- United States

- /

- Household Products

- /

- NYSE:CLX

Clorox (NYSE:CLX) Raises Earnings Guidance Despite 1% Dip in Sales

Reviewed by Simply Wall St

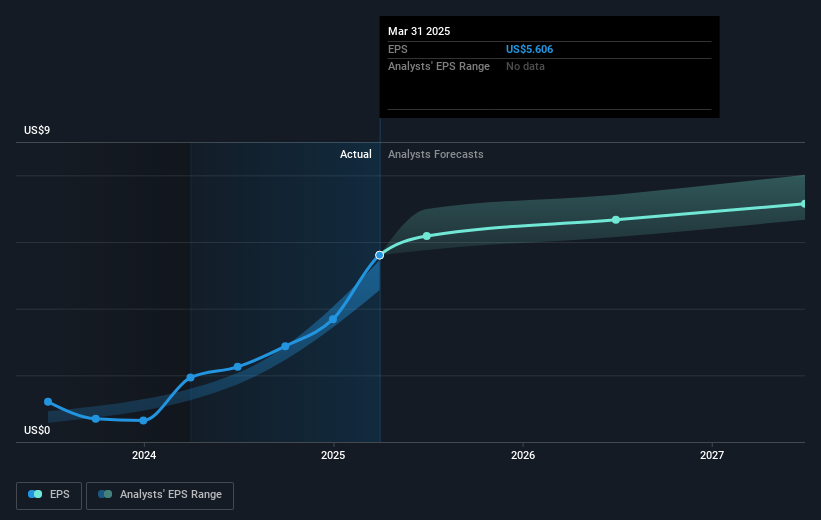

Clorox (NYSE:CLX) recently reported a robust recovery in earnings, including a third-quarter net income jump to $186 million, up from a net loss a year ago. This upbeat financial performance comes amidst the company's revised earnings guidance, reflecting optimism for organic sales growth despite headwinds from divestitures. The broader market, which had a winning streak snapped as investors await tariff news and the Federal Reserve's decisions, showed a moderate downward trend. Clorox's stock performance over the last week remained flat, aligning with the broader market's overall movement, suggesting the company's positive updates had a stabilizing impact.

We've discovered 3 possible red flags for Clorox that you should be aware of before investing here.

Clorox's recent earnings recovery and revised guidance reflect optimism for organic sales growth, reinforcing the company's narrative of operational enhancements. These strategic steps, including ERP conversion and full control of the Glad JV, are expected to drive productivity improvements by 2026. Such initiatives aim to increase revenue and earnings through enhanced margins and operational efficiency. Over the past year, Clorox's total return, including share price and dividends, was 2.65%, while the company outperformed the US Household Products industry, which had a return of 3.4% decline. This context highlights Clorox's ability to manage internal and external pressures effectively.

Despite near-term stability, uncertainties like a CFO transition and competitive pressures could impact revenue and earnings forecasts. Analysts project revenue growth of 2% annually, with profit margins expanding significantly over three years. If these catalysts unfold as anticipated, Clorox's earnings could rise to $963.2 million by April 2028, assuming a declining number of outstanding shares and a PE ratio of 23.3x. The current share price of US$141.2 trades at a discount to the consensus price target of US$155.95, suggesting potential for future appreciation. Yet, investors should consider alternative scenarios in light of possible disruptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Clorox, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLX

Clorox

Engages in the manufacture and marketing of consumer and professional products worldwide.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives