- United States

- /

- Personal Products

- /

- NasdaqCM:SKIN

Positive Sentiment Still Eludes The Beauty Health Company (NASDAQ:SKIN) Following 33% Share Price Slump

To the annoyance of some shareholders, The Beauty Health Company (NASDAQ:SKIN) shares are down a considerable 33% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 82% loss during that time.

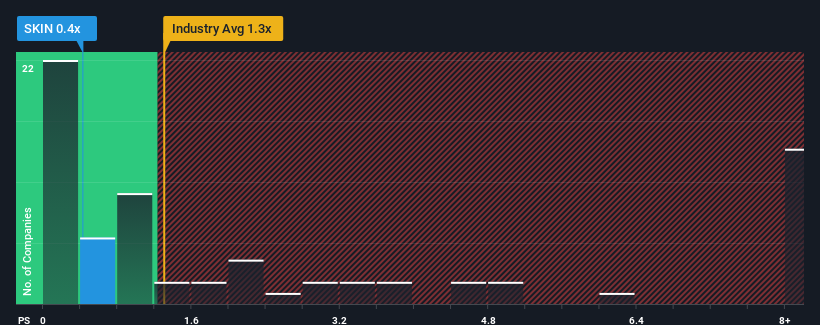

After such a large drop in price, Beauty Health may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Personal Products industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beauty Health

How Has Beauty Health Performed Recently?

Beauty Health could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Beauty Health's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Beauty Health?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beauty Health's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.3%. This was backed up an excellent period prior to see revenue up by 193% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 6.9% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 6.8% each year, which is not materially different.

With this in consideration, we find it intriguing that Beauty Health's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

The southerly movements of Beauty Health's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Beauty Health currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Beauty Health that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beauty Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SKIN

Beauty Health

Designs, develops, manufactures, markets, and sells esthetic technologies and products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives