- United States

- /

- Pharma

- /

- NasdaqCM:SXTC

China SXT Pharmaceuticals'(NASDAQ:SXTC) Share Price Is Down 12% Over The Past Year.

It is doubtless a positive to see that the China SXT Pharmaceuticals, Inc. (NASDAQ:SXTC) share price has gained some 212% in the last three months. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 12% in a year, falling short of the returns you could get by investing in an index fund.

Check out our latest analysis for China SXT Pharmaceuticals

China SXT Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

China SXT Pharmaceuticals' revenue didn't grow at all in the last year. In fact, it fell 7.9%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 12% in that time. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

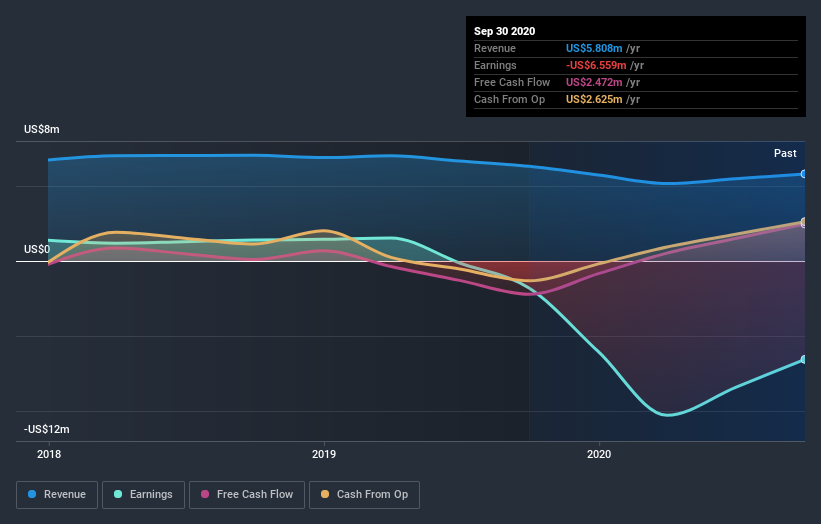

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of China SXT Pharmaceuticals' earnings, revenue and cash flow.

A Different Perspective

While China SXT Pharmaceuticals shareholders are down 12% for the year, the market itself is up 28%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 212%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with China SXT Pharmaceuticals (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade China SXT Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SXTC

China SXT Pharmaceuticals

A pharmaceutical company, engages in the research, development, manufacture, marketing, and sale of traditional Chinese medicine pieces (TCMP) in China.

Medium-low with adequate balance sheet.