- United States

- /

- Insurance

- /

- NasdaqGM:HUIZ

Potential Upside For Huize Holding Limited (NASDAQ:HUIZ) Not Without Risk

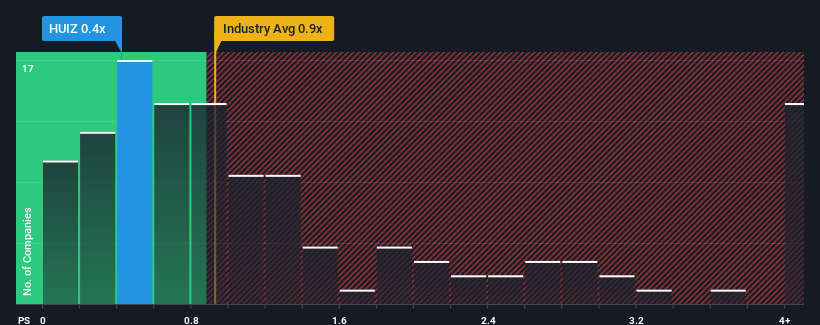

Huize Holding Limited's (NASDAQ:HUIZ) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Insurance industry in the United States have P/S ratios greater than 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Huize Holding

What Does Huize Holding's Recent Performance Look Like?

Huize Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Huize Holding.How Is Huize Holding's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Huize Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 38% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 4.5% growth forecast for the broader industry.

In light of this, it's peculiar that Huize Holding's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Huize Holding currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Huize Holding is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Huize Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Huize Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HUIZ

Huize Holding

Offers online insurance product and service platform through various internet channels in the People’s Republic of China.

Flawless balance sheet and good value.