- United States

- /

- Personal Products

- /

- NYSE:ELF

e.l.f. Beauty (NYSE:ELF) Faces Volatility Amid $500M Credit Facility News

Reviewed by Simply Wall St

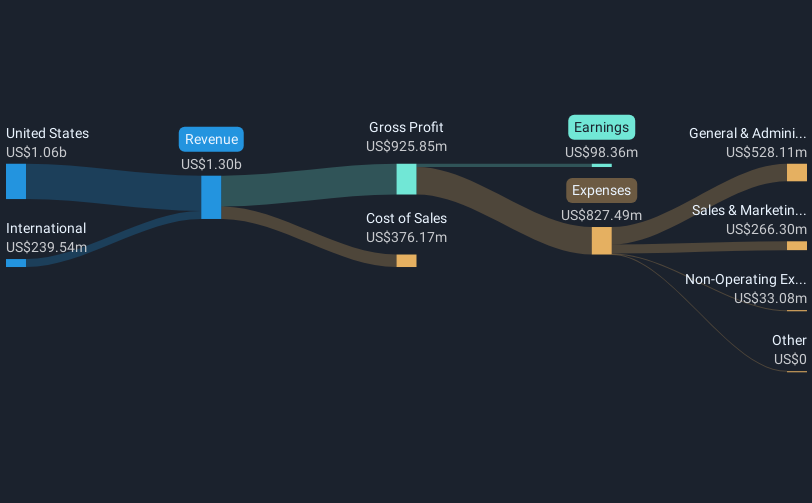

e.l.f. Beauty (NYSE:ELF) has announced significant developments, including a class action lawsuit over allegations of misleading financial statements and amendments to its debt structure through a new $500 million revolving credit facility. These legal and financial shifts may have contributed to the company's stock price declining by 9.4% over the last month. Amid ongoing adjustments in the company's financial strategies, broader market conditions have also presented challenges, with key indexes like the S&P 500 and Nasdaq Composite experiencing a series of declines, though they showed brief recoveries over two consecutive days. Investor sentiments have been particularly volatile, influenced by macroeconomic concerns and reactions to corporate news across sectors. Against this backdrop, the company's efforts to navigate both the financial and legal complexities are being closely monitored, reflecting the interconnected nature of their current situation with overall market trends.

The last 5 years have seen e.l.f. Beauty's shares deliver a total return of over 600%. This impressive performance highlights its journey from achieving high earnings growth to becoming profitable, with an average annual earnings growth of 52.6%. Such growth contrasts with recent setbacks where earnings over the past year showed a decline of 24%. Additionally, the company’s collaboration with Keys Soulcare to launch the Let Me Glow Illuminating Serum in late 2024 showcased its innovative product expansion, despite challenges in maintaining high net profit margins, which decreased from 14.5% to 7.6% this past year.

Furthermore, e.l.f. Beauty's recent financial adjustments, including a new US$500 million revolving credit facility, illustrate its strategic financial maneuvering amidst uncertain market conditions. Despite lowering its earnings guidance for 2025, adjusted financial covenants may position the company for longer-term resilience. The company's market dynamic reaffirms its ability to adapt and evolve amidst both operational and financial challenges, without overlooking potential long-term growth prospects as perceived in its anticipated earnings trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

Excellent balance sheet with reasonable growth potential.