- United States

- /

- Personal Products

- /

- NasdaqGS:IPAR

Is Interparfums Set for a Comeback After Recent 26% Share Price Drop in 2025?

Reviewed by Bailey Pemberton

If you’ve been eyeing Interparfums and wondering whether now is the time to take action, you’re not alone. The stock’s journey over the last several years has sparked curiosity, hesitation, and energetic debates among investors. On one hand, shares are down 5.7% over the last week, a drop that accelerates to 16.4% for the month, and a steeper 26.6% since the start of the year. Even the trailing twelve months haven’t been kind, with a dip of 21.2%. Looking at the bigger picture, the longer-term story is notable: Interparfums has risen by 34.5% over three years and an impressive 149.5% over five years, which suggests the business’s appeal is still present.

What’s behind these recent moves? Shifting market sentiment has played a part, with investors recalibrating their expectations amid broader market volatility and changing risk appetites. Despite these ups and downs, Interparfums stands out in one important area: its valuation. Out of six standard checks for undervaluation, Interparfums currently passes five, resulting in a value score of 5. In market terms, that’s a strong showing, and it suggests that at its last close of $94.5, there may be more value present than the price alone indicates.

So how do we break down that value? Next, we’ll explore the specific valuation approaches investors consider as they analyze the numbers, and why there might be an even more insightful way to measure the real worth of a company like Interparfums later in this article.

Why Interparfums is lagging behind its peers

Approach 1: Interparfums Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and discounting them back to today's dollars. This approach looks beyond short-term volatility and focuses on a business’s ability to generate cash over the long term.

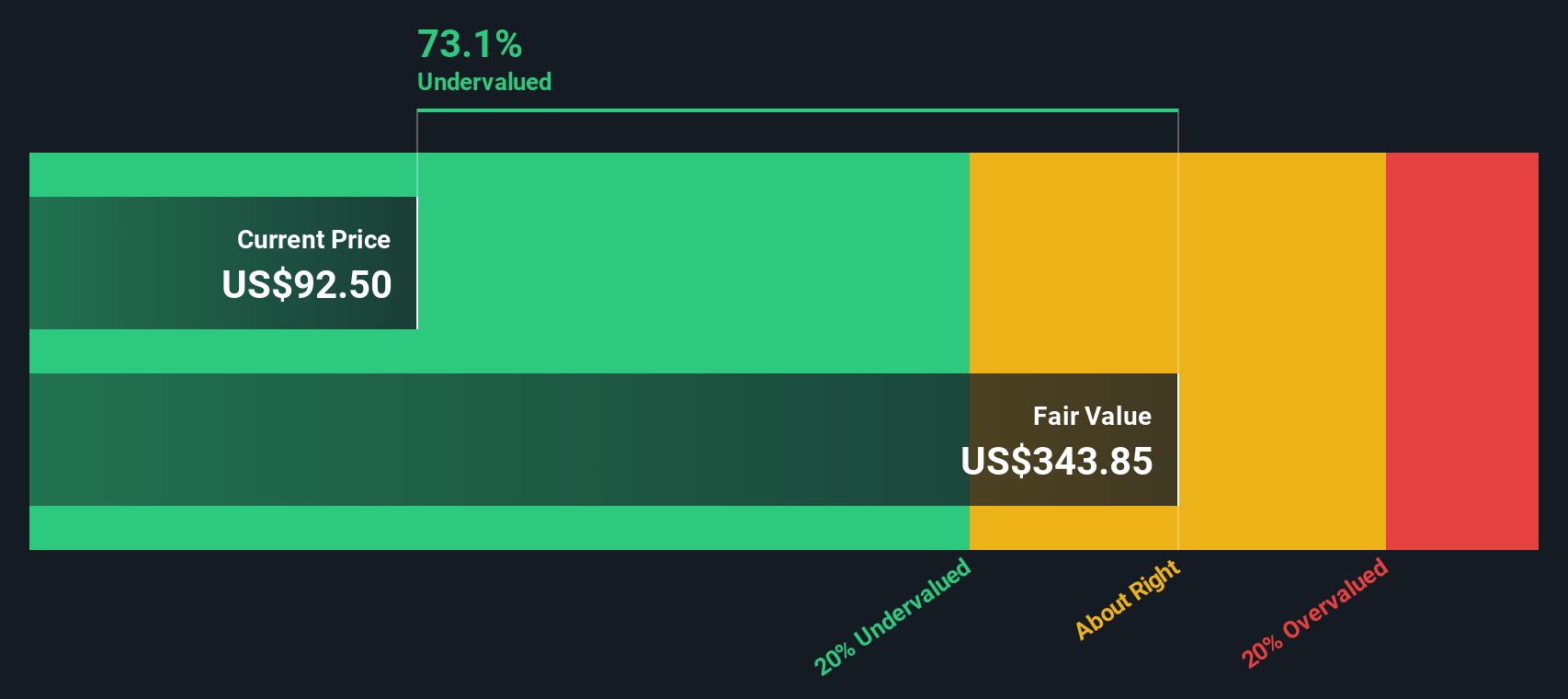

For Interparfums, the latest reported Free Cash Flow is $155.2 Million. Analysts project annual Free Cash Flow to reach $228.9 Million by 2026, increasing further to an estimated $730.8 Million in 2035. These projections are mostly based on available five-year analyst estimates, with further-out forecasts extrapolated from historical patterns. All figures are denominated in US Dollars.

Using its two-stage Free Cash Flow to Equity model, Simply Wall St calculates the intrinsic value for Interparfums at $338.73 per share. With the recent share price at $94.50, this implies the stock is trading at a 72.1% discount to its estimated fair value, creating a substantial margin of safety for potential investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Interparfums is undervalued by 72.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Interparfums Price vs Earnings (PE)

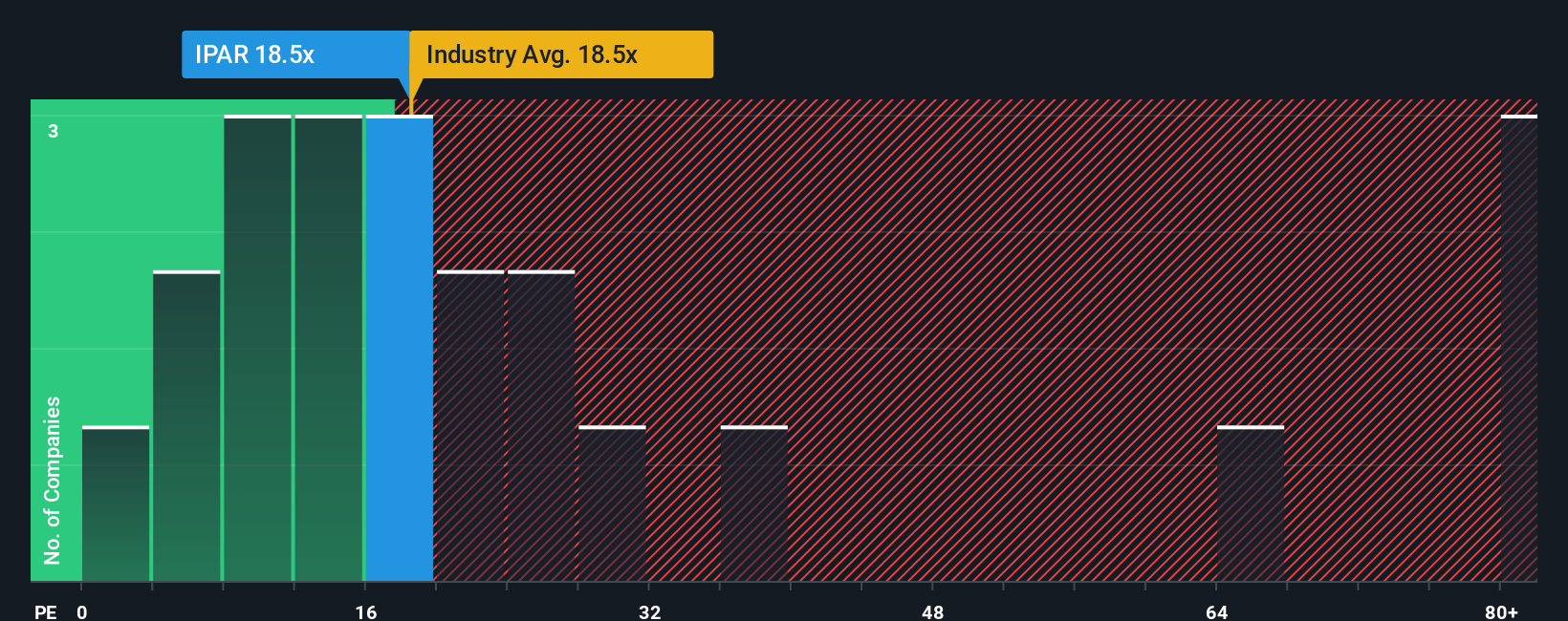

The Price-to-Earnings (PE) ratio is often favored when valuing profitable companies like Interparfums, as it reflects how much investors are willing to pay for each dollar of current earnings. A lower PE can indicate undervaluation, especially if profits are expected to grow, while a higher PE could suggest optimism about future earnings or reflect lower risk.

Both growth prospects and business risk can influence what counts as a “fair” PE ratio. Companies with strong earnings growth and stable performance often justify higher PE ratios, while elevated risks or limited growth potential typically warrant a lower multiple.

Interparfums currently trades at a PE of 18.9x. Compared to the Personal Products industry’s average of 22.5x and the peer group average of 36.6x, Interparfums appears modestly priced. However, simply matching these benchmarks may overlook important company-specific factors.

That’s where the Simply Wall St "Fair Ratio" comes in. This proprietary metric, calculated here as 18.8x for Interparfums, considers not just industry comparisons but also factors like earnings growth, profit margins, market capitalization, and company-specific risks. This offers a deeper perspective than traditional benchmarks.

Because Interparfums’ actual PE (18.9x) is almost identical to its Fair Ratio (18.8x), the stock’s valuation using this approach seems about right in the current market context.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Interparfums Narrative

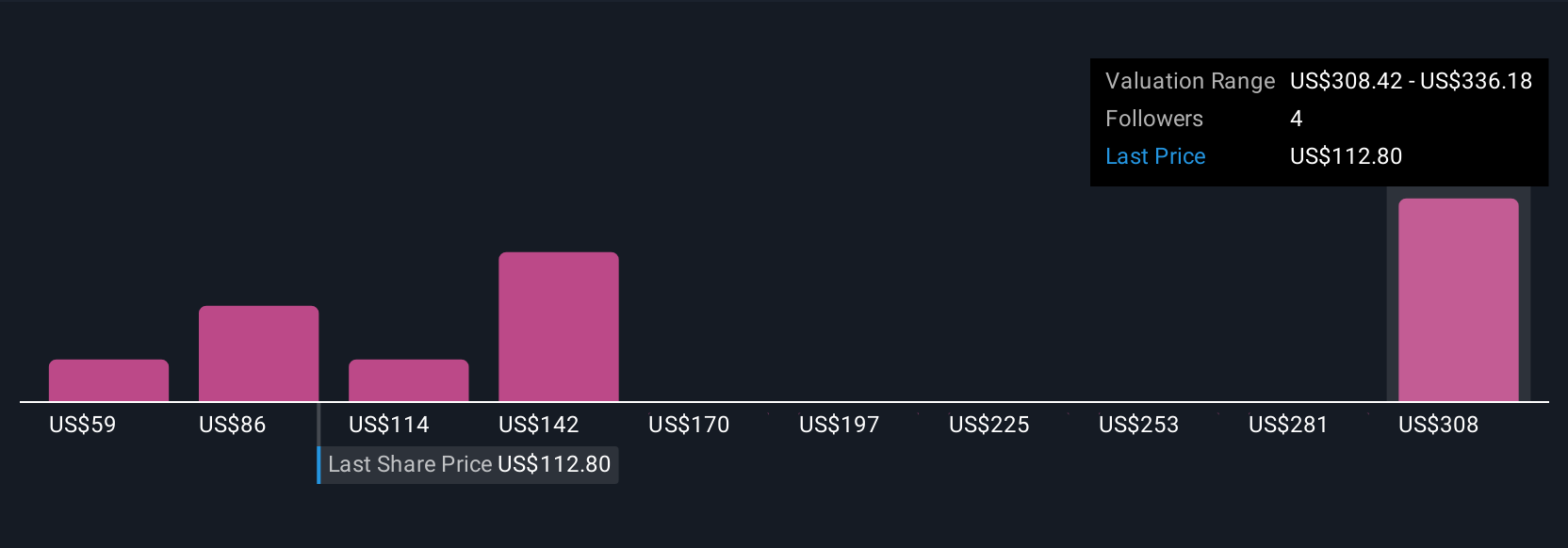

Earlier, we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives, a smarter approach that goes beyond the numbers alone. A Narrative is simply the story you believe about a company, from your perspective or experience, and it connects real-world insights to your forecast of future revenue, earnings, margins, and ultimately, what you think is a fair value for the stock.

Narratives bridge the gap between a company’s story, a financial model, and its true worth in the market. On the Simply Wall St platform, millions of investors are already using Narratives on the Community page to create, browse, and compare perspectives. All of this is as accessible as a quick post or comment.

With Narratives, you can quickly see if your Fair Value estimate suggests the share price is attractive, too high, or somewhere in between, helping you decide when to buy, sell, or hold. Even better, Narratives are kept up to date automatically when important news or new financial results are released, so your investment thesis can evolve as the facts change.

For example, some investors see Interparfums’ expansion into luxury licensing and e-commerce as a catalyst for market-leading growth, justifying a Fair Value as high as $163.33. Others focus on risk factors like heavy dependence on licensed brands or currency swings and arrive at a much lower estimate.

Do you think there's more to the story for Interparfums? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPAR

Interparfums

Manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives