- United States

- /

- Household Products

- /

- NYSE:CL

Colgate-Palmolive's (NYSE:CL) Unusual Items Impacted the FY 2021 Results

In uncertain times, investors tend to seek refuge in certain sectors. Such was the case with Colgate-Palmolive Company's(NYSE: CL), which outperformed the broad market through January.

Yet, the stock seems stuck in a range for the last 1.5 years, signaling a potential big breakout.

Check out our latest analysis for Colgate-Palmolive

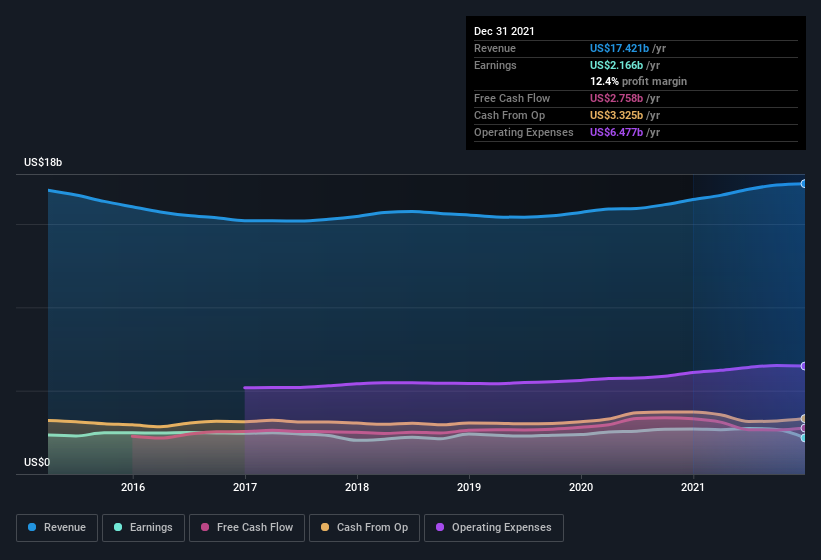

Full-year 2021 results:

- EPS: US$2.56 (down from US$3.15 in FY 2020).

- Revenue: US$17.4b (up 5.8% from FY 2020).

- Net income: US$2.17b (down 20% from FY 2020).

- Profit margin: 12% (down from 16% in FY 2020). Higher expenses drove the decrease in the margin.

Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 20%.

Over the next year, revenue is forecast to grow 2.7%, compared to a 3.5% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have increased by 4% per year, whereas the company's share price has risen by 8% per year.

Technically Speaking

The stock has been in the broader consolidation since July 2020, establishing the support at US$75 and resistance at US$84. While not speculating about the future movement, we have to point out that one of these baselines will, eventually, break – with the new price target equal to the distance of the current support and resistance ($9).

How Do Unusual Items Influence Profit?

Our data indicate that Colgate-Palmolive's profit was reduced by US$571m, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items often are one-off. And that's hardly a surprise, given these line items are considered unusual. If Colgate-Palmolive doesn't see those unusual expenses repeat, then all else being equal, we'd expect its profit to increase over the coming year.

That might leave you wondering what analysts forecast in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability based on their estimates.

Our Take On Colgate-Palmolive's Profit Performance

Unusual items (expenses) detracted from Colgate-Palmolive's earnings over the last year, but we might see an improvement next year. Based on this observation, we consider it likely that Colgate-Palmolive's statutory profit understates its earnings potential.

Unfortunately, though, its earnings per share fell back over the last year. Looking at the ongoing situation, we can conclude that there is still plenty of uncertainty in logistic costs, supply chain pressures, inflation, and volatility in demand. At this point, despite a US$69b market cap, a merger or an acquisition wouldn't be a big surprise.

With this in mind, we wouldn't consider investing in stock unless we thoroughly understand the risks. At Simply Wall St, we found 2 warning signs for Colgate-Palmolive, and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of Colgate-Palmolive's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity to indicate favorable business economics, while others like to "follow the money" and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:CL

Colgate-Palmolive

Manufactures and sells consumer products in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives