- United States

- /

- Personal Products

- /

- NasdaqGS:IPAR

Does Interparfums' (IPAR) Latest Award Reinforce Its Competitive Edge in Fragrance Leadership?

Reviewed by Sasha Jovanovic

- Interparfums, Inc. was recently named "Beauty Company of the Year, Public" by Women's Wear Daily, a prominent fashion and beauty publication, recognizing its achievements in financial performance, innovation, brand influence, and global market leadership.

- This industry accolade highlights the company's effective execution and solidifies its standing as a significant leader in the fragrance sector.

- We'll explore how recognition for financial excellence and brand influence may further reshape Interparfums' investment narrative and long-term prospects.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Interparfums Investment Narrative Recap

To invest in Interparfums, one must see long-term value in its ability to grow renowned fragrance brands, retain licenses, and capture evolving consumer demand in a competitive market. While earning the "Beauty Company of the Year, Public" honor from Women's Wear Daily adds to Interparfums' brand stature, the award does not materially affect the most pressing short-term catalyst, continued global brand launches and retail expansion, or significantly alter the main risk of revenue concentration in key licensed brands.

Among recent developments, the company's expansion of executive leadership, including bringing onboard industry veterans with deep retail and luxury brand expertise, stands out. This move is directly relevant, as it may help Interparfums manage both the opportunities and complexities that come from increased brand visibility and further global expansion.

However, investors should also keep in mind that despite rising industry recognition, reliance on a handful of top licenses still poses an ongoing financial risk if one falters or is not renewed...

Read the full narrative on Interparfums (it's free!)

Interparfums' outlook anticipates $1.7 billion in revenue and $206.2 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 5.0%, with earnings rising by $45.2 million from the current $161.0 million.

Uncover how Interparfums' forecasts yield a $163.33 fair value, a 66% upside to its current price.

Exploring Other Perspectives

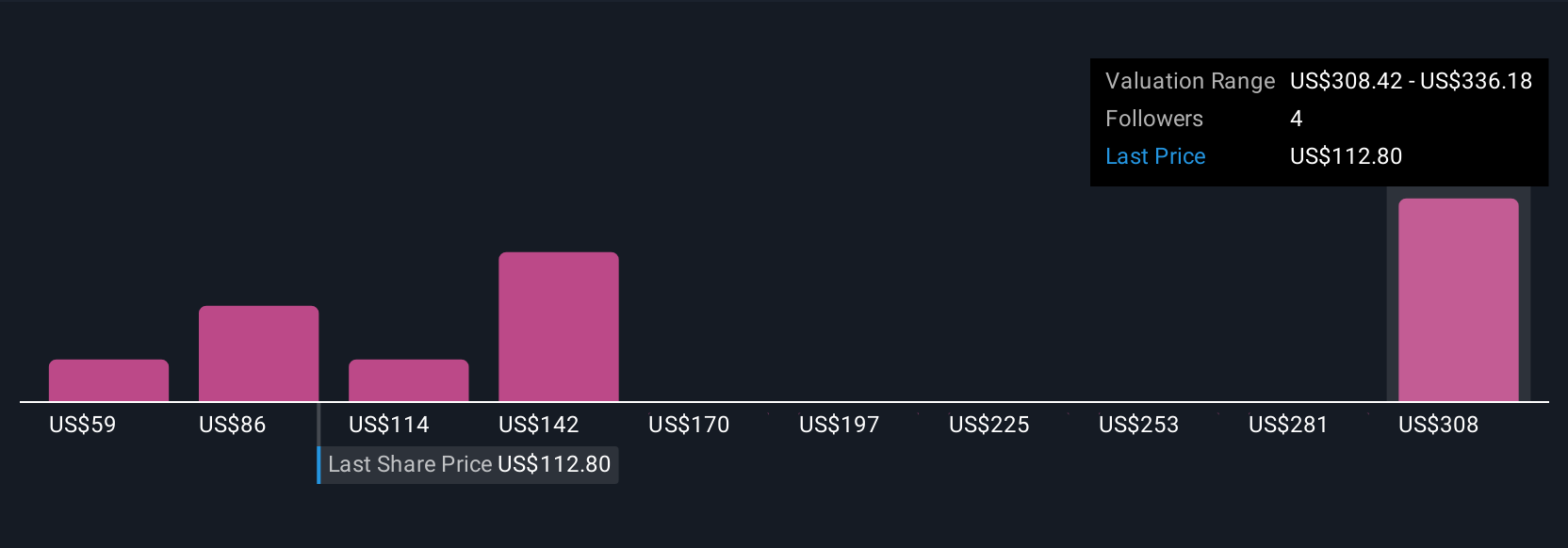

Nine members of the Simply Wall St Community provided fair value estimates for Interparfums, ranging from US$52.71 to US$14,448 per share. While these views are diverse, current analyst consensus highlights the challenge of license concentration risk as a key factor shaping future results.

Explore 9 other fair value estimates on Interparfums - why the stock might be a potential multi-bagger!

Build Your Own Interparfums Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interparfums research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interparfums research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interparfums' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPAR

Interparfums

Manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives