- United States

- /

- Insurance

- /

- NasdaqGS:AMSF

If You Like EPS Growth Then Check Out AMERISAFE (NASDAQ:AMSF) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like AMERISAFE (NASDAQ:AMSF). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for AMERISAFE

How Quickly Is AMERISAFE Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, AMERISAFE's EPS has grown 25% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

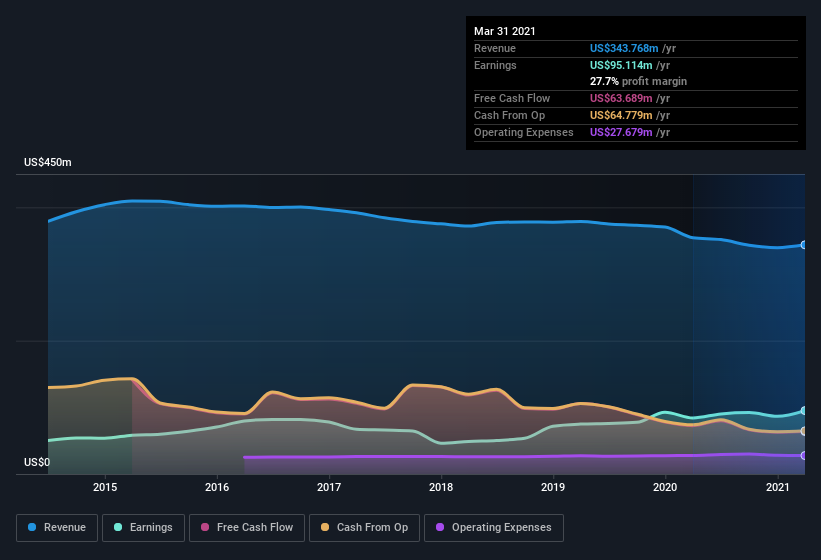

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that AMERISAFE's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. AMERISAFE's EBIT margins have actually improved by 4.5 percentage points in the last year, to reach 34%, but, on the flip side, revenue was down 3.0%. That falls short of ideal.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of AMERISAFE's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are AMERISAFE Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no AMERISAFE insiders reported share sales in the last twelve months. But the really good news is that Independent Director Sean Traynor spent US$509k buying stock stock, at an average price of around US$63.59. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

The good news, alongside the insider buying, for AMERISAFE bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$23m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 1.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Gerry Frost, is paid less than the median for similar sized companies. For companies with market capitalizations between US$1.0b and US$3.2b, like AMERISAFE, the median CEO pay is around US$3.7m.

The AMERISAFE CEO received US$1.9m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does AMERISAFE Deserve A Spot On Your Watchlist?

You can't deny that AMERISAFE has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for AMERISAFE you should be aware of, and 1 of them is a bit concerning.

The good news is that AMERISAFE is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade AMERISAFE, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:AMSF

AMERISAFE

An insurance holding company, underwrites workers’ compensation insurance in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives