- United States

- /

- Personal Products

- /

- NYSE:NUS

Improved Revenues Required Before Nu Skin Enterprises, Inc. (NYSE:NUS) Stock's 27% Jump Looks Justified

Nu Skin Enterprises, Inc. (NYSE:NUS) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

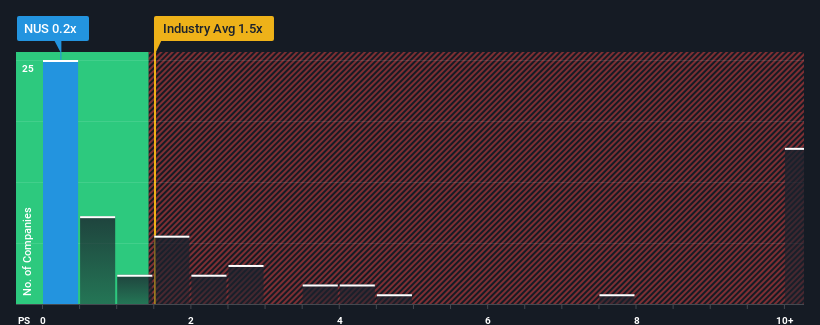

Even after such a large jump in price, when close to half the companies operating in the United States' Personal Products industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider Nu Skin Enterprises as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Nu Skin Enterprises

How Nu Skin Enterprises Has Been Performing

Nu Skin Enterprises could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Nu Skin Enterprises' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Nu Skin Enterprises?

The only time you'd be truly comfortable seeing a P/S as low as Nu Skin Enterprises' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. The last three years don't look nice either as the company has shrunk revenue by 36% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 11% during the coming year according to the two analysts following the company. Meanwhile, the broader industry is forecast to expand by 0.4%, which paints a poor picture.

With this in consideration, we find it intriguing that Nu Skin Enterprises' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Nu Skin Enterprises' P/S Mean For Investors?

Despite Nu Skin Enterprises' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Nu Skin Enterprises' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You always need to take note of risks, for example - Nu Skin Enterprises has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nu Skin Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NUS

Nu Skin Enterprises

Engages in the development and distribution of various beauty and wellness products worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives