- United States

- /

- Insurance

- /

- NasdaqGS:ACGL

Do You Like Arch Capital Group Ltd. (NASDAQ:ACGL) At This P/E Ratio?

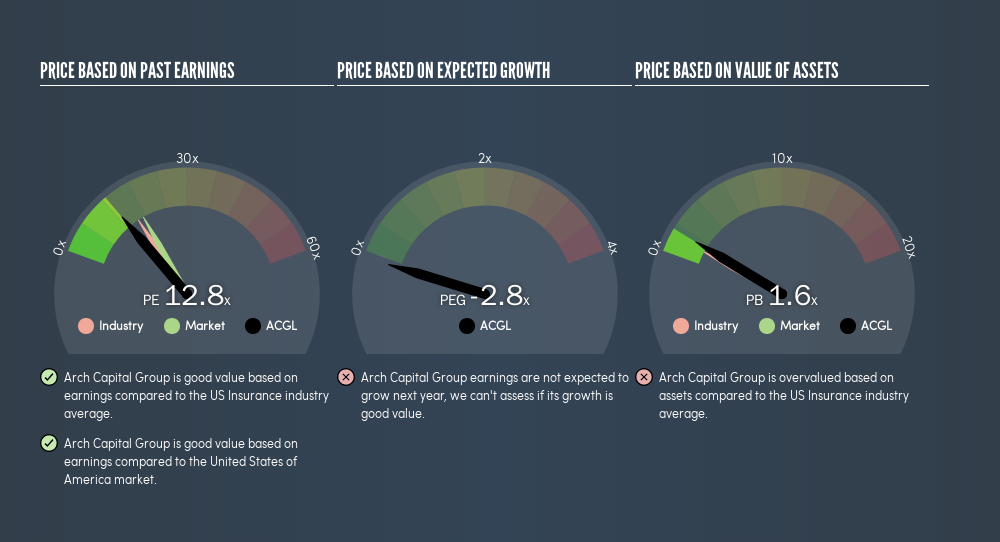

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). To keep it practical, we'll show how Arch Capital Group Ltd.'s (NASDAQ:ACGL) P/E ratio could help you assess the value on offer. Based on the last twelve months, Arch Capital Group's P/E ratio is 12.8. That means that at current prices, buyers pay $12.8 for every $1 in trailing yearly profits.

Check out our latest analysis for Arch Capital Group

How Do You Calculate Arch Capital Group's P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Arch Capital Group:

P/E of 12.8 = $39.5 ÷ $3.09 (Based on the trailing twelve months to June 2019.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.'

How Does Arch Capital Group's P/E Ratio Compare To Its Peers?

We can get an indication of market expectations by looking at the P/E ratio. If you look at the image below, you can see Arch Capital Group has a lower P/E than the average (15.7) in the insurance industry classification.

Its relatively low P/E ratio indicates that Arch Capital Group shareholders think it will struggle to do as well as other companies in its industry classification.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. That means even if the current P/E is high, it will reduce over time if the share price stays flat. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Arch Capital Group's 140% EPS improvement over the last year was like bamboo growth after rain; rapid and impressive. Even better, EPS is up 32% per year over three years. So you might say it really deserves to have an above-average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

Arch Capital Group's Balance Sheet

Arch Capital Group's net debt is 6.2% of its market cap. The market might award it a higher P/E ratio if it had net cash, but its unlikely this low level of net borrowing is having a big impact on the P/E multiple.

The Verdict On Arch Capital Group's P/E Ratio

Arch Capital Group has a P/E of 12.8. That's below the average in the US market, which is 17.3. The company does have a little debt, and EPS growth was good last year. If it continues to grow, then the current low P/E may prove to be unjustified.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: Arch Capital Group may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:ACGL

Arch Capital Group

Provides insurance, reinsurance, and mortgage insurance products in the United States, Canada, Bermuda, the United Kingdom, Europe, and Australia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives