- United States

- /

- Personal Products

- /

- NYSE:BRBR

BellRing Brands (BRBR) Announces US$400 Million Share Repurchase Program

Reviewed by Simply Wall St

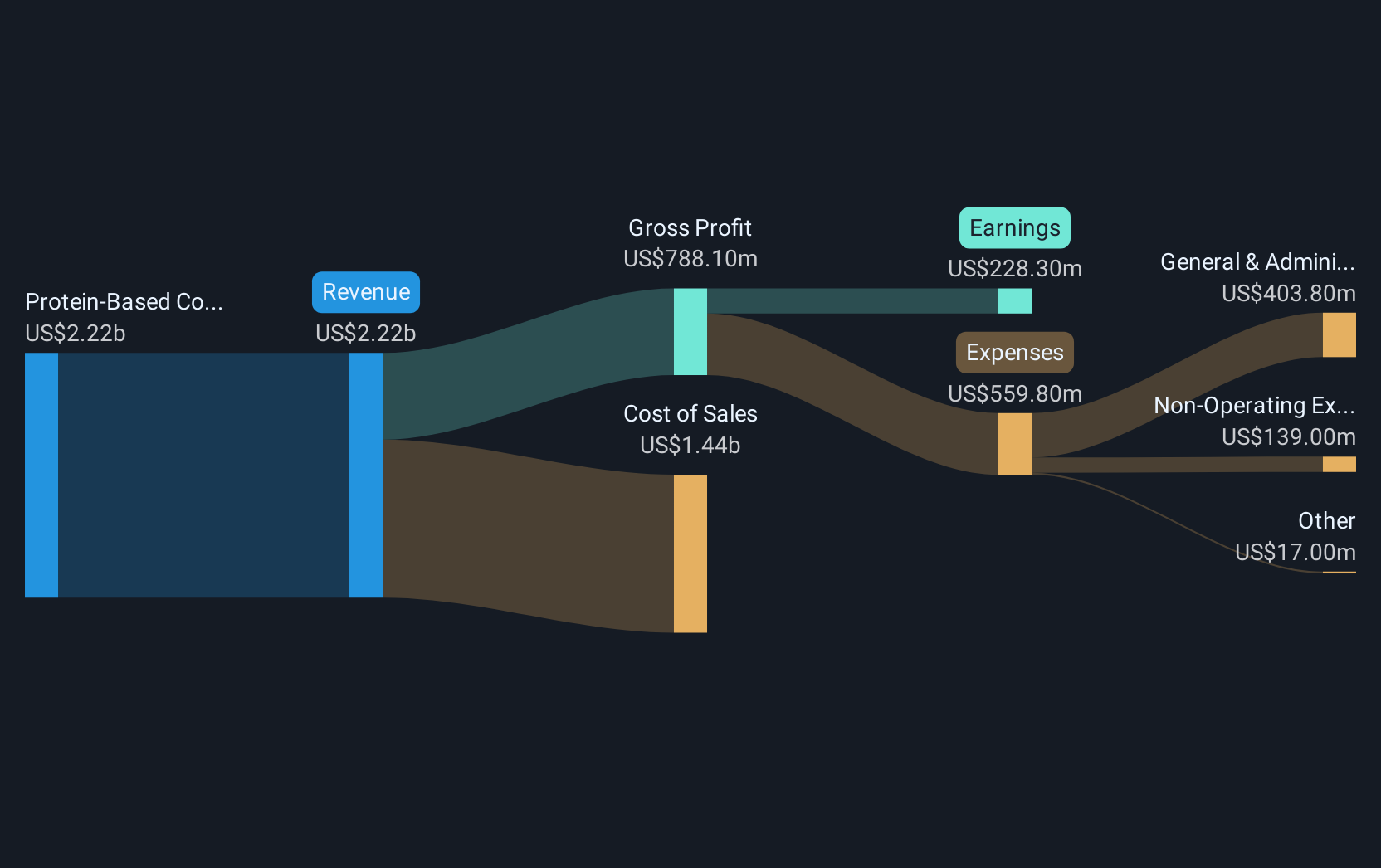

BellRing Brands (BRBR) announced a significant share repurchase program and a substantial credit agreement amendment, both on September 2, 2025. These strategic financial maneuvers included a buyback of up to $400 million worth of shares and the doubling of its credit facility with extended maturity, reflecting an attempt to enhance financial flexibility and shareholder value. During the same period, the broader market rose sharply on the back of anticipated interest rate cuts and record high stock indexes. Despite the broader market trends, BellRing’s stock experienced a 5.33% decline over the past month, indicating other company-specific factors at play.

The recent news surrounding BellRing Brands' share repurchase program and credit facility expansion may enhance the company's financial flexibility and shareholder value. By buying back up to US$400 million in shares, the company aims to reduce the number of shares outstanding, potentially improving earnings per share. This financial strategy, coupled with the amended credit facility, strengthens BellRing's balance sheet, potentially supporting its revenue and earnings forecasts. In the long term, such strategic financial decisions could aid in overcoming headwinds like margin pressure and competition in the ready-to-drink shake market. BellRing's recent financial maneuvers could provide a buffer against short-term market volatility and align with its long-term revenue growth strategy.

Over a five-year period, BellRing Brands delivered a total return of 93.47%, highlighting its strong overall performance despite recent short-term declines. This return is noteworthy in comparison to the past year's underperformance relative to the broader US market, which gained 20%, while BellRing's stock underperformed. When placed in context with the US Personal Products industry’s declines, this historical performance suggests resilience amid broader sector struggles.

The current share price of US$36.76 reflects a substantial 42.82% discount to the consensus price target of US$52.50, suggesting potential upside if the stock aligns with analyst expectations. However, achieving this price target hinges on the company's ability to meet anticipated revenue growth and earnings projections. With revenue forecast to grow annually by 7.5%, below the US market average of 9.5%, achieving the desired increase in share price would require BellRing to effectively leverage its enhanced financial flexibility and market leadership in RTD shakes.

Review our growth performance report to gain insights into BellRing Brands' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BellRing Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRBR

BellRing Brands

Provides various nutrition products in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives