- United States

- /

- Personal Products

- /

- NasdaqGS:OLPX

Olaplex Holdings, Inc.'s (NASDAQ:OLPX) Shares Climb 27% But Its Business Is Yet to Catch Up

Those holding Olaplex Holdings, Inc. (NASDAQ:OLPX) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 49% in the last twelve months.

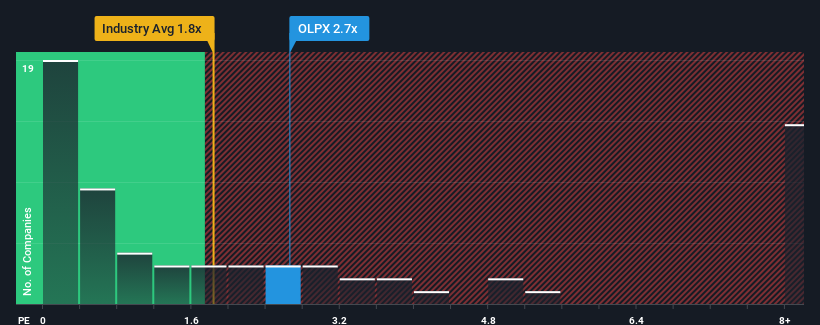

Since its price has surged higher, you could be forgiven for thinking Olaplex Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.7x, considering almost half the companies in the United States' Personal Products industry have P/S ratios below 1.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Olaplex Holdings

How Has Olaplex Holdings Performed Recently?

Olaplex Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Olaplex Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Olaplex Holdings would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 26% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 3.4% as estimated by the nine analysts watching the company. With the industry predicted to deliver 7.4% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Olaplex Holdings is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Olaplex Holdings' P/S

Olaplex Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Olaplex Holdings, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Olaplex Holdings that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Olaplex Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OLPX

Olaplex Holdings

Through its subsidiaries, develops, manufactures, and sells haircare products in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives