- United States

- /

- Personal Products

- /

- NasdaqGS:IPAR

Should You Be Adding Inter Parfums (NASDAQ:IPAR) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Inter Parfums (NASDAQ:IPAR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Inter Parfums

Inter Parfums' Improving Profits

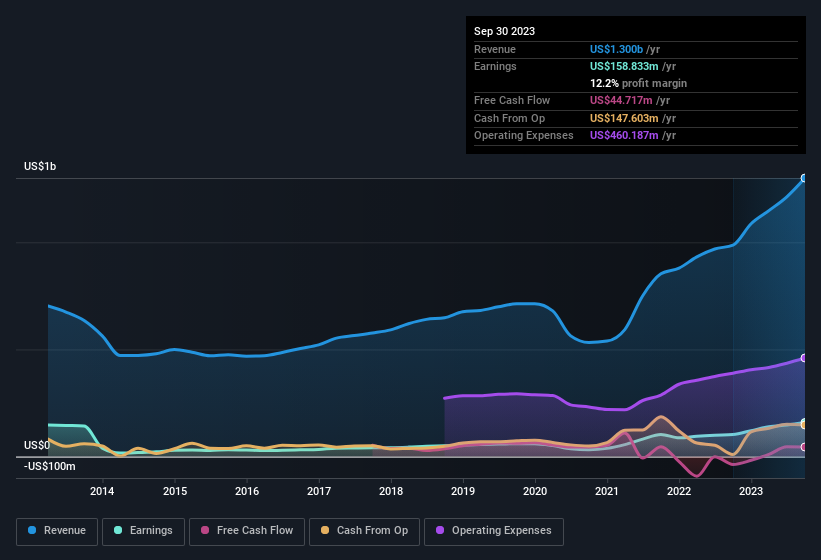

In the last three years Inter Parfums' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, Inter Parfums' EPS soared from US$3.24 to US$4.97, over the last year. That's a impressive gain of 53%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Inter Parfums is growing revenues, and EBIT margins improved by 4.2 percentage points to 20%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Inter Parfums' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Inter Parfums Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Inter Parfums insiders own a significant number of shares certainly is appealing. In fact, they own 44% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. At the current share price, that insider holding is worth a staggering US$2.0b. That level of investment from insiders is nothing to sneeze at.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between US$2.0b and US$6.4b, like Inter Parfums, the median CEO pay is around US$6.4m.

Inter Parfums' CEO took home a total compensation package of US$1.4m in the year prior to December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Inter Parfums Worth Keeping An Eye On?

For growth investors, Inter Parfums' raw rate of earnings growth is a beacon in the night. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Everyone has their own preferences when it comes to investing but it definitely makes Inter Parfums look rather interesting indeed. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Inter Parfums , and understanding them should be part of your investment process.

Although Inter Parfums certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IPAR

Interparfums

Manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives