- United States

- /

- Insurance

- /

- NasdaqGS:CINF

Cincinnati Financial (CINF): Valuation Update Following Strong Q3 2025 Earnings and Analyst Optimism

Reviewed by Simply Wall St

Cincinnati Financial (CINF) impressed investors with its latest earnings release, as Q3 2025 results came in stronger than anticipated. The boost was largely thanks to outsized gains in the company’s equity securities portfolio and a notable drop in catastrophe-related losses.

See our latest analysis for Cincinnati Financial.

Cincinnati Financial’s share price has enjoyed steady upward momentum this year, rising 16.5% year-to-date and delivering an 8.6% total shareholder return over the past twelve months. Thanks to strong Q3 earnings and another dividend affirmation, investors are clearly perceiving more growth potential and a favorable risk profile compared to earlier in the year.

If Cincinnati’s strong run has you looking for what else could break out next, consider broadening your search and discover fast growing stocks with high insider ownership

While Cincinnati Financial’s share performance and recent earnings look promising, the key question for investors is whether the current price fully reflects future growth, or if there is still a compelling buying opportunity left.

Most Popular Narrative: 3.8% Undervalued

With Cincinnati Financial’s fair value estimate sitting just above the most recent closing price, the outlook is tilting to a modest upside. This small margin signals a market in close alignment with consensus on future growth and earnings potential.

Consistent underwriting discipline, profitable premium growth, diversified expansion, strong investment results, and technology-driven efficiencies are supporting Cincinnati Financial's long-term earnings stability and competitive positioning.

Want a glimpse inside the math behind that valuation? The narrative leans heavily on bold assumptions about future profit margins, long-term earnings and premium growth, and an above-average projected price multiple, which is well beyond what is typical for the industry. Curious what is driving analysts to forecast this kind of fair value? Unpack the details in the full narrative.

Result: Fair Value of $172.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Cincinnati Financial remains vulnerable if catastrophe claims surge or if industry competition intensifies, either of which could challenge today's upbeat outlook.

Find out about the key risks to this Cincinnati Financial narrative.

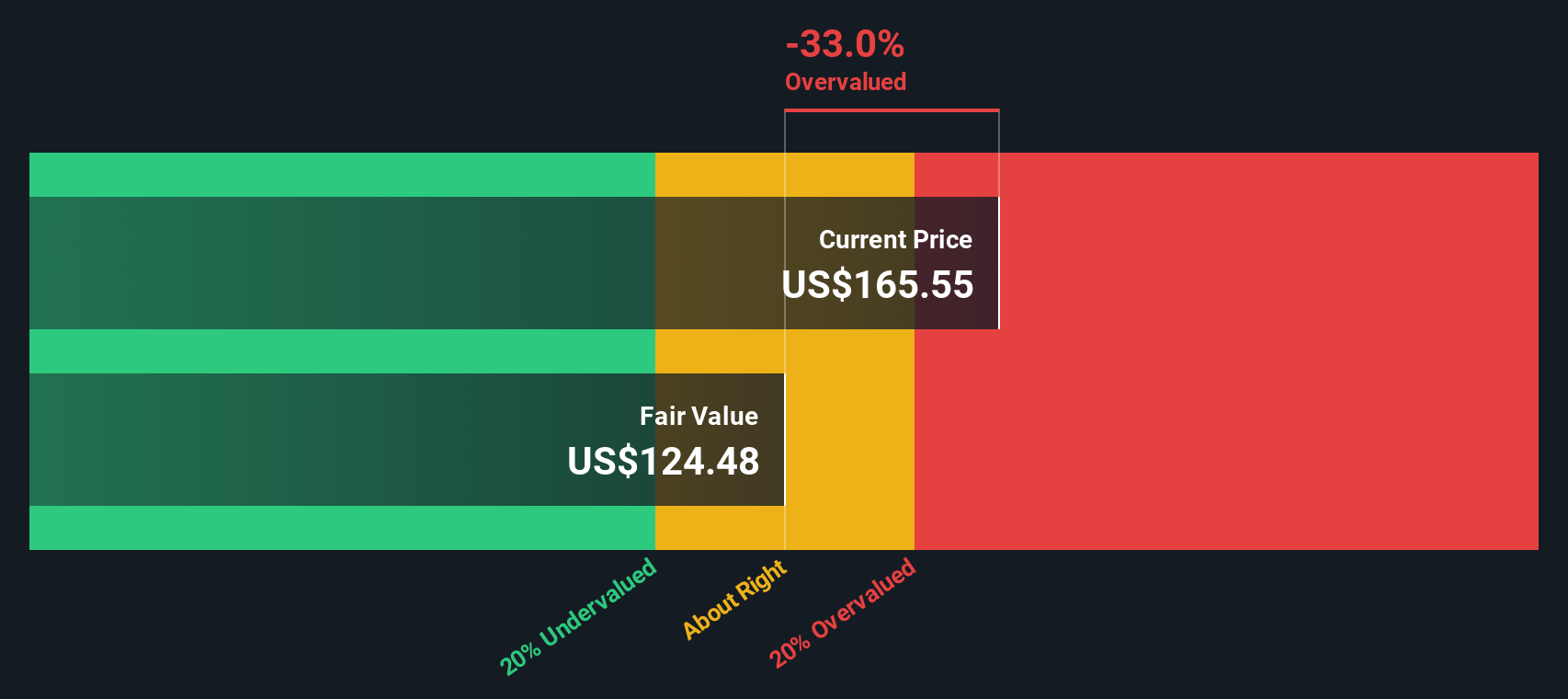

Another View: SWS DCF Model Insight

While analyst consensus values Cincinnati Financial’s upside based on earnings and market multiples, our SWS DCF model offers a different picture. Using projected cash flows, the DCF currently sees the stock trading above its fair value. This could suggest that recent optimism is already fully reflected in the price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cincinnati Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cincinnati Financial Narrative

If you want to dive deeper and reach your own conclusions, it only takes a few minutes to craft a personalized analysis that fits your view. So why not Do it your way

A great starting point for your Cincinnati Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't sit on the sidelines while new opportunities are rising to the top. Tap into smarter strategies by checking out these curated selections. Your next great investment could be waiting.

- Uncover steady income opportunities by starting with these 16 dividend stocks with yields > 3%, which deliver yields above 3% and have solid payout histories.

- Accelerate your growth strategy by spotlighting these 26 AI penny stocks, powering advancements in artificial intelligence, automation, and machine learning.

- Get ahead of the crowd by scanning these 927 undervalued stocks based on cash flows, where you'll spot potential bargains trading below intrinsic value based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CINF

Cincinnati Financial

Provides property casualty insurance products in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives