- United States

- /

- Personal Products

- /

- NYSE:BRBR

Does Regulatory Scrutiny on Sales Practices Signal Deeper Challenges Ahead for BellRing Brands (BRBR)?

Reviewed by Sasha Jovanovic

- Earlier this week, Bleichmar Fonti & Auld LLP announced it is investigating BellRing Brands, Inc. for potential violations of federal securities laws after recent disclosures about inventory and sales practices.

- This investigation follows revelations that BellRing’s recent sales growth depended on temporary retailer inventory loading and expanded promotions, rather than sustained consumer demand.

- Now, let's examine how heightened regulatory scrutiny and inventory practice concerns may influence BellRing's investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BellRing Brands Investment Narrative Recap

To be comfortable as a BellRing Brands shareholder, you need to believe in ongoing demand for convenient protein nutrition and the company's ability to drive category growth through innovation and wider distribution. However, the recent disclosure that sales gains were largely driven by retailer inventory loading and promotions, not underlying consumer demand, raises questions about the reliability of near-term growth, making sustained revenue momentum the main catalyst to watch and inventory normalization the most pressing risk right now.

BellRing’s August Q3 earnings announcement is especially relevant amid these concerns. The company reported net income of US$21 million, a sharp drop from US$73.7 million a year prior, amid slower sales growth and margin pressures that may reflect the short-term impact of retailer de-stocking and heavier promotional activity.

But while BellRing’s long-term growth story is rooted in consumer trends, investors should be aware that, unlike underlying demand, temporary inventory fluctuations can...

Read the full narrative on BellRing Brands (it's free!)

BellRing Brands' outlook suggests $2.8 billion in revenue and $312.5 million in earnings by 2028. This is based on an expected 8.1% annual revenue growth rate and a $84.2 million increase in earnings from $228.3 million today.

Uncover how BellRing Brands' forecasts yield a $51.43 fair value, a 54% upside to its current price.

Exploring Other Perspectives

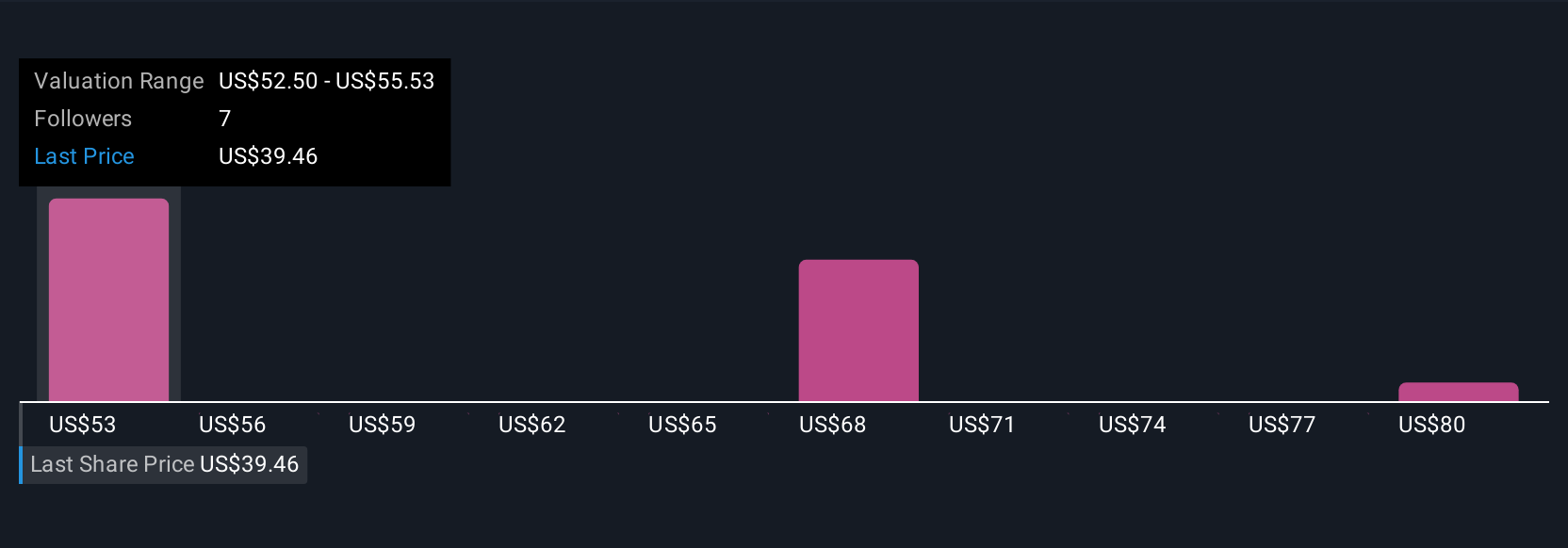

Simply Wall St Community members assessed BellRing’s fair value from US$45 to US$82.83, reflecting four distinct viewpoints. With inventory and sales practices under scrutiny, your view on short-term demand drivers matters now more than ever.

Explore 4 other fair value estimates on BellRing Brands - why the stock might be worth just $45.00!

Build Your Own BellRing Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BellRing Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BellRing Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BellRing Brands' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BellRing Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRBR

BellRing Brands

Provides various nutrition products in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives