- United States

- /

- Personal Products

- /

- NYSE:KVUE

Kenvue (NYSE:KVUE) Appoints New CFO as 2025 Sales Increase 1%-3%

Reviewed by Simply Wall St

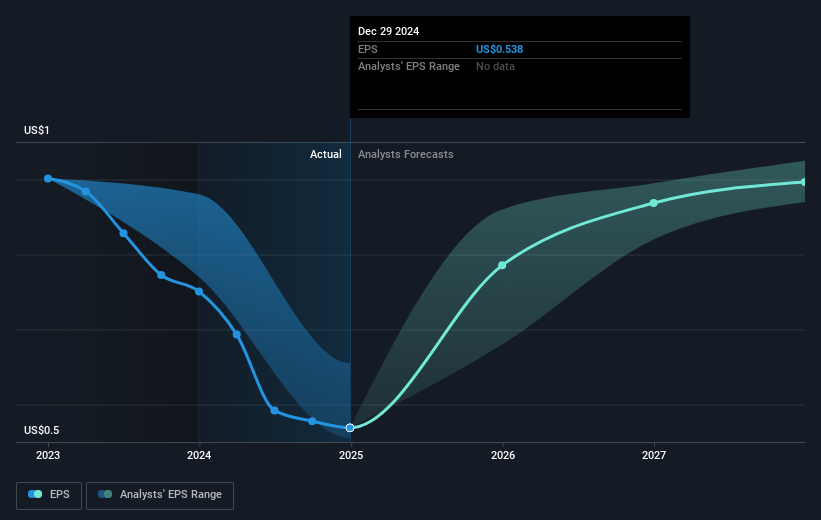

Kenvue (NYSE:KVUE) recently appointed Amit Banati as its new CFO, an executive change aligning with its strategy to augment shareholder value. Concurrently, the company raised its net sales guidance for 2025, expecting an increase of up to 3%, and reported first-quarter earnings with net income of $296 million. During the last quarter, Kenvue's share price moved up by 17%, a shift resonating with broader positive market trends, including a 7.7% market climb over the past year. These events, alongside collaborations with Microsoft for enhanced digital operations, supplemented the positive relationship with market momentum.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent changes at Kenvue, including appointing Amit Banati as CFO and enhancing sales guidance, reflect a clear commitment to improving shareholder returns through increased operational efficiency and growth. The collaboration with Microsoft suggests a strong focus on digital transformation, potentially enhancing Kenvue's revenue growth and earnings forecasts. These developments align with the company's broader strategy to boost brand engagement and streamline operations, which could positively affect their projected cost savings and margin improvements.

Over the last year, Kenvue's total return, including share price and dividends, reached 16.24%. This performance outpaced both the overall US market, which returned 7.2%, and the Personal Products industry, which saw a decline of 25.3%. Such resilience indicates the company's ability to thrive amid market challenges and strategic shifts.

In the context of Kenvue's price movement, the recent quarter's 17% share price increase aligns closely with the broader market ascent and the positive sentiment surrounding the company's future outlook. At a current share price of US$23.57, it remains close to the analyst consensus price target of US$24.27, which is 2.9% higher. While analysts see a fair value slightly above current levels, they anticipate moderate growth, contingent on achieving anticipated earnings of US$2.3 billion by 2028. These forecasts suggest optimism balanced by challenges such as ongoing J&J transition costs and supply chain stability risks.

Learn about Kenvue's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kenvue, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives