Stock Analysis

- United States

- /

- Insurance

- /

- NasdaqGS:ACGL

Arch Capital Group (NASDAQ:ACGL) Shareholders Booked A 51% Gain In The Last Five Years

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Arch Capital Group Ltd. (NASDAQ:ACGL) share price is up 51% in the last five years, that's less than the market return. Zooming in, the stock is actually down 16% in the last year.

Check out our latest analysis for Arch Capital Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Arch Capital Group achieved compound earnings per share (EPS) growth of 9.4% per year. This EPS growth is reasonably close to the 9% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. In fact, the share price seems to largely reflect the EPS growth.

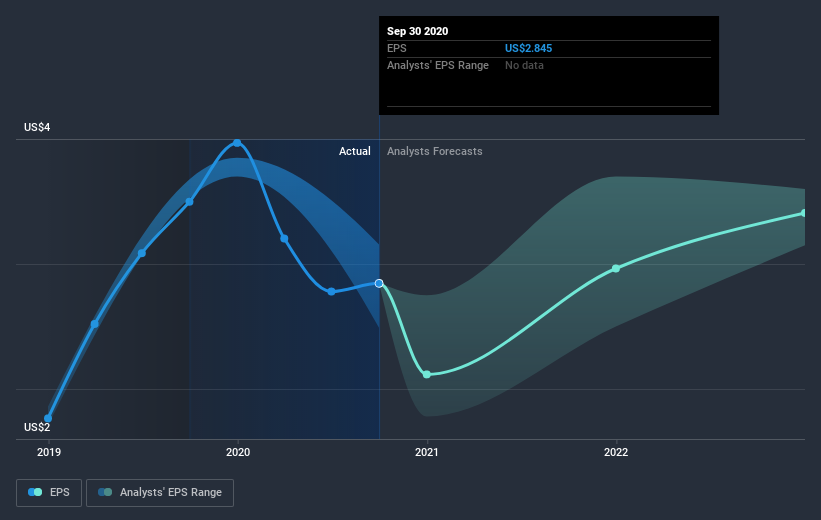

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Arch Capital Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Arch Capital Group had a tough year, with a total loss of 16%, against a market gain of about 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 9% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Arch Capital Group you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Arch Capital Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Arch Capital Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:ACGL

Arch Capital Group

Provides insurance, reinsurance, and mortgage insurance products worldwide.

Outstanding track record and undervalued.