- United States

- /

- Capital Markets

- /

- NYSE:GAM

Promising Undiscovered Gems in the United States for January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown a robust 23% rise over the past year with earnings expected to grow by 15% annually. In this dynamic environment, identifying promising stocks often involves finding those companies that combine strong fundamentals with potential for growth, making them true undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Nature's Sunshine Products (NasdaqCM:NATR)

Simply Wall St Value Rating: ★★★★★★

Overview: Nature's Sunshine Products, Inc. is a natural health and wellness company that manufactures and sells nutritional and personal care products across Asia, Europe, North America, Latin America, and internationally with a market capitalization of $271.59 million.

Operations: Nature's Sunshine generates revenue from sales of nutritional and personal care products, with $199.31 million from Asia and $139.43 million from North America. The company's net profit margin reflects its profitability after accounting for all expenses, taxes, and costs associated with its operations.

Nature's Sunshine Products, a player in the natural health sector, showcases robust earnings growth of 110% over the past year, significantly outperforming its industry. With no debt and trading at 61% below estimated fair value, it presents an intriguing proposition. The company reported Q3 sales of US$114.62 million and net income of US$4.35 million, marking an increase from last year’s figures. Recently, it repurchased 56,000 shares for US$0.71 million as part of a larger buyback initiative aimed at enhancing shareholder value amidst macroeconomic challenges impacting North America and China markets.

Mid Penn Bancorp (NasdaqGM:MPB)

Simply Wall St Value Rating: ★★★★★★

Overview: Mid Penn Bancorp, Inc. is the bank holding company for Mid Penn Bank, offering commercial banking services to a diverse clientele including individuals, partnerships, non-profit organizations, and corporations with a market cap of $541.84 million.

Operations: Mid Penn Bancorp generates revenue primarily from its full-service commercial banking and trust business, amounting to $173.42 million.

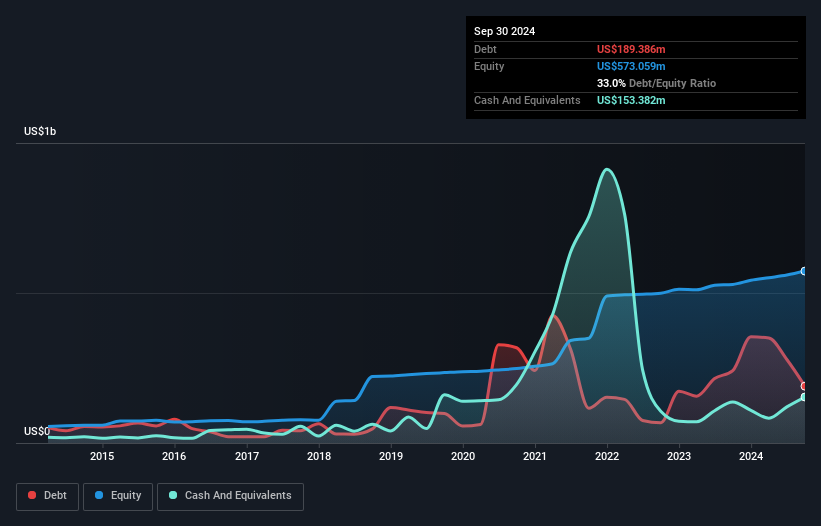

With total assets of US$5.5 billion and equity of US$573.1 million, Mid Penn Bancorp stands as a promising financial entity. It boasts total deposits of US$4.7 billion against loans amounting to US$4.4 billion, reflecting robust operations with low-risk funding sources making up 95% of liabilities. The bank's earnings growth over the past year at 17.8% outpaced the industry average, which was -11.8%. With an allowance for bad loans at 205%, it effectively manages risks while trading at a notable discount to its estimated fair value by 43%. Recent follow-on equity offerings raised approximately $70 million, hinting at strategic expansion plans.

- Dive into the specifics of Mid Penn Bancorp here with our thorough health report.

Examine Mid Penn Bancorp's past performance report to understand how it has performed in the past.

General American Investors Company (NYSE:GAM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of $1.19 billion.

Operations: The primary revenue stream for General American Investors Company is derived from its financial services segment, specifically closed-end funds, generating $26.75 million.

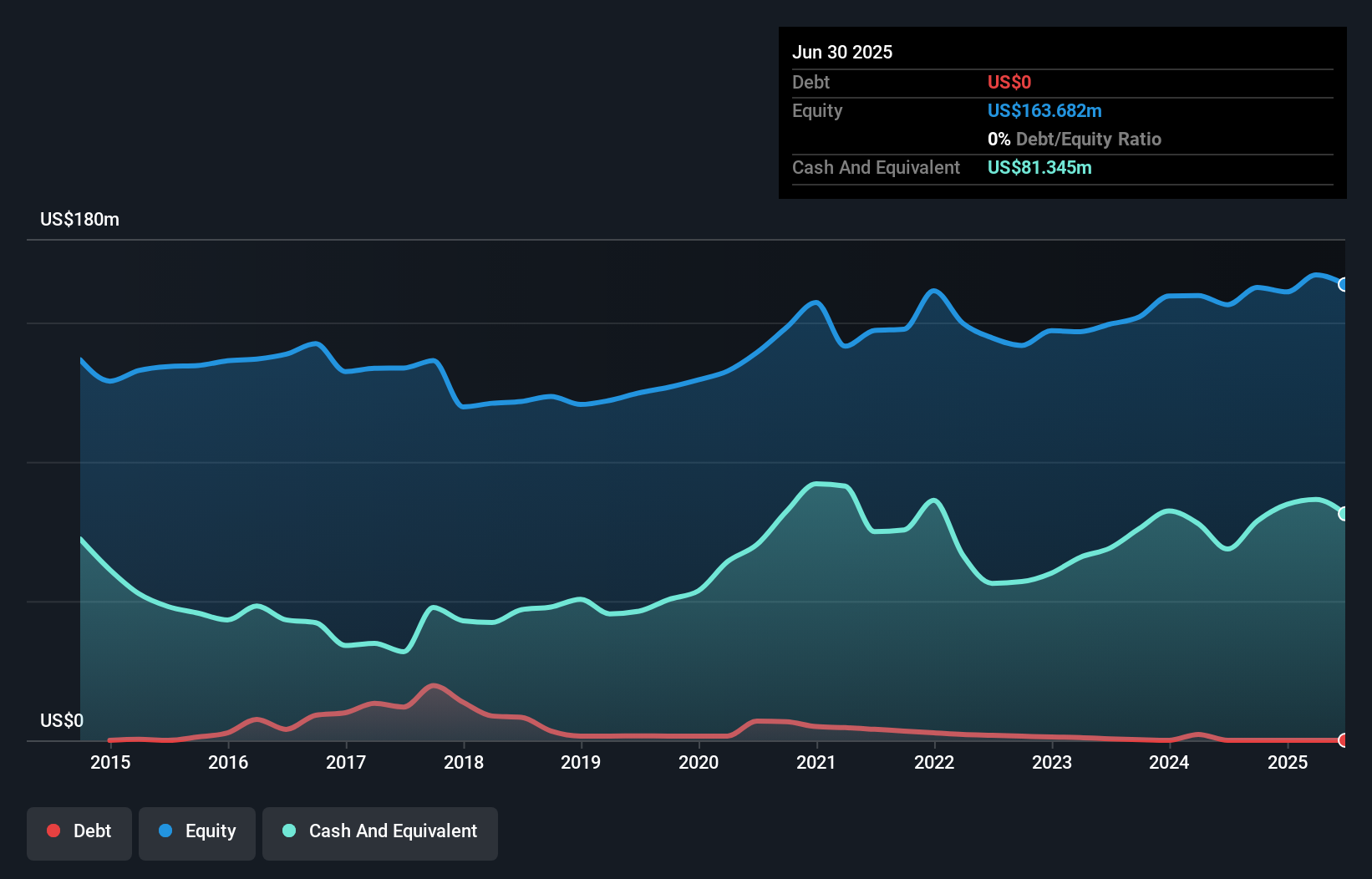

General American Investors Company, a small-cap entity, is currently trading at 63.6% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings have surged by 25.7%, outpacing the Capital Markets industry's growth of 12.8%. Notably, GAM has been debt-free for five years and recently declared a dividend of $4.50 per share from long-term capital gains and net investment income for 2024. However, a significant one-off gain of US$285 million in the last financial year impacts its earnings quality assessment. The company's future prospects remain intriguing given these dynamics.

Taking Advantage

- Explore the 246 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAM

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives