- United States

- /

- Household Products

- /

- NasdaqGS:KMB

Kimberly-Clark (KMB): Evaluating Valuation Following Transformation Initiative and Safe Dividend Stock Status

Reviewed by Kshitija Bhandaru

If you are an investor looking at Kimberly-Clark (KMB) this week, you are probably weighing the company’s fresh recognition as one of the safest high dividend stocks. That spotlight comes as Kimberly-Clark pushes forward with its multi-year Transformation Initiative, aimed at squeezing out inefficiencies and ramping up product innovation. For anyone who values stable cash flow but is also seeking a little upside, this blend of safety and change could be worth a closer look.

The attention is not just about the dividend. Over the past year, Kimberly-Clark’s shares have slipped 9%, with the momentum softening not just in the past month but over the most recent quarter as well. Recent results show declining annual revenue growth but a slight uptick in net profitability, suggesting the company’s cost-cutting may be helping its bottom line. These mixed signals set up an interesting environment for investors deciding what comes next.

So, after the share price dip and against the backdrop of transformation, is Kimberly-Clark now cheap relative to its potential, or is the market already factoring in the improvements to come?

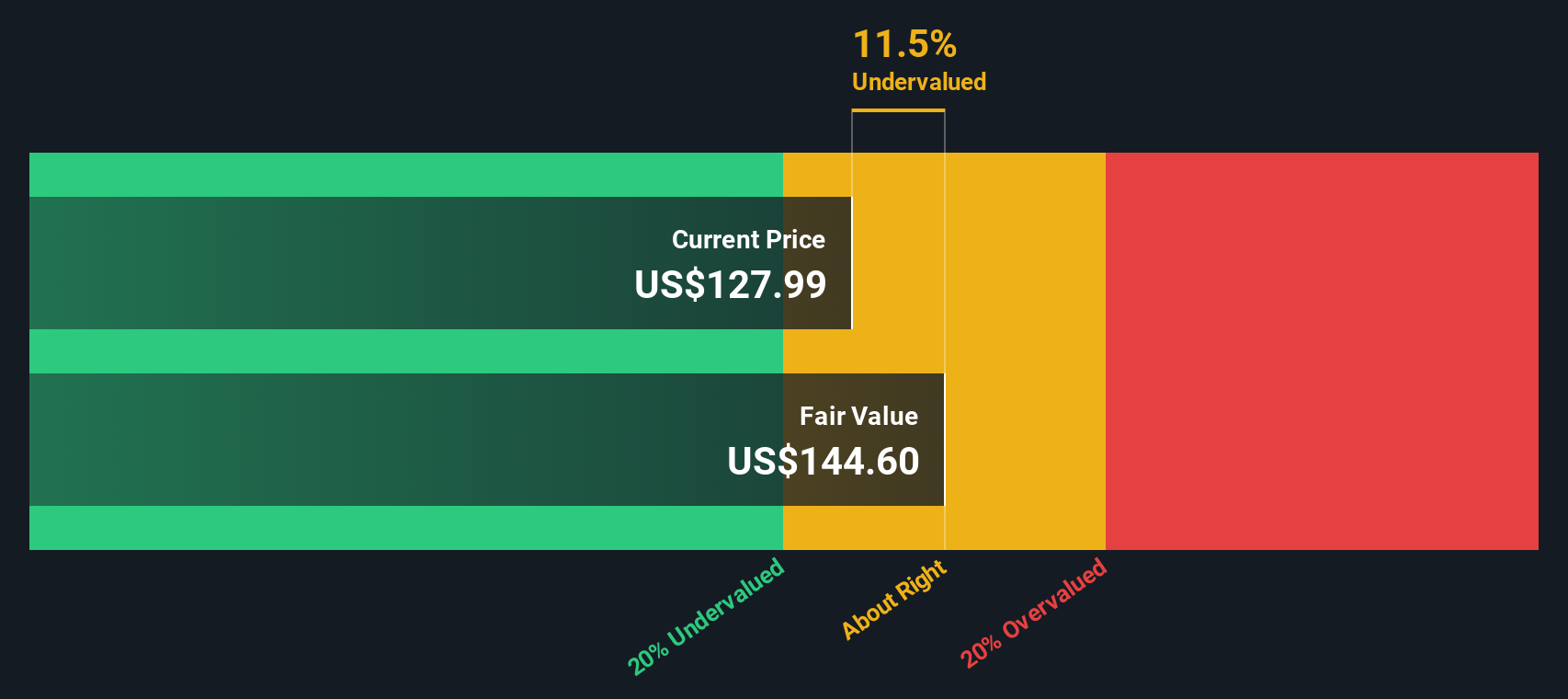

Most Popular Narrative: 12.7% Undervalued

According to the most widely followed narrative, Kimberly-Clark stock is currently trading below what analysts consider to be its fair value, pricing in future earnings and margin improvements.

Robust global and North American consumption trends for essential personal care and hygiene products, bolstered by innovation and brand reinvestment, position Kimberly-Clark to benefit from ongoing population growth and rising health and hygiene consciousness, supporting volume growth and long-term revenue expansion. Continued innovation across premium and mid-tier product lines, combined with effective go-to-market strategies and increased in-house marketing capabilities, allows Kimberly-Clark to capitalize on durable demand for premiumized and differentiated hygiene solutions, supporting structural net margin expansion.

What is really powering this undervalued call? Analysts aren't just betting on stability; they are also factoring in substantial improvements in efficiency and a premium valuation multiple that is uncommon for consumer staples. Want to see the projections that make this price target so compelling? Dive in for the detailed breakdown driving the fair value calculation.

Result: Fair Value of $142.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased competition or a slowdown in consumer spending could quickly undermine these optimistic projections. This highlights potential headwinds for Kimberly-Clark’s outlook.

Find out about the key risks to this Kimberly-Clark narrative.Another View: What Does Our DCF Model Say?

Looking at Kimberly-Clark through the lens of the SWS DCF model, the outcome closely echoes the earlier valuation and suggests the shares are still priced below fair value. Could both approaches be seeing the same opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kimberly-Clark Narrative

If you see things differently or want to follow your own research path, you can easily build your own story and perspective in under three minutes. Do it your way

A great starting point for your Kimberly-Clark research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more actionable investment ideas?

You do not need to settle for the usual market picks. Take the next step and uncover standout opportunities tailored for ambitious investors. These could be the difference-makers your portfolio needs.

- Spot AI disruptors early, setting trends and capturing massive growth with AI penny stocks powering tomorrow’s game-changing innovations.

- Catch strong cash flow bargains by searching for undervalued companies using our tool for undervalued stocks based on cash flows that the market is overlooking right now.

- Tap into the unstoppable rise of blockchain and digital currency by using the selector for cryptocurrency and blockchain stocks reshaping finance and tech across the globe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KMB

Kimberly-Clark

Manufactures and markets personal care products in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives