- United States

- /

- Household Products

- /

- NYSE:PG

Does P&G’s Recent Share Rebound Signal a Compelling 2025 Valuation Opportunity?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Procter & Gamble is still worth buying at today’s price, you are not alone. This breakdown is designed to give you a clear, practical view of its real value.

- The stock has recently bounced about 4.0% over the last week, but it is still down roughly 12.5% year to date. This mix can signal either improving sentiment or lingering concern about future returns.

- Investors have been digesting a stream of product innovation updates and ongoing cost saving initiatives, alongside management’s continued focus on core brands across beauty, fabric care and household products. Together, these developments help explain why the market has been rethinking both the growth outlook and risk profile for this consumer staples giant.

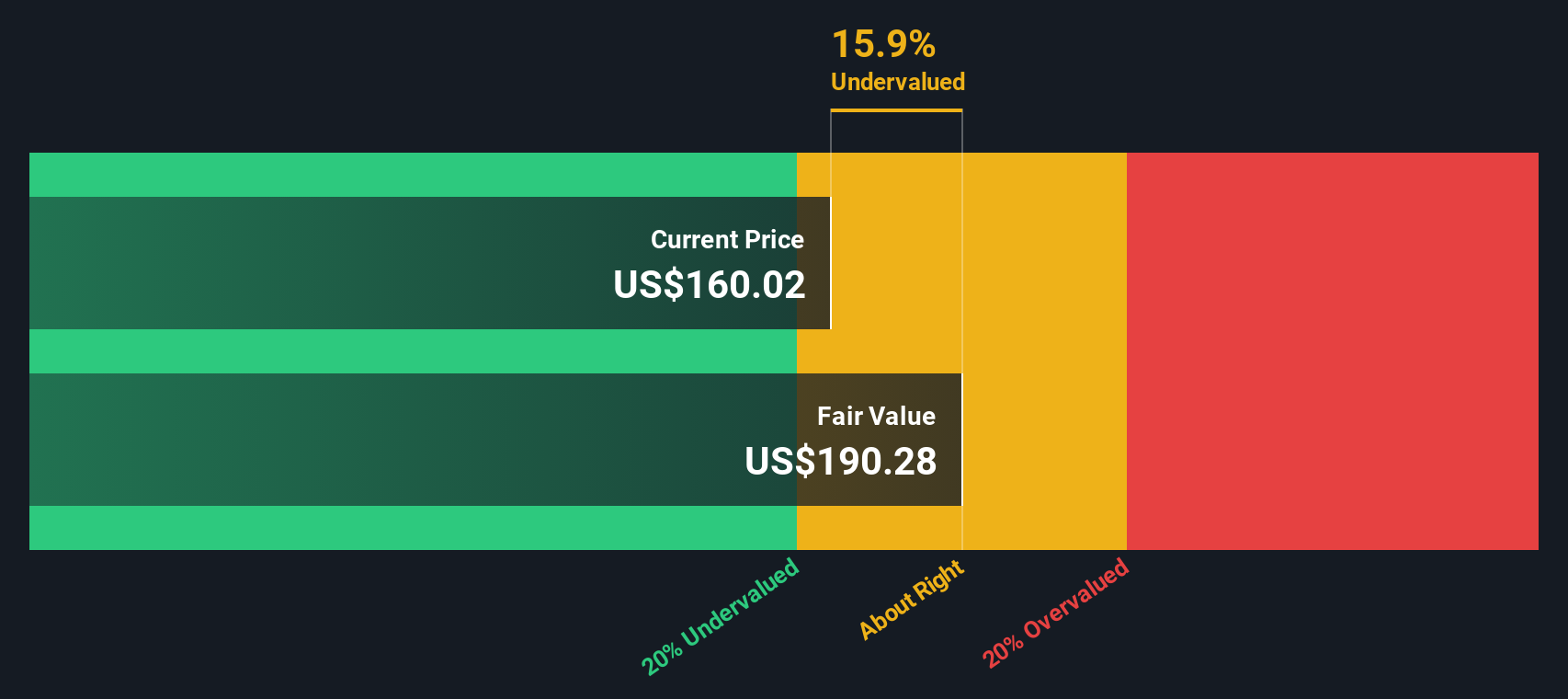

- Right now Procter & Gamble scores a 3 out of 6 on our valuation checks. This suggests it looks undervalued on some measures but not all, so next we will walk through each valuation approach and then finish with a more holistic way to think about what the stock is really worth.

Approach 1: Procter & Gamble Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting the cash it is expected to generate in the future and then discounting those cash flows back to a present value.

For Procter & Gamble, the model starts with last twelve month free cash flow of about $15.4 billion and uses analyst forecasts for the next few years, then extends those projections further into the future. By 2028, free cash flow is expected to reach roughly $17.5 billion, with additional years gradually increasing from there based on more modest growth assumptions.

Putting all those projected $ cash flows into the 2 Stage Free Cash Flow to Equity model gives an estimated intrinsic value of about $194.19 per share. Compared with the current share price, this implies the stock is trading at roughly a 25.2% discount to its estimated fair value. This indicates the market may not be fully pricing in P&G’s future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Procter & Gamble is undervalued by 25.2%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Procter & Gamble Price vs Earnings

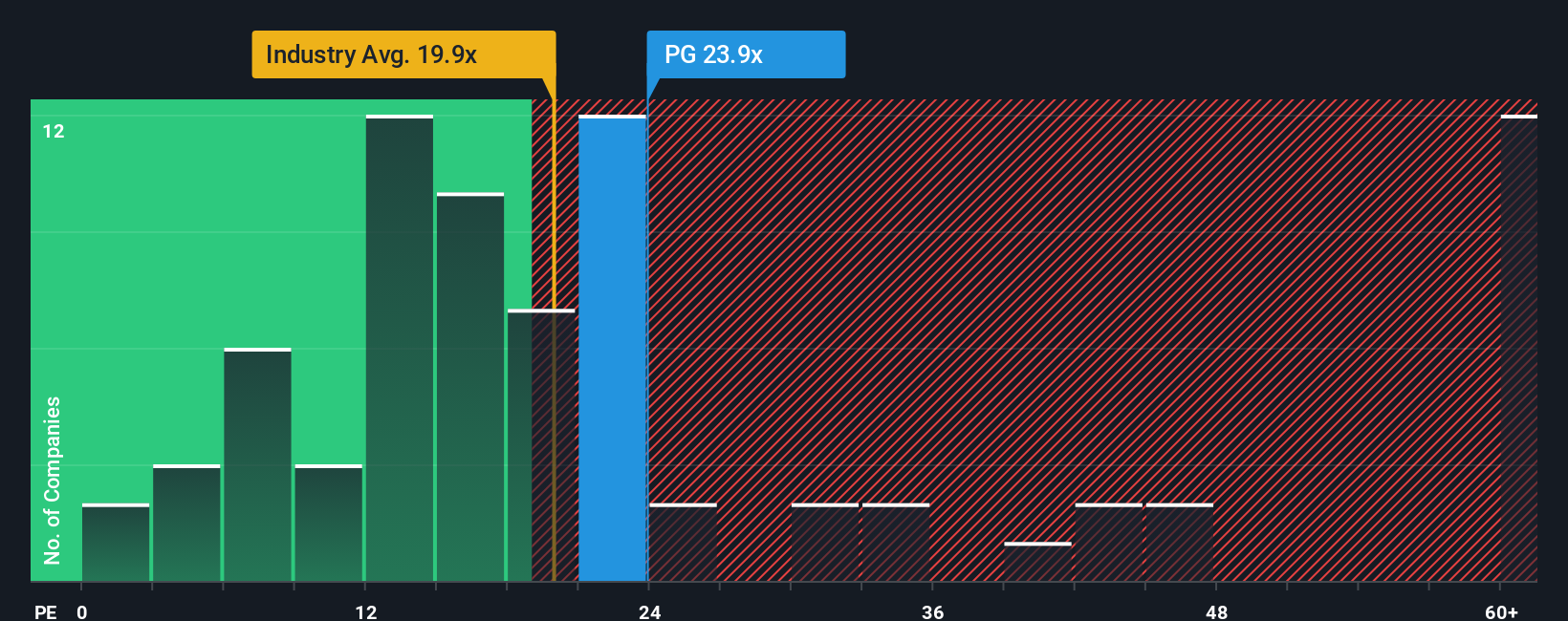

For profitable, mature companies like Procter & Gamble, the price to earnings, or PE, ratio is a useful yardstick because it directly links what investors pay for the stock to the earnings the business is currently generating. It also lets us compare PG with other household product companies using a common, earnings based lens.

What counts as a fair PE depends on how quickly earnings are expected to grow and how risky those earnings are, with higher growth and lower risk generally justifying a higher multiple. Procter & Gamble currently trades on a PE of about 20.6x, which is slightly above its peer average of 20.1x and well ahead of the broader Household Products industry average of around 17.3x. Simply Wall St’s Fair Ratio model, which adjusts for factors like PG’s earnings growth outlook, margins, size and risk profile, suggests a fair PE of roughly 22.0x.

This Fair Ratio is more informative than a simple peer or industry comparison because it tailors the benchmark to PG’s specific fundamentals rather than treating all companies as interchangeable. With the shares trading below the 22.0x Fair Ratio, the PE view points to Procter & Gamble being modestly undervalued on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Procter & Gamble Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach a story to your numbers by linking your view of a company’s future revenues, earnings and margins to a concrete fair value estimate. A Narrative on Simply Wall St’s Community page captures what you believe will drive Procter & Gamble over time, turns that view into a financial forecast, and then compares your Fair Value to today’s Price so you can quickly see whether it looks like a buy, hold, or sell to you. Because Narratives are updated dynamically when new information like earnings, news or guidance arrives, they stay aligned with the real world instead of going stale in a spreadsheet. For example, one PG Narrative on the platform currently sees fair value around $119.81 while another sits near $168.50, showing how two reasonable investors can look at the same company, apply different growth, margin and risk assumptions, and reach very different but clearly articulated decisions.

For Procter & Gamble, however, we will make it really easy for you with previews of two leading Procter & Gamble Narratives:

Fair value: $168.50 per share

Implied undervaluation: ((168.50 - 145.21) / 168.50) ≈ 13.8%

Assumed revenue growth: 3.15%

- Analyst consensus assumes steady mid single digit earnings growth supported by modest 3.15% annual revenue growth and a small uplift in profit margins.

- Capital returns, including ongoing share repurchases and dividends, are expected to support earnings per share growth even if top line momentum stays moderate.

- Risks center on macro and geopolitical volatility, tariffs, and currency moves, but the overall view is that the stock is roughly fairly priced around the consensus target with limited upside from here.

Fair value: $119.81 per share

Implied overvaluation: ((145.21 - 119.81) / 119.81) ≈ 21.2%

Assumed revenue growth: 4.68%

- Sees P&G as a mature business with growth likely to track inflation at roughly 2 to 4%, with margins normalizing toward 20 to 22% over time.

- Blended valuation across DCF, dividend discount, historical yield and historical PE points to a fair value of about $119.81, below the current share price.

- Conclusion is that the company remains a high quality, diversified dividend payer, but that investors are currently paying a premium for that stability with limited expected upside.

Do you think there's more to the story for Procter & Gamble? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)