- United States

- /

- Personal Products

- /

- NasdaqGM:ODD

Oddity Tech (ODD): Valuation in Focus After Jefferies Buy Rating and Medical Skincare Launch Plans

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 3.7% Overvalued

The current narrative suggests Oddity Tech is trading slightly above its estimated fair value. This reflects optimism about the company’s growth in AI-driven beauty and wellness markets, but also highlights a premium in its stock price.

"ODDITY Tech offers significant upside potential if it delivers on its growth projections and successfully diversifies its product portfolio. Its innovation in AI and strategic moves into new markets make it an attractive long-term play in the beauty and wellness space."

Is Oddity Tech’s future growth already priced in, or could its upcoming launches push valuations even higher? Behind this fair value calculation are assumptions the market may not expect. Surprising profit projections and ambitious expansion goals shape this outlook. Only a closer look will reveal what is driving analyst confidence.

Result: Fair Value of $58.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a potential slowdown in consumer spending or unexpected challenges with new product launches could quickly change the market’s outlook for Oddity Tech.

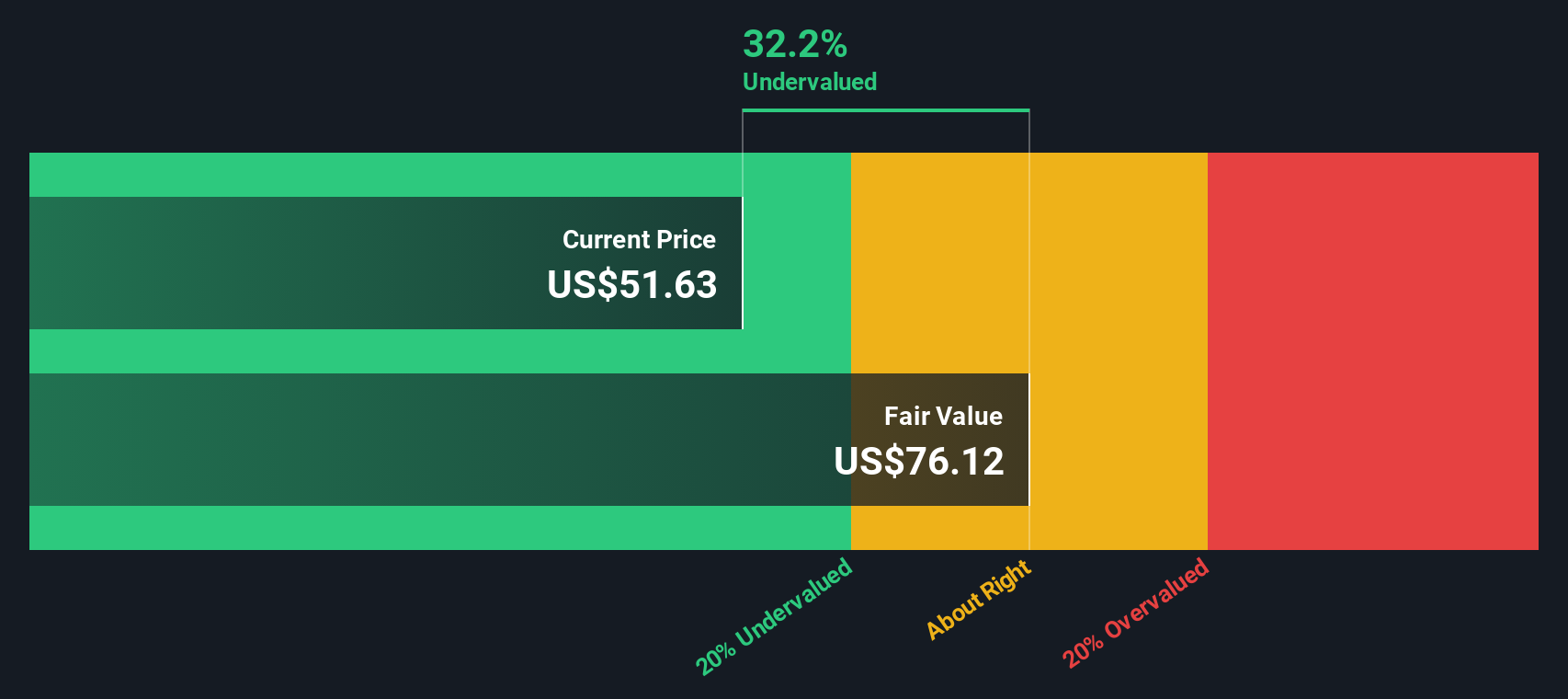

Find out about the key risks to this Oddity Tech narrative.Another View: DCF Suggests Undervaluation

Looking from another angle, our DCF model takes a more optimistic view, indicating the shares may actually be undervalued at current levels. Why do the two approaches diverge so much? Which approach will the market trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Oddity Tech for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Oddity Tech Narrative

Of course, if your perspective differs or you want to dig into the numbers yourself, you can easily shape your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Oddity Tech.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. There are compelling stocks across the market waiting for you. The Simply Wall Street Screener reveals powerful options you won’t want to overlook.

- Tap into remarkable income with steady payers offering yields above 3% by checking out dividend stocks with yields > 3%.

- Uncover undervalued gems poised for strong potential, all easily found inside undervalued stocks based on cash flows.

- Ride the momentum powering tomorrow’s breakthroughs. Find leading-edge artificial intelligence opportunities at AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ODD

Oddity Tech

Operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives