- United States

- /

- Household Products

- /

- NYSE:PG

P&G (PG) Net Margin Rises to 18.6%, Reinforcing Steady-Growth Narrative

Reviewed by Simply Wall St

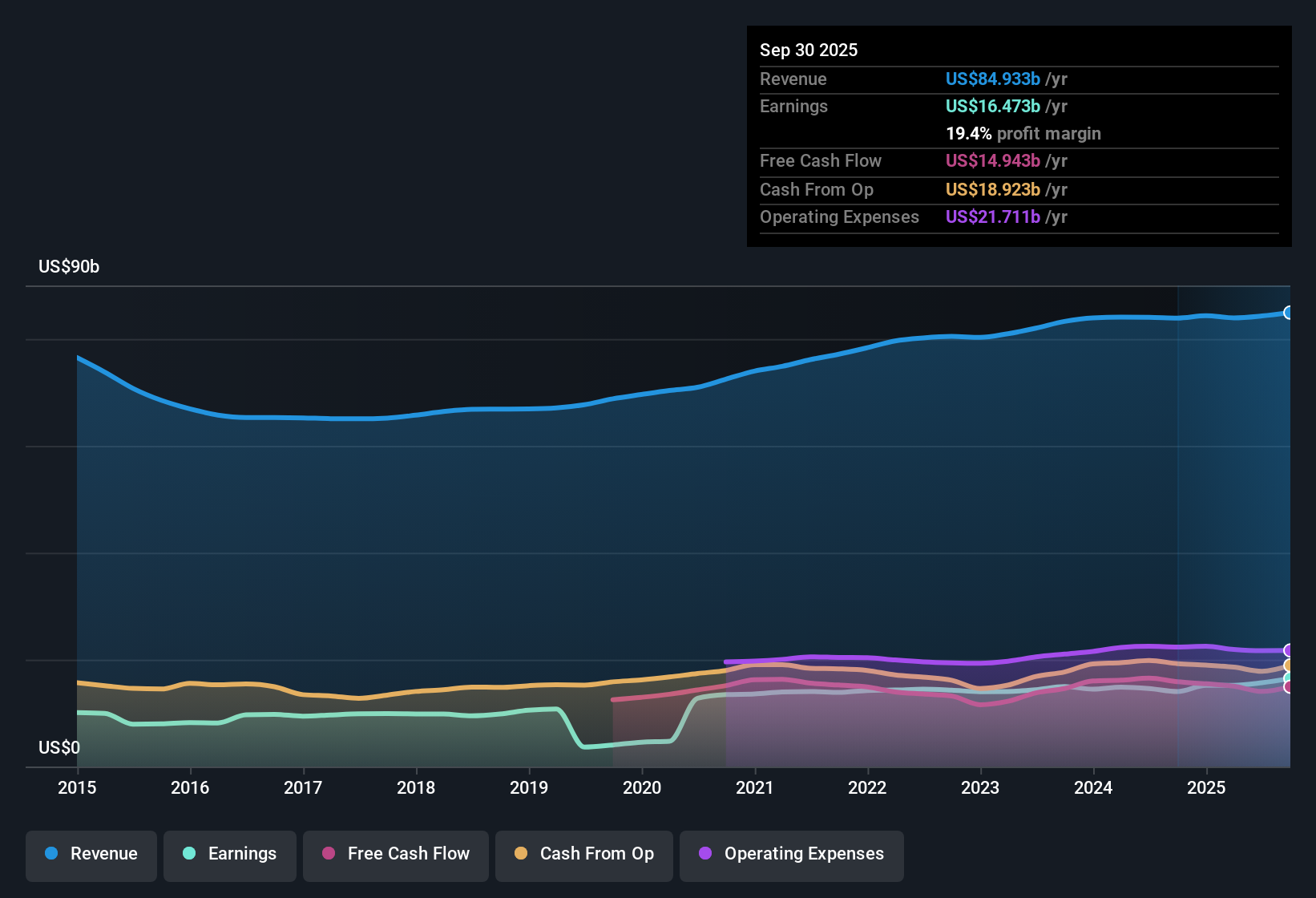

Procter & Gamble (PG) reported annual earnings growth of 7.5% this year, up from a 2.2% average over the last five years. Net profit margins also improved, rising to 18.6% from 17.4%. With revenue and earnings growth forecasts pointing to 3% per year, trailing the broader US market’s expectations, investors will note the recent boost in profitability. However, they will need to assess it against simmering concerns around the company's moderate growth profile and risks like insider selling and only fair financial strength.

See our full analysis for Procter & Gamble.Next, we’ll see how these numbers hold up against the big-picture narratives the market follows, examining where the numbers fit and where they challenge expectations.

See what the community is saying about Procter & Gamble

Premium to Industry, Discount to Peers

- Procter & Gamble trades at a Price-To-Earnings ratio of 22.8x, which is below the peer average of 23.8x but above the global household products industry average of 20.1x. This indicates the shares are priced at a premium to the wider industry while offering a slight discount compared to the closest competitors.

- Analysts' consensus view recognizes this positioning could imply relative value for investors seeking core US consumer brands.

- A PE ratio below direct peers hints at affordable entry versus similar large caps, but

- the premium to the global industry average, combined with slower projected growth (3% per year vs. market’s 10.1%), limits room for further multiple expansion and puts focus on durability of margins and returns.

- The current share price of $152.49 is notably below the DCF fair value estimate of $193.68, and about 9.6% below the analyst price target of $168.64. This provides a cushion that aligns with consensus thinking that the stock is close to fairly priced rather than markedly undervalued or overvalued.

- Sustained execution on productivity and market share gains could close the gap to fair value, but upside is tempered by lackluster growth relative to the market and industry.

- Consensus narrative flags this equilibrium as neither an obvious bargain nor a clear overreach at current levels, leaving analyst conviction in the middle.

- The balanced outlook in current market pricing fits with the broader consensus that while Procter & Gamble offers attractive income and defensiveness, material share price rerating may require a step up in organic growth or a shift in valuation sentiment.

What do analysts think drives these balanced expectations? See both sides of the story in the full market narrative. 📊 Read the full Procter & Gamble Consensus Narrative.

Margin Expansion Eases Cost Pressures

- Net profit margins have increased from 17.4% to 18.6% over the past year, even as projected revenue growth sits at just 3% annually. This shows that higher profitability is compensating for below-market top-line momentum.

- Consensus narrative highlights that productivity gains and cost controls are cushioning against economic and input headwinds.

- This is boosting margins beyond industry levels (industry currently averages 21.6x PE, but P&G’s profit margin expansion stands out despite only modest revenue gains), and

- these buffer effects are expected to continue, with analysts projecting net margins to reach 19.2% in three years, keeping the dividend secure and supporting returns even under sluggish growth conditions.

Share Reduction Supports Earnings Per Share

- P&G is expected to decrease its number of shares outstanding by 0.54% per year over the next three years, against the backdrop of forecasted earnings to rise from $15.7 billion to $17.8 billion by 2028.

- Consensus narrative views this as a supportive catalyst for per-share earnings growth.

- Sustained buybacks plus cash returned via dividends signal management’s confidence in earnings durability, while

- analysts warn that these capital returns are only sustainable if productivity improvements and margin gains can continue to offset tepid sales expansion and other external risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Procter & Gamble on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about the results in a new light? Share your perspective by building your own narrative in just a few minutes. Do it your way

A great starting point for your Procter & Gamble research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Procter & Gamble has shown improved margins, its projected revenue and earnings growth remain below the market and industry averages. This limits its upside potential.

If you want companies delivering more consistent expansion, use stable growth stocks screener (2099 results) to discover stocks with steady gains every year, not just defensive strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026