- United States

- /

- Personal Products

- /

- NYSE:USNA

USANA Health Sciences, Inc.'s (NYSE:USNA) Prospects Need A Boost To Lift Shares

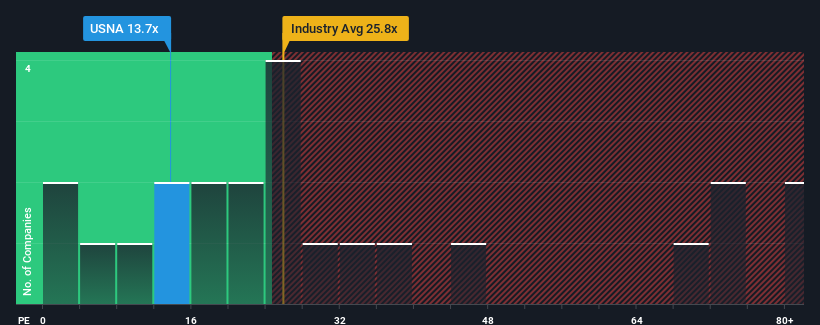

With a price-to-earnings (or "P/E") ratio of 13.7x USANA Health Sciences, Inc. (NYSE:USNA) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, USANA Health Sciences has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for USANA Health Sciences

Is There Any Growth For USANA Health Sciences?

There's an inherent assumption that a company should underperform the market for P/E ratios like USANA Health Sciences' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.1%. The last three years don't look nice either as the company has shrunk EPS by 44% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 18% during the coming year according to the two analysts following the company. That's not great when the rest of the market is expected to grow by 11%.

With this information, we are not surprised that USANA Health Sciences is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of USANA Health Sciences' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for USANA Health Sciences you should be aware of, and 1 of them is a bit unpleasant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade USANA Health Sciences, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:USNA

USANA Health Sciences

Develops, manufactures, and sells science-based nutritional, personal care, and skincare products in the Asia Pacific, the Americas, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives