- United States

- /

- Personal Products

- /

- NasdaqGS:HNST

Honest Company (HNST): Evaluating Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Honest Company.

Despite the rough patch for Honest Company shares this year, with a steep year-to-date share price return of -47.72%, there are hints of renewed interest as its recent positive net income growth sets a different tone. Looking at the bigger picture, short-term momentum has faded. However, the three-year total shareholder return of 8.23% shows that some long-term investors have still come out ahead.

If you’re interested in what else is catching investor attention right now, it’s a great moment to uncover fast growing stocks with high insider ownership

With Honest Company’s share price hovering well below analyst targets and fundamentals showing signs of life, the question now is whether the market is overlooking a compelling value or if all the upside is already priced in.

Most Popular Narrative: 47.7% Undervalued

The consensus narrative points to Honest Company's fair value being well above its last close. The recent share price drop contrasts this outlook and has sparked a debate on the potential upside.

The company is capitalizing on the accelerating shift towards natural and clean-label products, as seen in strong growth in sensitive skin, fragrance-free, and natural baby personal care items. This positions Honest to benefit from increasing consumer demand and supports future revenue expansion.

Wondering how bullish analysts see Honest's future? Their fair value estimate is based on rapid earnings gains, expanding profit margins, and a future earnings multiple that is uncommon in the sector. Curious how these projections could justify a price nearly double today's? Only the full narrative unpacks the details.

Result: Fair Value of $6.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in diaper category growth and rising tariff costs could present challenges for Honest Company's margin expansion and raise questions about its turnaround narrative.

Find out about the key risks to this Honest Company narrative.

Another View: Price-to-Earnings Signals Caution

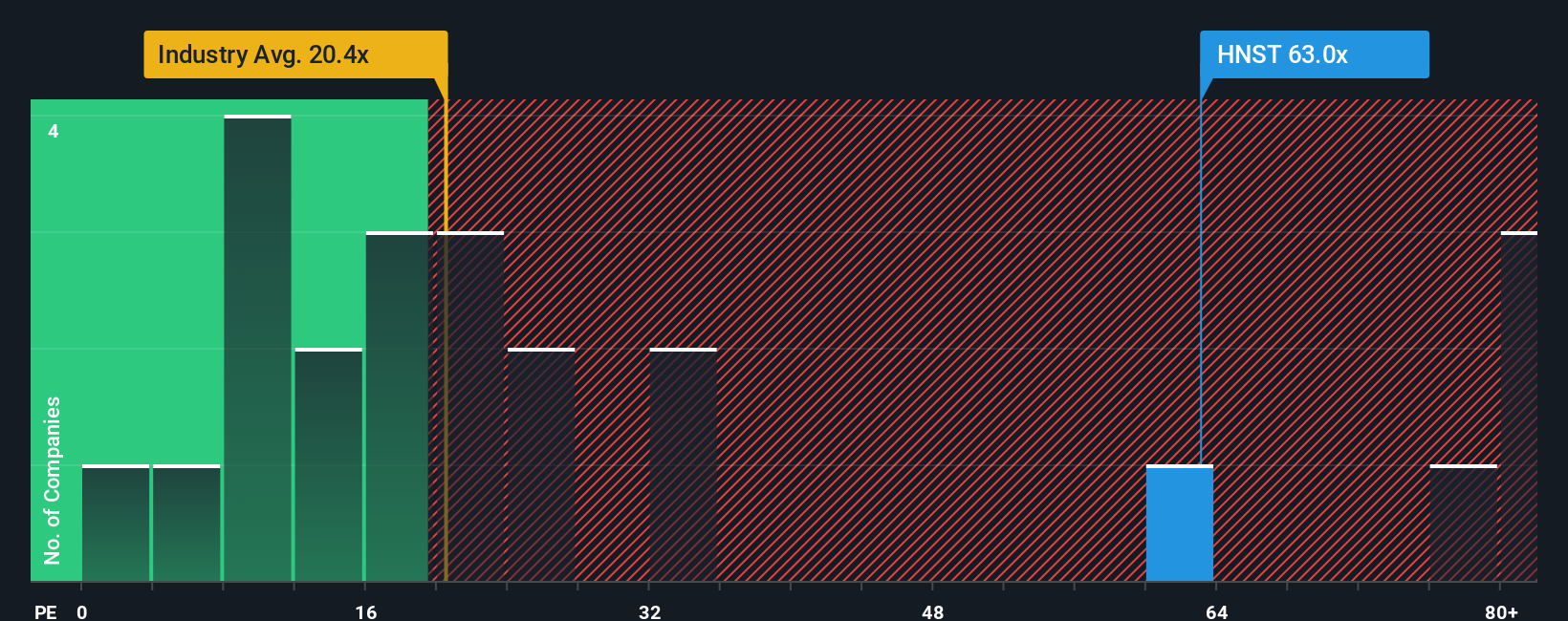

While the consensus narrative points to Honest Company as undervalued, looking through the lens of price-to-earnings paints a much different picture. At 61x, Honest's ratio is much higher than both the industry average (19.8x) and its peer group (11.6x), and well above the fair ratio of 21.2x. This sizable gap suggests investors may be paying a premium, raising the question: could optimism outpace reality if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Honest Company Narrative

If you'd rather draw your own conclusions or question the popular sentiment, you can dig into the numbers and shape your own view in minutes with Do it your way.

A great starting point for your Honest Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great investing goes beyond one stock. Keep your edge sharp and capitalize on other opportunities that could outperform. These screens consistently surface stocks Wall Street can’t ignore.

- Maximize your income potential and tap into stability by reviewing these 17 dividend stocks with yields > 3% with attractive yields above 3% for reliable returns.

- Seize the AI revolution’s momentum and pinpoint promising upstarts among these 26 AI penny stocks that are driving the future of intelligent technology.

- Boost your portfolio’s value growth by targeting these 871 undervalued stocks based on cash flows trading below what their fundamentals suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honest Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HNST

Honest Company

Manufactures and sells diapers and wipes, skin and personal care, and household and wellness products.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives