- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble (PG): Exploring Valuation After Recent 6% Share Price Dip

Reviewed by Kshitija Bhandaru

See our latest analysis for Procter & Gamble.

Bigger picture, Procter & Gamble’s 1-year share price return has lagged, down over 9%. Its total shareholder return over the same period is negative, hinting that investor momentum has faded recently despite steady earnings growth and a resilient business model.

If you’re sizing up other opportunities beyond the big consumer names, it could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

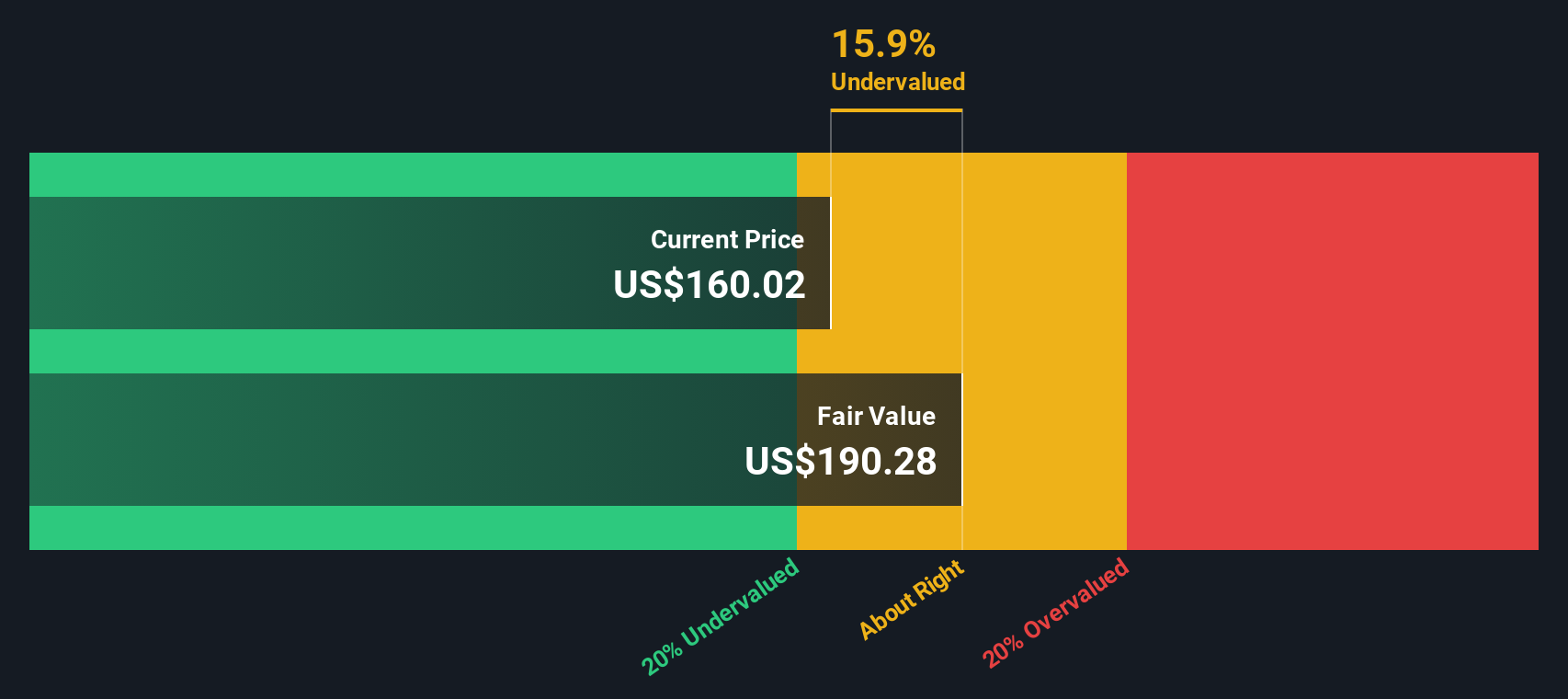

With shares trading well below analyst targets and solid business fundamentals, investors may wonder if Procter & Gamble is currently undervalued or if the market is already factoring in all expected growth, leaving limited upside from this point.

Most Popular Narrative: 25.7% Overvalued

The most followed narrative, according to andre_santos, compares Procter & Gamble’s fair value of $119.81 to the latest close at $150.58, highlighting a meaningful valuation gap. This marks a clear difference in perceived upside versus current market pricing.

Margins may taper slightly to 20–22% as competitive pressure increases, but will likely remain above the industry average of 14–16%. Return on Invested Capital (ROIC): 5-Year Avg: 20.20% | Last Year: 19.99%. Expected to remain around 20%, supported by P&G’s mature and efficient operations.

Curious which future financial targets are driving such a sharp difference from today’s price? The narrative leans on robust margins, steady cash flow, and operational strength. There is a twist in the projections. See what else is fueling this bold fair value.

Result: Fair Value of $119.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected shifts in consumer preferences or operational setbacks could challenge these fair value assumptions and result in performance outcomes that differ from current expectations.

Find out about the key risks to this Procter & Gamble narrative.

Another View: SWS DCF Model Signals Undervaluation

While narrative-based fair value estimates suggest Procter & Gamble is overvalued, our DCF model points in the opposite direction. The SWS DCF model puts fair value at $195.60, which is well above today’s price. It sees more upside potential than the narrative suggests and raises the question: which approach better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Procter & Gamble Narrative

If you see things differently or want to dive into the numbers on your own, it’s quick and easy to craft your personal outlook. Do it your way.

A great starting point for your Procter & Gamble research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to get ahead: use the Simply Wall Street Screener to spot standout opportunities and refresh your investing watchlist today.

- Tap into companies delivering resilient income streams and see which are paying over 3% yields by checking out these 18 dividend stocks with yields > 3%.

- Catch the next wave of healthcare technology by scouting these 32 healthcare AI stocks making breakthroughs in AI-driven patient solutions and diagnostics.

- Step into the quantum frontier and follow these 26 quantum computing stocks as they unlock a new era of computing power and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives