- United States

- /

- Personal Products

- /

- NYSE:ELF

e.l.f. Beauty (ELF): Reassessing Valuation After Morgan Stanley Update Renews Investor Confidence

Reviewed by Simply Wall St

e.l.f. Beauty (ELF) rose after its appearance at the Morgan Stanley conference, where management explained how they plan to navigate weaker guidance, tariff pressure, and softening demand while still aiming to maintain growth.

See our latest analysis for e.l.f. Beauty.

That bounce at the Morgan Stanley event comes after a rough stretch, with the 30 day share price return down 33.55% and the year to date share price return off 34.65%. Even though the five year total shareholder return of 265.32% still points to a strong long term wealth creation story, it suggests momentum has cooled rather than vanished.

If this update has you rethinking growth stories in consumer names, it could be worth exploring fast growing stocks with high insider ownership as a way to spot the next potential outperformer.

With shares now more than 30% below recent highs but still sporting a rich long term growth record, the real question is whether today’s price underestimates e.l.f.’s next chapter or already bakes in its future gains.

Most Popular Narrative Narrative: 34% Undervalued

With e.l.f. Beauty last closing at $80.37 against a narrative fair value of $121.71, the story hinges on how durable its growth engines really are.

The expansion into new international markets and rapid growth in existing ones (e.g., 30% international net sales growth, top rankings in new geographies, global Sephora rollout) provides significant runway for future revenue growth and increased diversification, which is likely under appreciated by the market.

Curious how aggressive global expansion, rising margins, and a premium future earnings multiple all fit together? Want to see the exact growth blueprint behind that fair value?

Result: Fair Value of $121.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on China-based manufacturing and rising tariffs, along with softer international growth, could pressure margins and challenge the long-term upside case.

Find out about the key risks to this e.l.f. Beauty narrative.

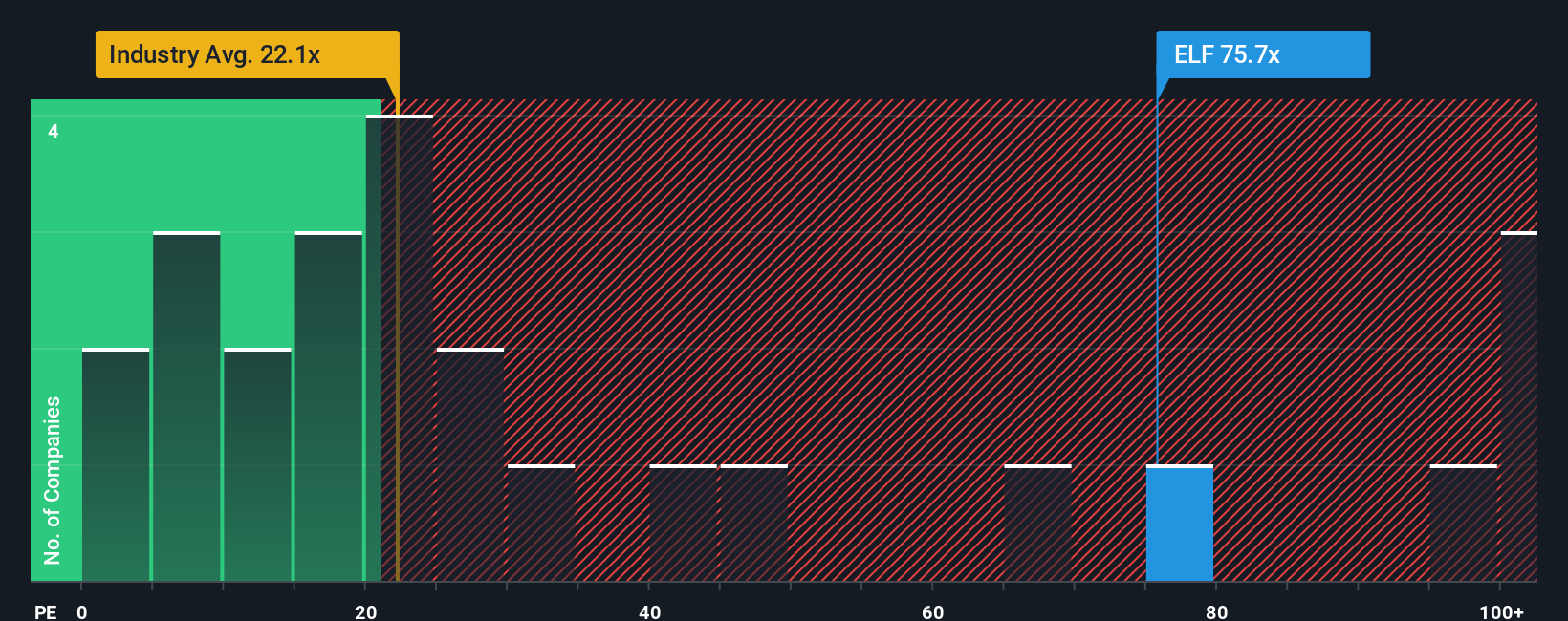

Another View: Rich On Earnings Multiples

While narratives suggest upside, the current share price implies a price to earnings ratio of 58.6 times, which is well above both the North American Personal Products industry at 22.5 times and a fair ratio of 43.3 times. That premium hints at valuation risk if growth expectations slip, rather than a safety margin.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own e.l.f. Beauty Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom narrative in just a few minutes using Do it your way.

A great starting point for your e.l.f. Beauty research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, you may wish to scan a few hand picked stock ideas from the Simply Wall St Screener, tailored to different strategies.

- Explore potential bargain opportunities by running through these 919 undervalued stocks based on cash flows that may be priced below their estimated intrinsic value based on cash flows.

- Support your growth-focused approach by checking out these 25 AI penny stocks that are involved in artificial intelligence innovation.

- Focus on income by reviewing these 14 dividend stocks with yields > 3% that currently offer dividend yields above 3% and are listed on public markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026