- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

Did Erie Indemnity's (ERIE) Earnings Miss Signal a Shift in Its Resilient Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Erie Indemnity Company reported second quarter 2025 earnings that missed analyst expectations, with both diluted earnings per share and revenue coming in below forecasts.

- Despite these headwinds, the company is recognized for strong financial health, consistent dividend payments, and a notable track record of revenue growth and high return on equity compared to peers.

- We'll examine how the recent earnings shortfall and Erie’s financial resilience shape the company's current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Erie Indemnity's Investment Narrative?

For shareholders in Erie Indemnity, a central belief is that the company’s strengths, robust financial health, reliable dividends, and high returns on equity, stack up well even following a tough earnings report and the stock’s fall to new lows. The recent news about earnings and revenue missing forecasts might seem to threaten near-term momentum, yet the larger catalysts for the business, such as its long dividend track record, strong capital base, and steady management execution, appear intact for now. The market’s sharp reaction mainly reflects heightened sensitivity to shortfalls after a challenging year, rather than a wholesale change in the business fundamentals. Risks do shift slightly here: A drawn-out period of weak results could test investor patience and valuation, especially given the stock’s higher-than-average pricing relative to peers and the broader insurance industry. Overall, the latest earnings miss seems unlikely to shift the bigger drivers or risk profile dramatically, but ongoing underperformance could weigh more heavily if trends persist.

Yet, pricing risk remains a critical concern for those closely following Erie Indemnity’s story.

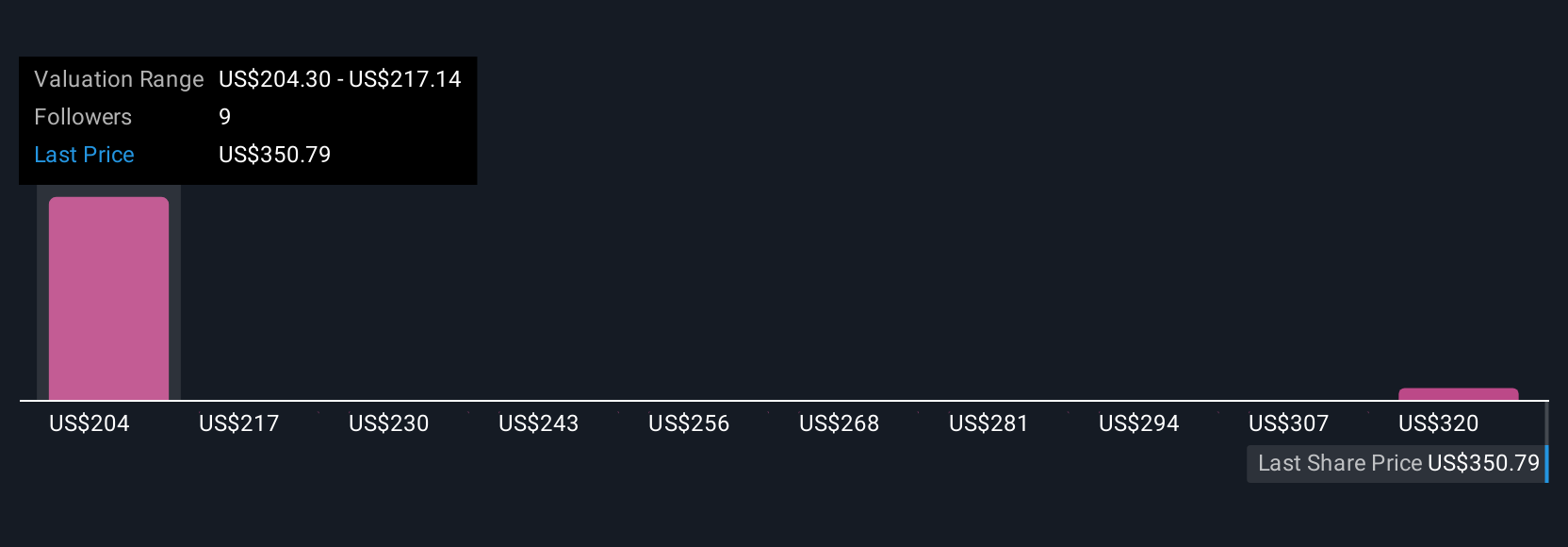

Erie Indemnity's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Erie Indemnity - why the stock might be worth 36% less than the current price!

Build Your Own Erie Indemnity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erie Indemnity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Erie Indemnity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erie Indemnity's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives