- United States

- /

- Personal Products

- /

- NYSE:HLF

Herbalife (HLF): Reassessing Valuation After Weak Volumes, EPS Pressure and a Cautious Growth Outlook

Reviewed by Simply Wall St

Herbalife (HLF) is back in the spotlight after investors reacted to another weak update on sales volumes and earnings per share, which pushed the stock lower as the market refocused on the company’s underlying growth problem.

See our latest analysis for Herbalife.

Despite the latest pullback on weak volumes and EPS, Herbalife’s share price has climbed to $12.57 and delivered a strong year to date share price return. However, the five year total shareholder return remains deeply negative, which suggests recent momentum is more about shifting sentiment on near term risk than a proven return to durable growth.

If this kind of rebound has you rethinking where momentum and fundamentals might line up better, it could be worth exploring fast growing stocks with high insider ownership.

So with EPS under pressure, volume trends still soft and the share price already up sharply this year, is Herbalife now quietly undervalued, or are markets already pricing in every bit of its potential recovery?

Most Popular Narrative: 30% Overvalued

With Herbalife closing at $12.57 against a narrative fair value near $9.67, the most followed view sees the stock already baking in a recovery premium.

The analysts have a consensus price target of $9.333 for Herbalife based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $11.0, and the most bearish reporting a price target of just $7.0.

Want to see what kind of revenue glide path, shrinking margins and future earnings multiple need to line up to defend that lower fair value tag?

Result: Fair Value of $9.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still upside risks if Herbalife’s personalized wellness push gains traction and early volume improvements in North America broaden into sustained growth.

Find out about the key risks to this Herbalife narrative.

Another View: Multiples Point to Deep Value

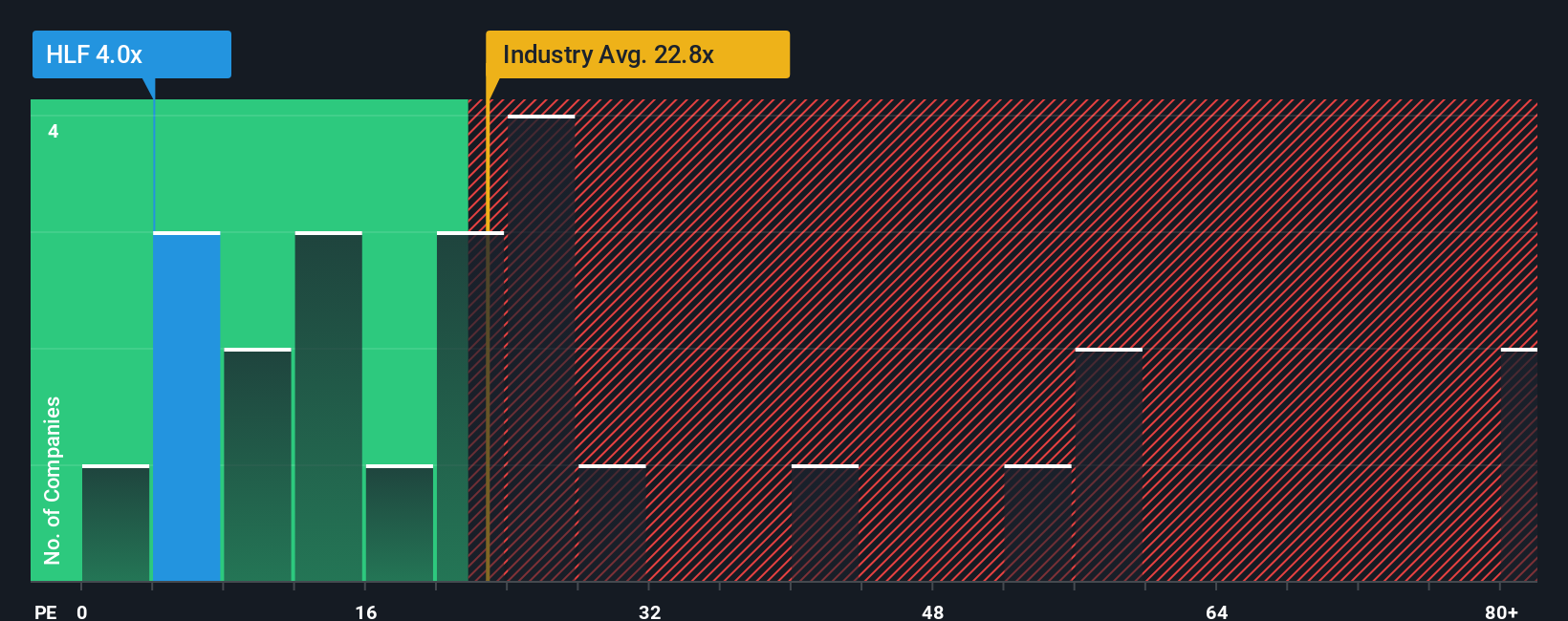

While the narrative fair value suggests Herbalife is overvalued, our ratio work paints a very different picture. On about 4x earnings versus an industry near 22.5x and a peer average of 13.9x, the stock trades at a significant discount to a fair ratio of 11.8x. This spread implies the market may be heavily discounting execution and balance sheet risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Herbalife Narrative

If you see the numbers differently, or want to dig into the figures yourself, you can build a complete view in minutes by starting with Do it your way.

A great starting point for your Herbalife research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart move by using the Simply Wall St Screener to uncover opportunities you might regret missing later.

- Explore potential value opportunities by scanning these 900 undervalued stocks based on cash flows that strong cash flow signals suggest the market has not fully appreciated yet.

- Consider the AI theme by reviewing these 26 AI penny stocks that may benefit from advances in automation, data analytics and intelligent software.

- Support your income strategy by focusing on these 15 dividend stocks with yields > 3% that can contribute to long term compounding through cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Herbalife might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLF

Herbalife

Provides health and wellness products in North America, Mexico, South and Central America, Europe, the Middle East, Africa, China, and the Asia Pacific.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026