- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

Undiscovered Gems In The US Market Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

The United States market has experienced a robust upswing, rising 5.8% in the last week and climbing 4.8% over the past year, with all sectors gaining ground and earnings projected to grow by 14% annually. In this favorable environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking to uncover potential growth stories before they become widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 32.14% | 14.78% | 4.37% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

International General Insurance Holdings (NasdaqCM:IGIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: International General Insurance Holdings Ltd. operates as a specialty insurance and reinsurance provider, with a market capitalization of approximately $1.06 billion.

Operations: IGIC generates revenue primarily from Specialty Short-Tail and Specialty Long-Tail segments, contributing $256.02 million and $146.30 million, respectively. The Reinsurance segment adds $80.82 million to the total revenue, while Corporate contributes an additional $55.88 million.

International General Insurance Holdings (IGI) stands out with its disciplined underwriting and risk management, contributing to stable earnings and net margins around 24.7%. The company is expanding in the U.S. and Europe, aiming for a 3% annual revenue growth over three years. Recent results show Q4 revenue at US$135 million, up from US$129 million year-over-year, though net income dipped to US$30 million from US$33 million. IGI has repurchased 220,354 shares for approximately US$4.93 million recently as part of a larger buyback strategy totaling 5.22 million shares since May 2022.

PDF Solutions (NasdaqGS:PDFS)

Simply Wall St Value Rating: ★★★★★★

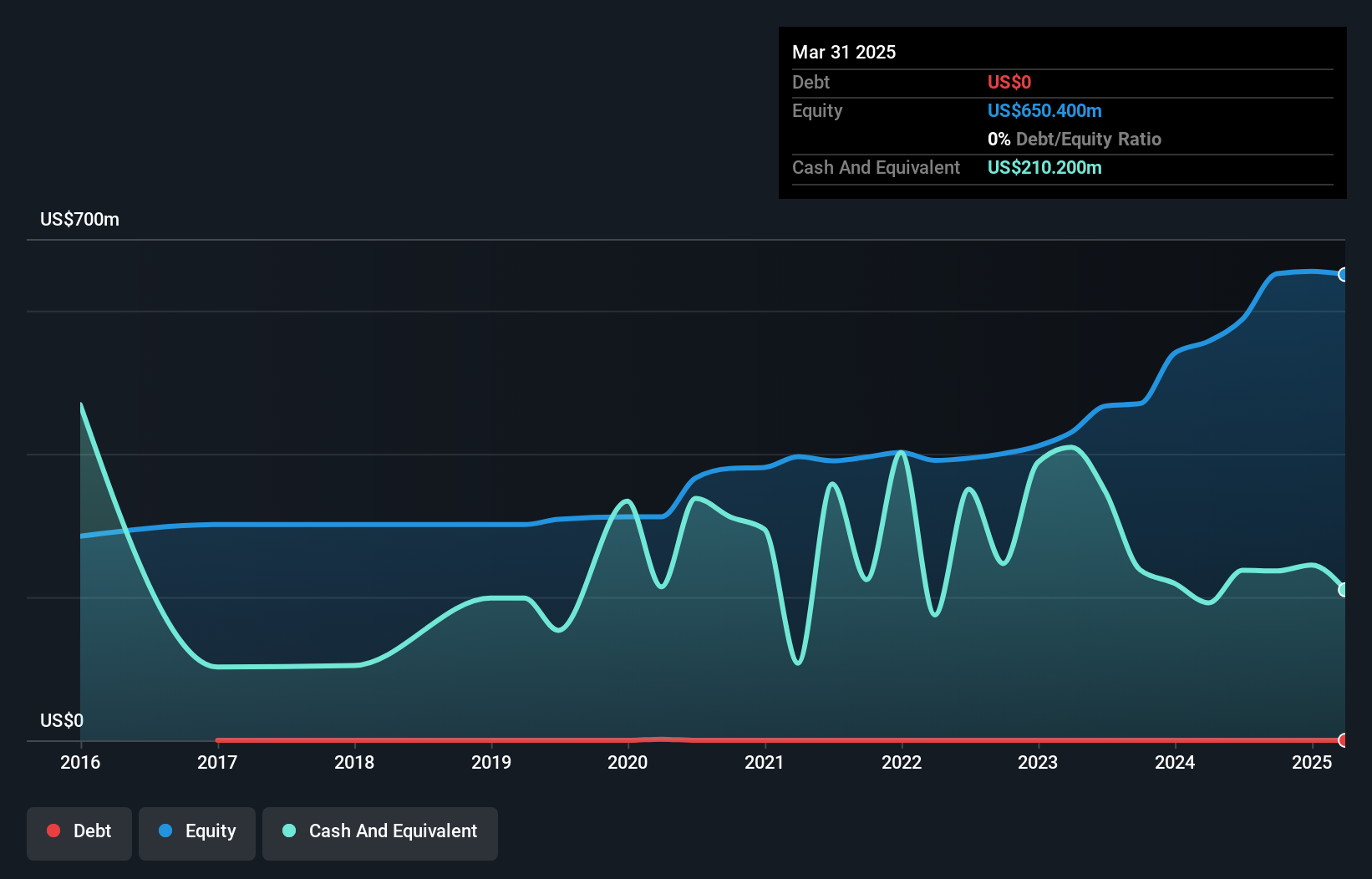

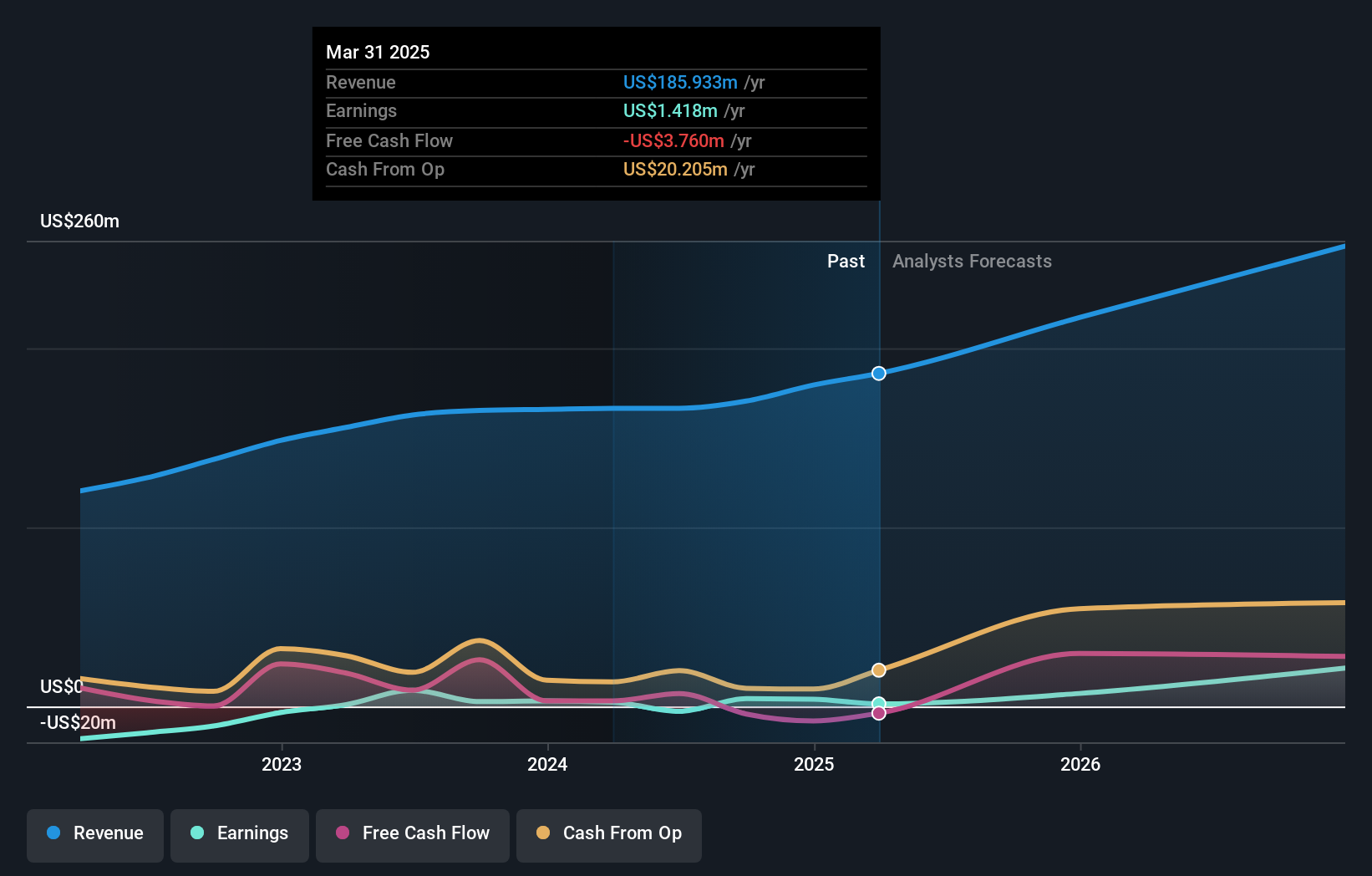

Overview: PDF Solutions, Inc. offers proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, methodologies, and professional services across various countries including the United States and Asia with a market cap of $715.39 million.

Operations: PDF Solutions generates revenue primarily from its Software & Programming segment, which reported $179.47 million. The company's market cap stands at $715.39 million.

PDF Solutions, a nimble player in the semiconductor sector, posted an impressive 30.7% earnings growth last year, outpacing the industry's -5.9%. The company is debt-free and trades at 20.9% below its estimated fair value, suggesting potential undervaluation. Recent earnings reports reveal full-year sales of US$179 million with net income rising to US$4 million from US$3 million previously. Despite no share buybacks recently and negative free cash flow of -US$8 million as of late 2024, PDF's focus on AI applications could drive future revenue growth projected at nearly 18% annually.

Banco Latinoamericano de Comercio Exterior S. A (NYSE:BLX)

Simply Wall St Value Rating: ★★★★★☆

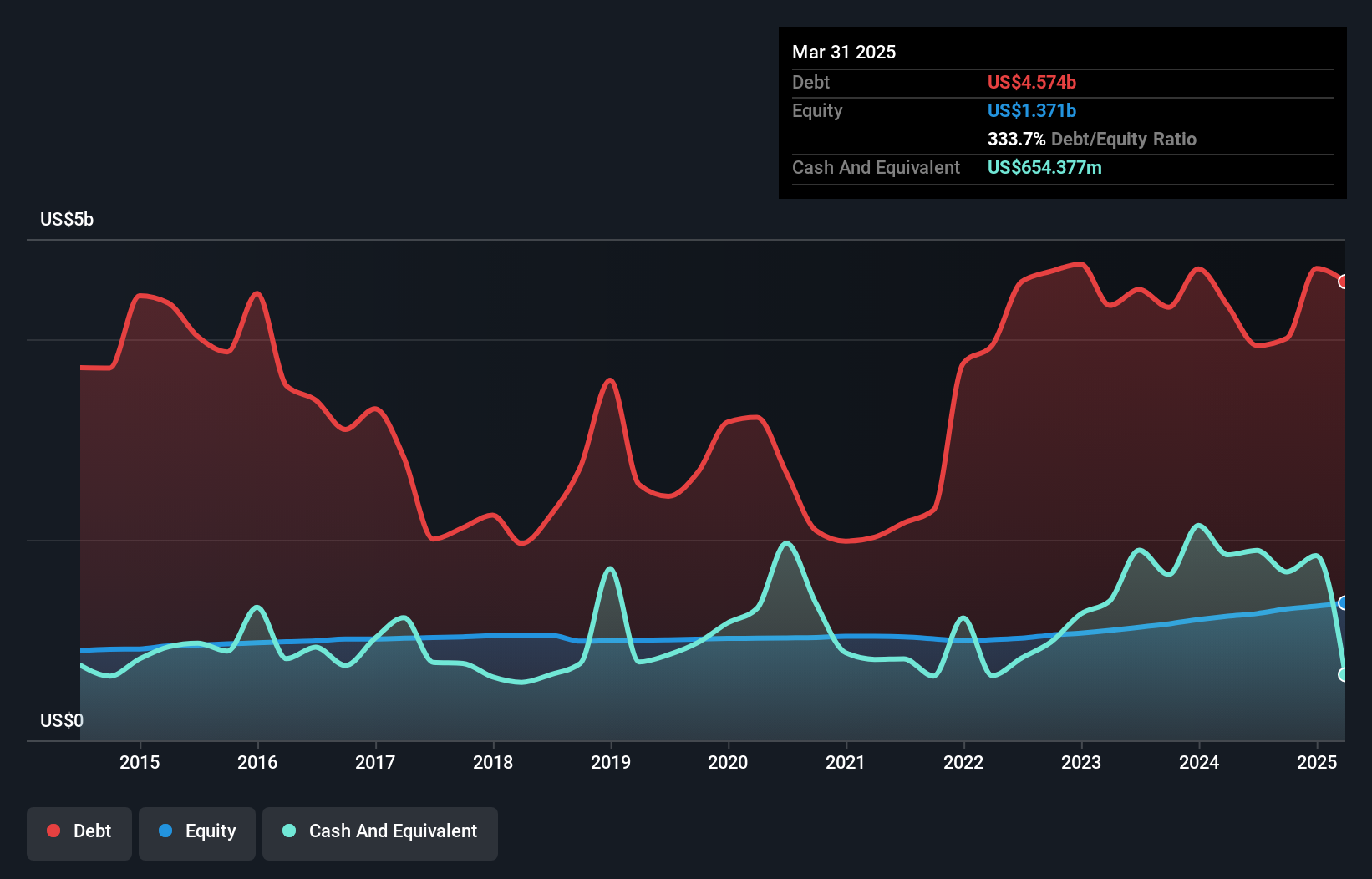

Overview: Banco Latinoamericano de Comercio Exterior S.A. (NYSE:BLX) is a financial institution that provides trade financing solutions across Latin America and the Caribbean, with a market cap of approximately $1.34 billion.

Operations: BLX generates its revenue primarily from two segments: Treasury, contributing $27.87 million, and Commercial, which accounts for $258.47 million. The company's financial performance is influenced by these revenue streams.

Bladex, with assets totaling US$11.9 billion and equity of US$1.3 billion, is making strides in the financial sector by expanding its client base by 70% and reducing onboarding times by 52%. The bank's strategic initiatives include a new trade finance platform aimed at boosting non-interest income. With total loans at US$8.3 billion and deposits of US$5.4 billion, Bladex maintains a strong position with an appropriate bad loan ratio of 0.2% and a sufficient allowance for bad loans at 459%. Analysts project earnings growth to continue, forecasting annual revenue growth of 10% over the next three years.

Taking Advantage

- Click this link to deep-dive into the 283 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PDF Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives