- United States

- /

- Personal Products

- /

- NasdaqGS:HNST

A Piece Of The Puzzle Missing From The Honest Company, Inc.'s (NASDAQ:HNST) 25% Share Price Climb

The Honest Company, Inc. (NASDAQ:HNST) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 49% in the last twelve months.

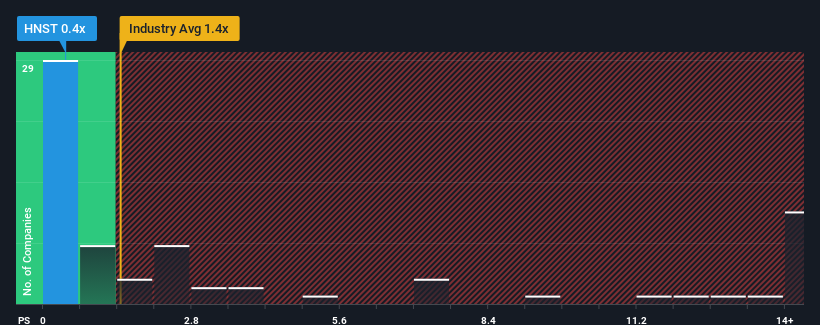

Even after such a large jump in price, Honest Company may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Personal Products industry in the United States have P/S ratios greater than 1.4x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Honest Company

What Does Honest Company's Recent Performance Look Like?

Recent times have been advantageous for Honest Company as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Honest Company.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Honest Company would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.6% last year. The solid recent performance means it was also able to grow revenue by 12% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 4.5% per year over the next three years. With the industry predicted to deliver 5.7% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it odd that Honest Company is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Honest Company's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Honest Company's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Honest Company remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Honest Company you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Honest Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HNST

Honest Company

Manufactures and sells diapers and wipes, skin and personal care, and household and wellness products.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives