caution on PLMR Reflect Deeper Questions About Palomar Holdings’ Long-Term Strategy?

Reviewed by Sasha Jovanovic

- In recent days, several analysts, including those from Evercore ISI Group, JP Morgan, Keefe, Bruyette & Woods, and Piper Sandler, have updated their views on Palomar Holdings, maintaining their existing ratings while adjusting future expectations for the company.

- This pattern of ongoing rating maintenance alongside revised outlooks highlights continuing uncertainty and shifting sentiment among market participants regarding Palomar Holdings’ future prospects.

- We'll explore how the continued analyst caution and revised outlooks might influence Palomar Holdings’ long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Palomar Holdings Investment Narrative Recap

To be a shareholder in Palomar Holdings, you need to believe that demand for specialty insurance in catastrophe-exposed property lines will keep expanding, underpinning premium growth and solid underwriting performance. The recent trend of maintained analyst ratings, even as price targets are adjusted lower, signals caution but does not materially affect the company’s key short-term catalyst, robust growth in residential earthquake and flood insurance, or change the primary risk, which remains exposure to reinsurance cost swings and claim volatility from natural disasters.

Among recent announcements, Palomar’s new strategic partnership with Neptune Flood stands out, as it enhances the company’s flood insurance reach by leveraging cutting-edge AI technology. This move aligns directly with the catalyst of broadening specialty insurance offerings and supports the ongoing growth theme in catastrophe-prone segments, reinforcing the company’s position as it continues to expand its top-line performance.

On the other hand, investors should be cautious of the risks tied to Palomar’s heavy reliance on reinsurance and catastrophe-exposed markets, especially if industry conditions shift and...

Read the full narrative on Palomar Holdings (it's free!)

Palomar Holdings' narrative projects $1.3 billion in revenue and $268.3 million in earnings by 2028. This requires 23.0% yearly revenue growth and a $113.4 million earnings increase from $154.9 million today.

Uncover how Palomar Holdings' forecasts yield a $159.67 fair value, a 37% upside to its current price.

Exploring Other Perspectives

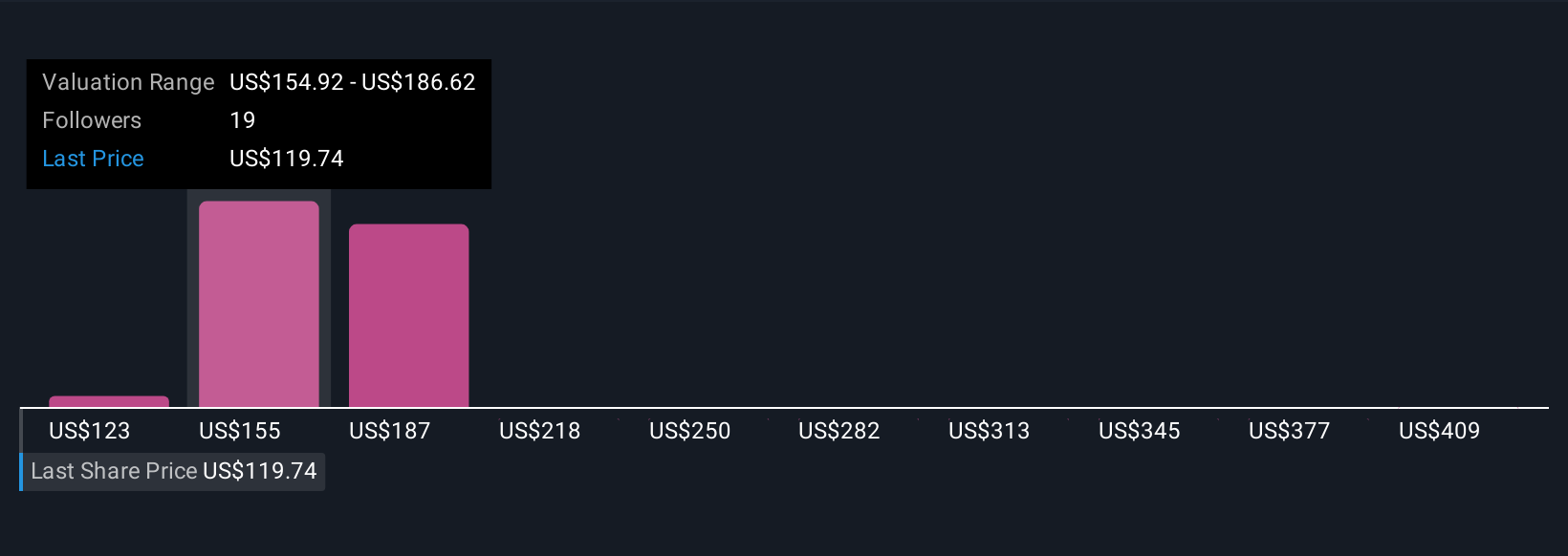

Simply Wall St Community members set fair values for Palomar Holdings from US$123.22 to US$440.20 across six independent estimates. With continued reliance on catastrophe-exposed lines posing unique risks, your expectations may diverge significantly from the analyst consensus, see what other investors are forecasting.

Explore 6 other fair value estimates on Palomar Holdings - why the stock might be worth just $123.22!

Build Your Own Palomar Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Palomar Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Palomar Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Palomar Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLMR

Palomar Holdings

A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026