- United States

- /

- Insurance

- /

- NasdaqGS:PFG

Principal Financial Group (NasdaqGS:PFG) Appoints Joel Pitz As New CFO And EVP

Reviewed by Simply Wall St

Principal Financial Group (NasdaqGS:PFG) recently appointed Joel Pitz as the chief financial officer and executive vice president, marking a pivotal leadership change. This corporate shift aligns with the company's positive price movement of 12% over the last month. During the same period, the broader market exhibited growth of 11% over the past year, but remained flat last week, signifying that the company's executive appointments added weight to this trend. Furthermore, the company's buyback program updates and first-quarter earnings—despite showing a decline in revenue and income—were initially concerning, yet didn't hinder PFG's upward trajectory.

The recent appointment of Joel Pitz as CFO and executive vice president at Principal Financial Group could influence the company's future strategy, particularly in managing financial resources and navigating market volatility. Despite the company's revenue and earnings showing a decline in the first quarter, the share price's upward move of 12% suggests investor confidence in the leadership change and potential effectiveness in cost management and strategic direction.

Over the long term, Principal Financial Group's total return, including share price and dividends, was 148.71% over five years, highlighting considerable growth. In contrast, the company underperformed the broader US market over the past year, which returned 11.7%, indicating some challenges in recent momentum.

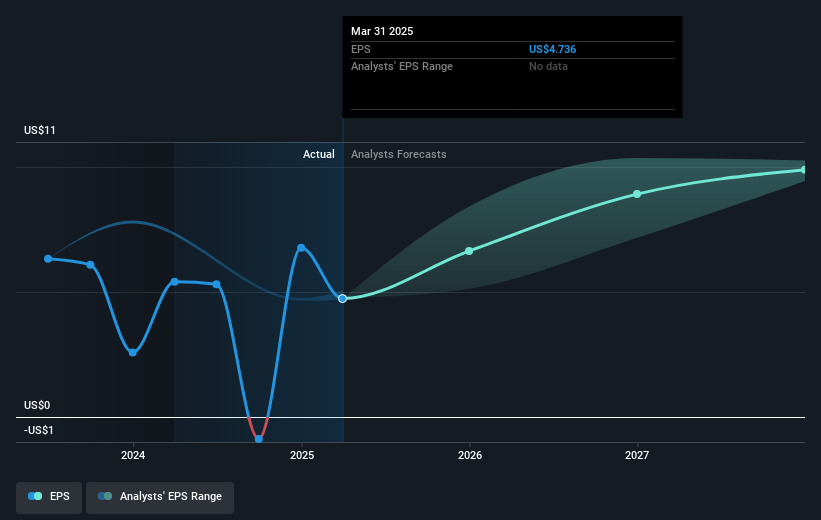

The leadership change, combined with the company's efforts to capitalize on growth opportunities in the retirement and global asset management sectors, could affect revenue and earnings forecasts positively. Analysts predict a 4.4% annual revenue growth over the next three years, with profit margins expected to rise to 11.6%. Given the current share price of US$76.34, slightly below the consensus analyst price target of US$81.08, there is confidence in continued growth. Nonetheless, potential market volatility remains a concern, requiring management to efficiently implement strategic initiatives to maintain momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFG

Principal Financial Group

Provides retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives