- United States

- /

- Personal Products

- /

- NasdaqCM:FLGC

Investors Give Flora Growth Corp. (NASDAQ:FLGC) Shares A 28% Hiding

Flora Growth Corp. (NASDAQ:FLGC) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 85% loss during that time.

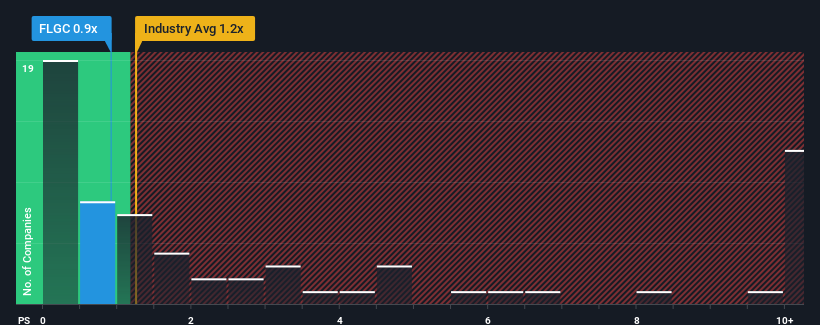

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Flora Growth's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Personal Products industry in the United States is also close to 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Flora Growth

How Flora Growth Has Been Performing

Recent times have been pleasing for Flora Growth as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. Those who are bullish on Flora Growth will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Flora Growth's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Flora Growth?

In order to justify its P/S ratio, Flora Growth would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 158% over the next year. With the industry only predicted to deliver 8.1%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Flora Growth is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Flora Growth's P/S?

With its share price dropping off a cliff, the P/S for Flora Growth looks to be in line with the rest of the Personal Products industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Flora Growth currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Flora Growth (3 are potentially serious!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Flora Growth, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FLGC

Flora Growth

Engages in the growth, cultivation, and development of medicinal cannabis and medicinal cannabis derivative products worldwide.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives