- United States

- /

- Household Products

- /

- NasdaqGS:WDFC

How Could WD-40's (WDFC) Premium Strategy Sustain Its Edge in a Shifting Market?

Reviewed by Sasha Jovanovic

- In recent days, analysts highlighted WD-40's strong free cash flow margins, premium pricing strategy, and industry-leading return on capital, setting it apart from peers struggling with weaker trends.

- This focus on operational excellence and premium product positioning has drawn renewed attention to the company’s competitive strengths within the maintenance products sector.

- We'll explore how renewed analyst attention on WD-40's cash generation and premium pricing could influence its broader investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

WD-40 Investment Narrative Recap

To be a shareholder in WD-40, you need to believe in its ability to maintain strong cash flow, defend its premium market position, and keep operational efficiency high, especially against industry peers with weaker trends. The recent analyst focus affirms these strengths but does not materially shift the biggest near-term catalyst, continued growth in key international markets, or the main risk, which remains the complex divestiture of its home care and cleaning division.

The most relevant recent announcement is WD-40's ongoing share buyback program, extending through August 2026. This move reiterates management’s confidence in the company’s financial health, aligning with the premium pricing and high cash generation highlighted by current analyst attention, while still keeping the spotlight on execution risks related to its planned asset sales.

By contrast, investors should pay close attention to ongoing uncertainties around the home care and cleaning business divestiture, as the impact on overall performance is...

Read the full narrative on WD-40 (it's free!)

WD-40's outlook anticipates $721.1 million in revenue and $83.6 million in earnings by 2028. This is based on a projected annual revenue growth rate of 5.6% and a decrease in earnings of $2.7 million from the current $86.3 million.

Uncover how WD-40's forecasts yield a $277.50 fair value, a 44% upside to its current price.

Exploring Other Perspectives

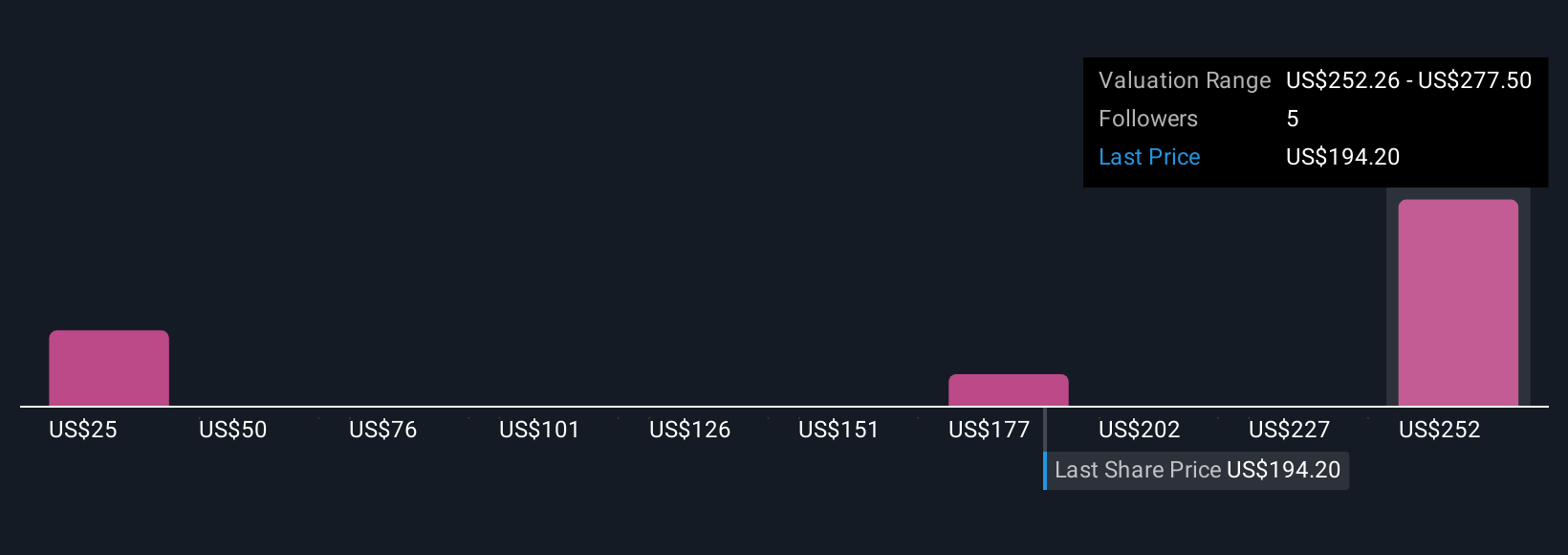

Simply Wall St Community members provided four fair value estimates ranging from US$25.11 to US$277.50 per share. While opinions vary, ongoing execution of asset sales remains a central theme for assessing future performance.

Explore 4 other fair value estimates on WD-40 - why the stock might be worth less than half the current price!

Build Your Own WD-40 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WD-40 research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free WD-40 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WD-40's overall financial health at a glance.

No Opportunity In WD-40?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WD-40 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDFC

WD-40

Develops and sells maintenance products, and homecare and cleaning products in North America, Central and South America, Asia, Australia, Europe, India, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives