- United States

- /

- Diversified Financial

- /

- NasdaqCM:PAYS

Bridgewater Bancshares And 2 Other Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market grapples with mixed performances and heightened volatility, particularly in the tech sector driven by AI valuation concerns, investors are increasingly focusing on companies with strong fundamentals and insider confidence. In this environment, growth companies like Bridgewater Bancshares that boast significant insider ownership are often seen as promising candidates due to the alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 51.6% |

| StubHub Holdings (STUB) | 21.9% | 73.4% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23% | 74.1% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 45.3% |

| Atour Lifestyle Holdings (ATAT) | 17.9% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 27.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Here's a peek at a few of the choices from the screener.

Bridgewater Bancshares (BWB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bridgewater Bancshares, Inc. is the bank holding company for Bridgewater Bank, offering a range of banking products and services in the United States with a market cap of $462.32 million.

Operations: The company generates revenue primarily through its banking segment, which accounted for $127.24 million.

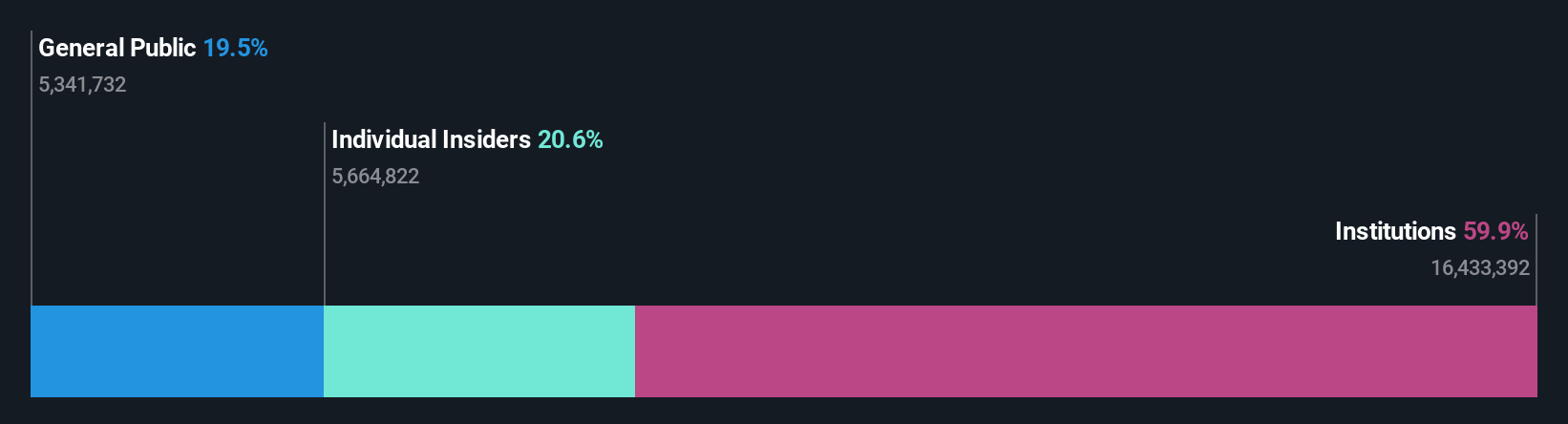

Insider Ownership: 20.6%

Revenue Growth Forecast: 14.7% p.a.

Bridgewater Bancshares is trading 26.8% below its estimated fair value, with analysts expecting a 23.3% price increase. Earnings are projected to grow at 22% annually, surpassing the US market average of 15.9%. Recent earnings reports show net income increased to US$11.6 million from US$8.68 million year-over-year for Q3 2025, despite substantial insider selling over the past quarter and no significant recent insider buying activity.

- Dive into the specifics of Bridgewater Bancshares here with our thorough growth forecast report.

- Our valuation report here indicates Bridgewater Bancshares may be undervalued.

Paysign (PAYS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paysign, Inc. offers prepaid card programs, patient affordability solutions, digital banking services, and payment processing for various sectors with a market cap of $281.27 million.

Operations: The company generates revenue from its vertically integrated provider of prepaid card products and processing services, totaling $58.38 million.

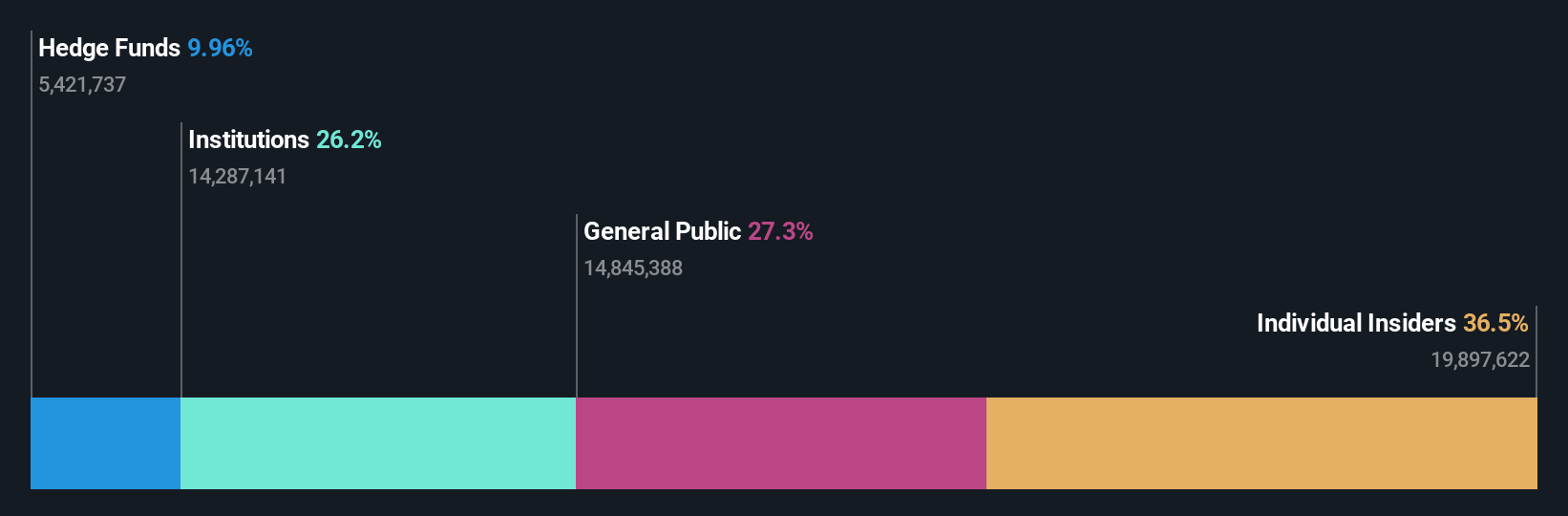

Insider Ownership: 36.1%

Revenue Growth Forecast: 17.5% p.a.

Paysign's recent earnings report shows robust growth, with Q3 2025 net income rising to US$2.22 million from US$1.44 million year-over-year, driven by a significant increase in patient affordability business revenues. The company projects full-year 2025 revenues between US$80.5 million and US$81.5 million, reflecting strong growth expectations despite past legal challenges and no recent insider trading activity. Paysign's revenue is forecast to grow faster than the overall market at 17.5% annually, supporting its growth trajectory.

- Click here to discover the nuances of Paysign with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Paysign's share price might be too optimistic.

Yatsen Holding (YSG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yatsen Holding Limited, along with its subsidiaries, develops and sells beauty products in the People’s Republic of China and has a market cap of approximately $641.92 million.

Operations: Yatsen Holding Limited's revenue is primarily derived from the development and sale of beauty products in China.

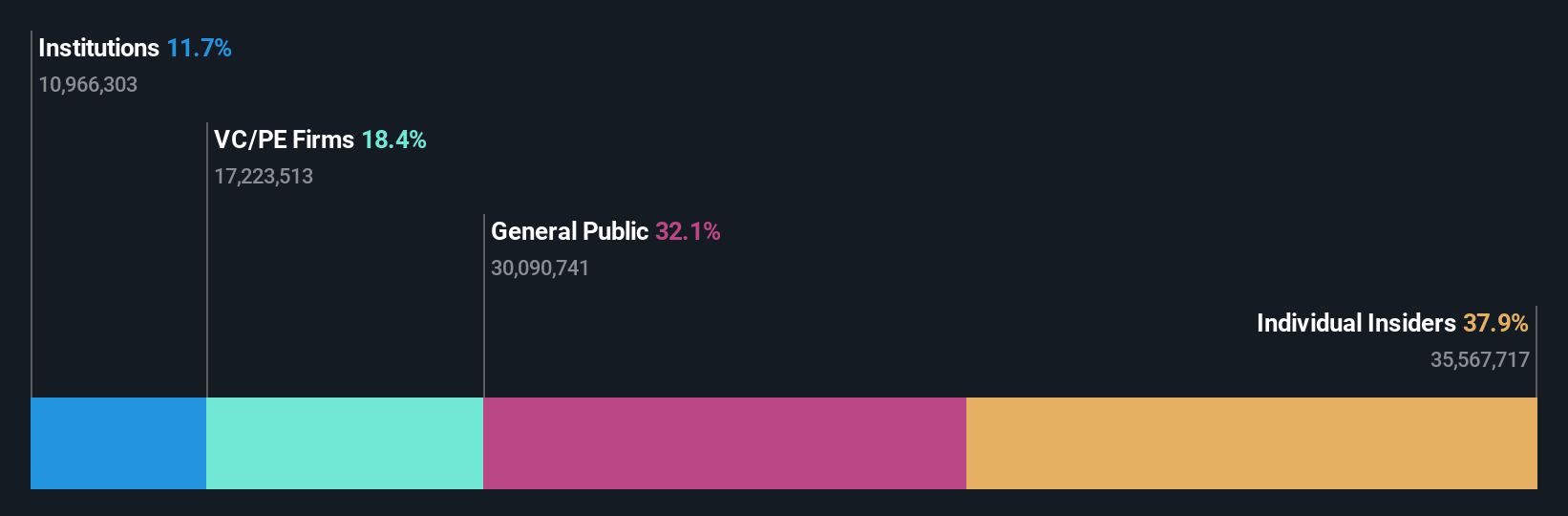

Insider Ownership: 37.9%

Revenue Growth Forecast: 14.9% p.a.

Yatsen Holding's earnings report for Q3 2025 shows sales of CNY 998.42 million, up from CNY 677.02 million a year earlier, while net loss narrowed to CNY 65.96 million from CNY 121.07 million. The company is trading at a significant discount to its estimated fair value and is expected to achieve profitability within three years with earnings projected to grow annually by over 128%. Revenue growth of 14.9% per year outpaces the US market average.

- Unlock comprehensive insights into our analysis of Yatsen Holding stock in this growth report.

- According our valuation report, there's an indication that Yatsen Holding's share price might be on the cheaper side.

Taking Advantage

- Click this link to deep-dive into the 193 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PAYS

Paysign

Provides prepaid card programs, comprehensive patient affordability offerings, digital banking services, and integrated payment processing services for businesses, consumers, and government institutions.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives