- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

Goosehead Insurance (GSHD) Is Up 5.8% After CEO Miller Increases Stake To 35,000 Shares

Reviewed by Sasha Jovanovic

- Recently, Goosehead Insurance President & CEO Mark Miller bought 5,000 additional shares, lifting his ownership to 35,000 shares according to an SEC filing.

- This insider purchase, combined with fresh but mixed analyst commentary, spotlights growing debate over Goosehead’s broker model, competitive pressures, and growth outlook.

- Next, we’ll explore how Miller’s increased share ownership could influence Goosehead Insurance’s existing investment narrative and perceived long-term resilience.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Goosehead Insurance Investment Narrative Recap

To own Goosehead Insurance, you need to believe its franchise-driven broker model can keep scaling despite rising competitive and regulatory pressure. Miller’s insider purchase is a confidence signal but does not materially change the key near term catalyst, which remains execution on profitable premium and agent growth, or the biggest risk, which is a slowdown in high quality franchise expansion that could weigh on revenue and earnings momentum.

The recent share repurchase activity, especially the US$58.62 million buyback of 685,000 shares in Q3 2025, is most relevant alongside Miller’s purchase, since both concentrate ownership among committed holders while the company pursues its growth agenda. Together, they frame a story where management is leaning into Goosehead’s model at a time when analysts are debating whether competitive and carrier pressures could challenge its ability to convert written premiums into sustainable revenue growth.

Yet behind these confident moves, investors should be aware of how fragile growth becomes if franchise recruiting and agent productivity start to...

Read the full narrative on Goosehead Insurance (it's free!)

Goosehead Insurance's narrative projects $588.5 million revenue and $71.4 million earnings by 2028. This requires 20.0% yearly revenue growth and about a $41.5 million earnings increase from $29.9 million today.

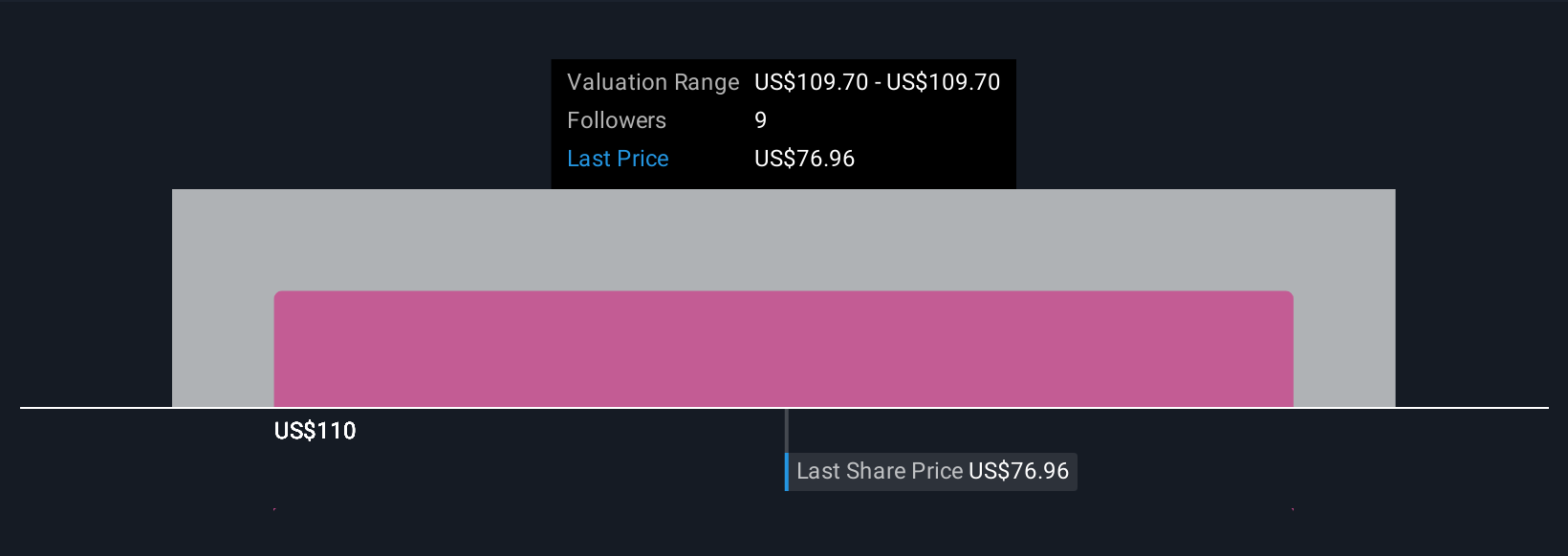

Uncover how Goosehead Insurance's forecasts yield a $93.70 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see fair value between US$72.42 and US$93.70 across 2 independent estimates, underscoring how far opinions can spread. You should weigh those views against the central risk that Goosehead’s franchise agent network must keep expanding efficiently to support the current growth narrative.

Explore 2 other fair value estimates on Goosehead Insurance - why the stock might be worth as much as 23% more than the current price!

Build Your Own Goosehead Insurance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goosehead Insurance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goosehead Insurance's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026