- United States

- /

- Personal Products

- /

- NYSE:EL

Estée Lauder Companies (NYSE:EL) Sees 19% Price Surge Over Last Month

Reviewed by Simply Wall St

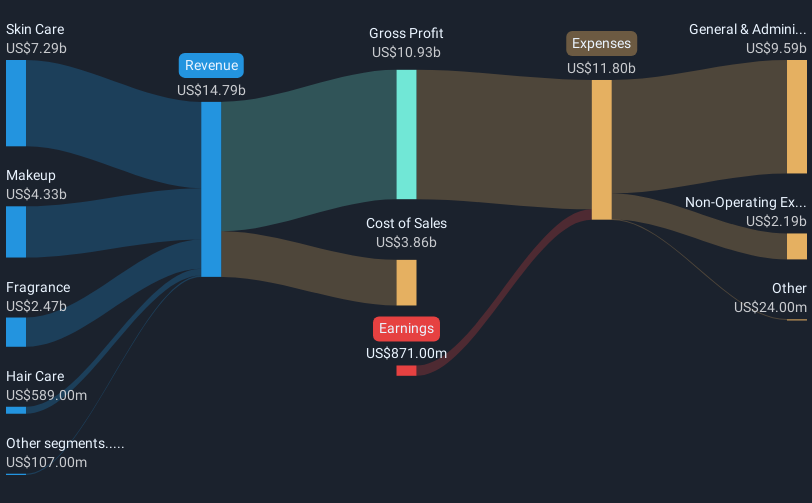

Estée Lauder Companies (NYSE:EL) announced a decline in its third-quarter performance with sales down to USD 3,550 million from USD 3,940 million, and net income reduced to USD 159 million. Despite this, the company's stock rose 19% over the past month, significantly outperforming the broader market's 4% rise. Positive sentiments from a dividend affirmation and executive changes, such as the appointment of Brian Franz as Chief Technology, Data & Analytics Officer, might have bolstered investor confidence. This divergence from the broader market trends suggests that investors are looking beyond short-term earnings challenges.

Estée Lauder Companies has 2 warning signs we think you should know about.

Despite Estée Lauder Companies announcing a decline in performance for the third quarter, recent executive changes and a dividend affirmation have seemingly been well-received by the market. Over the past year, the stock experienced a total return of 50.05% including dividends, although over the last month alone, it increased by 19%. This surge contrasts notably with a 4% rise in the broader market during the same period.

However, analysts remain cautious with a consensus price target of US$68.74, about 14.8% above its current share price of US$58.53, suggesting limited upside in the context of revenue and earnings challenges. Forecasts indicate an annual revenue growth rate of only 3% over the next few years, with significant pressure expected on profitability due to existing geopolitical tensions and weak consumer sentiment, particularly in China and some European regions.

Nevertheless, if Estée Lauder can successfully transform its operating model and improve its margins through digital expansion and restructuring efforts, there's potential for an increase in both revenue and earnings that could help close the gap to that target. For now, Estée Lauder’s total return and recent share price movement signal investor hope for future operational efficiencies albeit offset by the company's struggle to outperform the broader US Personal Products industry or market in the short term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives