- United States

- /

- Household Products

- /

- NYSE:CHD

How Attractive Is Church & Dwight Stock After Its 14% Drop in 2025?

Reviewed by Bailey Pemberton

Trying to figure out whether to stick with Church & Dwight or make a move? You’re not alone. This household products giant tends to divide opinion, especially after its latest price swings. Over the last year, the stock is down 10.6%, with a steeper drop of 14.4% so far this year. Despite these declines, there’s an interesting twist: Church & Dwight actually posted a 1.1% gain over the last week, even as sector sentiment remains mixed and broader markets grapple with volatility. The company’s three-year return of 28.2% hints at solid long-term potential, even if the five-year change is basically flat.

Several factors may be shaping how investors feel about Church & Dwight right now. For one, the stock’s recent dip could be reflecting persistent worries about consumer demand or broader shifts in market sentiment. Yet, even with those doubts, many investors see potential for recovery, especially if pricing power or demand for staple brands holds up. These are the kinds of factors that can affect perceived risk and opportunity, and that gets us straight to valuation.

Looking at the numbers, Church & Dwight racks up a value score of just 2 out of 6, which means it’s considered undervalued by only two of the six main tests analysts use. But is that the whole story? Let’s dive into what these approaches really say about the stock’s worth today, and why a more comprehensive view might reveal opportunities others are missing.

Church & Dwight scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Church & Dwight Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's current value by projecting its future cash flows and discounting them back to today, reflecting both expected growth and risk. For Church & Dwight, analysts and extrapolations suggest a steady growth in free cash flow over the next decade.

Currently, Church & Dwight’s most recent free cash flow stands at $873 million. Analysts project free cash flow to increase gradually, with estimates reaching about $1,196 million by 2029. Beyond the five-year analyst forecasts, further projections are algorithmically extended and show a continued, albeit modest, growth through 2035.

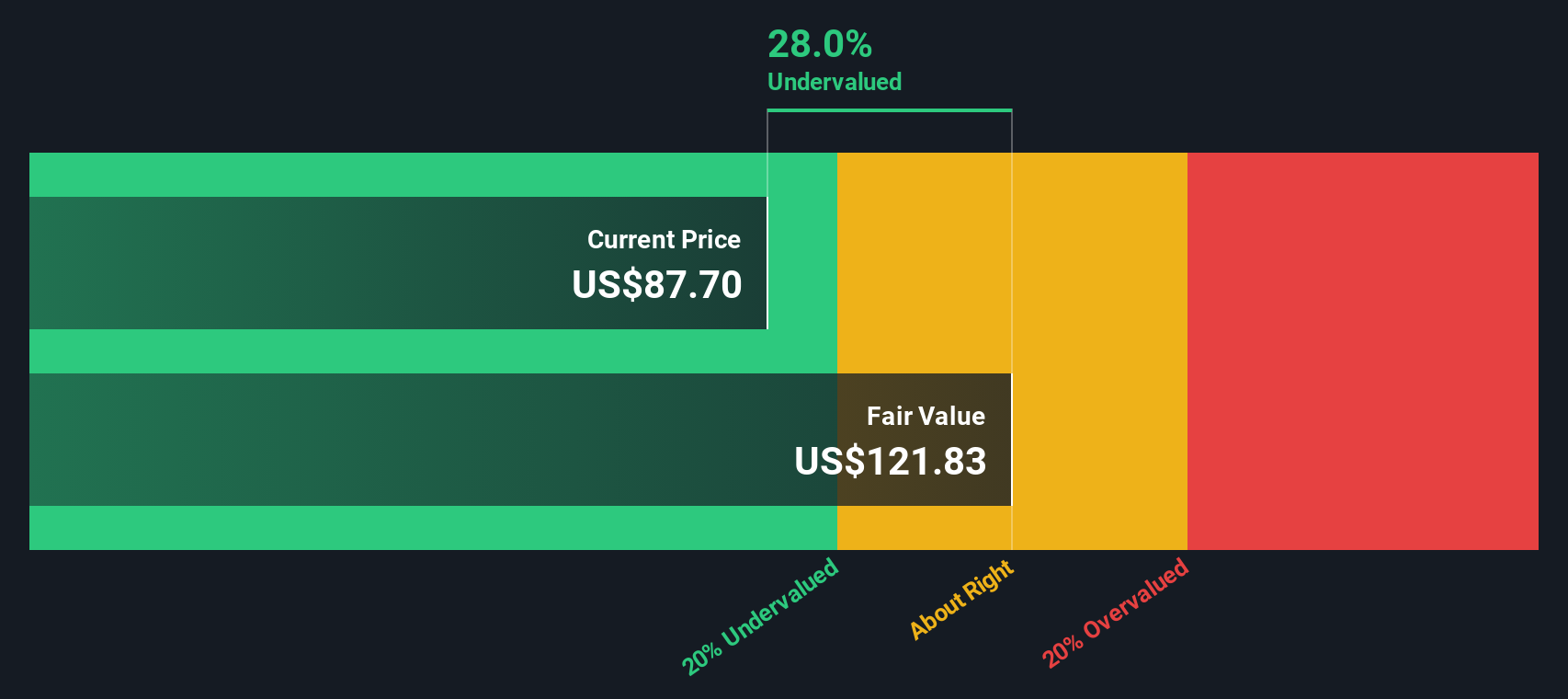

Based on this two-stage DCF analysis, Church & Dwight’s intrinsic value is estimated at $121.84 per share. Compared to the company’s recent market price, the DCF implies the stock is trading at a 27.0% discount. This suggests it may be notably undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Church & Dwight is undervalued by 27.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Church & Dwight Price vs Earnings

The price-to-earnings (PE) ratio is a favored valuation tool for established, profitable companies like Church & Dwight. It puts the company’s share price in context with its actual earnings power. This metric is particularly relevant because it reflects what investors are willing to pay for a dollar of company earnings, which is core for businesses with steady profits.

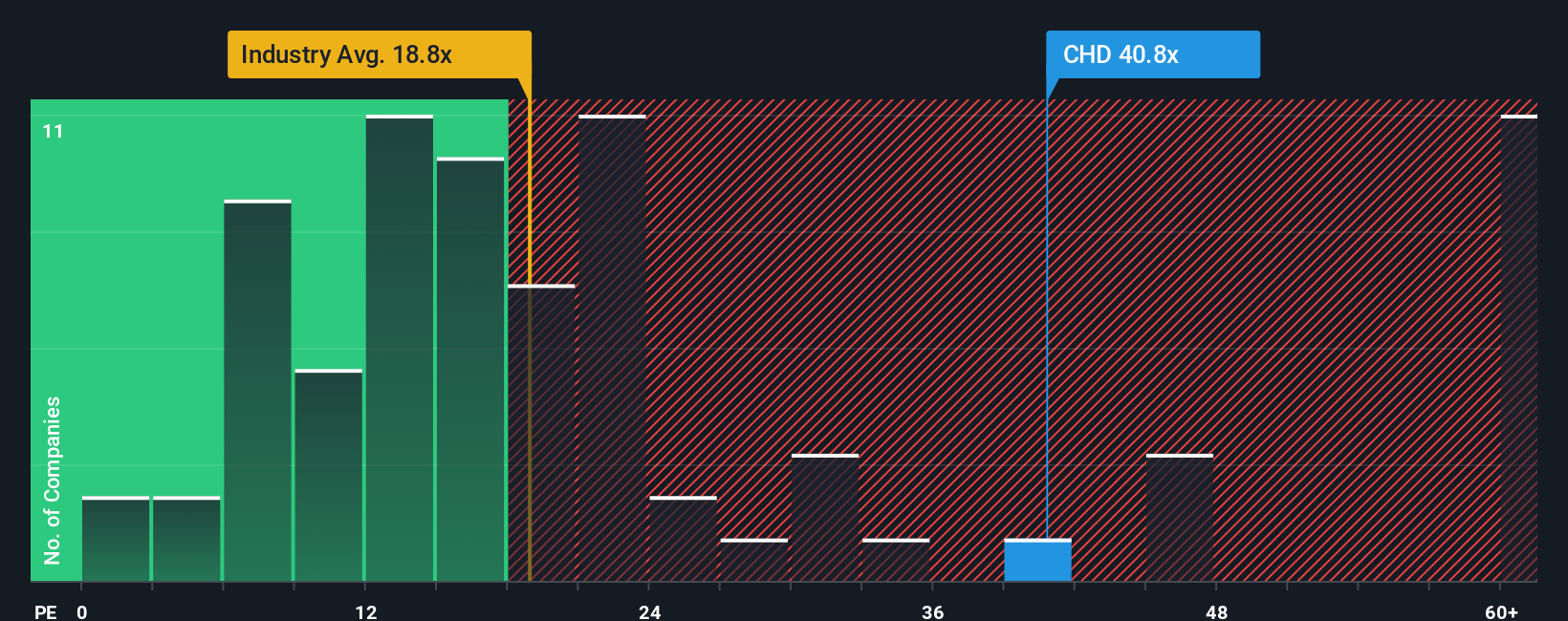

Growth expectations and perceived risk are big reasons why PE ratios can differ between companies. Firms expected to grow faster or viewed as lower risk typically fetch higher PE multiples, while slower growth or riskier prospects drive them lower. It is important to compare Church & Dwight’s current PE with both the industry and its own fair value implied by these factors.

Right now, Church & Dwight trades at 41.2x earnings, which is significantly above the industry average of 18.9x and its peer group’s 18.1x. However, Simply Wall St’s proprietary “Fair Ratio” for Church & Dwight is calculated at 22.5x. The Fair Ratio is a more comprehensive benchmark because it weighs not just industry comparisons but also considers the company’s unique outlook for earnings growth, its risks, profitability, and even its market cap. This makes it a smarter baseline for deciding fair value than simply looking at peers or sector medians.

Since Church & Dwight’s actual PE of 41.2x is much higher than its Fair Ratio of 22.5x, the stock appears overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Church & Dwight Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are your way to tell the story behind the numbers—your perspective about Church & Dwight’s future, which you express through your own fair value, revenue growth, earnings, and margin forecasts.

In simple terms, a Narrative connects what you believe about a company's business prospects directly to its financial forecast and, ultimately, to a fair value estimate for the stock. On Simply Wall St’s Community page, where millions of investors track and debate stocks, you can easily create, share, or follow Narratives for Church & Dwight and compare your assumptions with others.

Narratives help you decide when to buy or sell: if your Narrative’s fair value is above today’s share price, you might see an opportunity; if it’s below, you might decide to wait or sell. These insights update automatically as new earnings, news, or trends emerge.

For example, some investors have a Narrative that expects Church & Dwight’s e-commerce and new wellness brands to accelerate growth, seeing a potential value as high as $120 per share, while others focus on risks from weak vitamin sales and cost inflation, estimating a fair value as low as $73. Narratives let you see, refine, and act on both the “why” and the “how much,” so your investment decisions truly reflect your personal view of the company’s future.

Do you think there's more to the story for Church & Dwight? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHD

Church & Dwight

Develops, manufactures, and markets household, personal care, and specialty products.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives