- United States

- /

- Hospitality

- /

- NasdaqCM:YTRA

Top Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The U.S. stock market has seen a downturn following the end of the longest federal shutdown in history, with major indices slipping as technology shares led declines. Despite these challenges, opportunities remain for investors willing to explore smaller or newer companies often categorized under the term "penny stocks." These stocks can offer significant growth potential at lower price points, especially when they are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.73 | $379.32M | ✅ 4 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.20 | $924.51M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.63 | $607.59M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.15 | $713.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.99 | $261.53M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.19 | $26.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.75 | $1.02B | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8975 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.25 | $72.73M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 357 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Anixa Biosciences (ANIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anixa Biosciences, Inc. is a biotechnology company that develops therapies and vaccines targeting critical unmet needs in oncology, with a market cap of $151.42 million.

Operations: Anixa Biosciences, Inc. currently does not report any revenue segments.

Market Cap: $151.42M

Anixa Biosciences, Inc., a pre-revenue biotechnology company with a market cap of US$151.42 million, is advancing its pipeline of cancer therapies and vaccines despite being unprofitable. Recent developments include the completion of Phase 1 trials for its breast cancer vaccine, developed in collaboration with Cleveland Clinic, showing promising immune response data. The company plans to move into Phase 2 trials while maintaining a debt-free balance sheet and sufficient cash runway for over a year. Anixa's unique model involves strategic partnerships with research institutions to leverage cutting-edge technologies in oncology treatments and immunotherapies.

- Click to explore a detailed breakdown of our findings in Anixa Biosciences' financial health report.

- Examine Anixa Biosciences' earnings growth report to understand how analysts expect it to perform.

Yatra Online (YTRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yatra Online, Inc. is an online travel company operating in India and internationally, with a market cap of $97.74 million.

Operations: The company's revenue is derived from three main segments: Air Ticketing (₹2.12 billion), Hotels and Packages (₹6.01 billion), and Other Services (₹319.79 million).

Market Cap: $97.74M

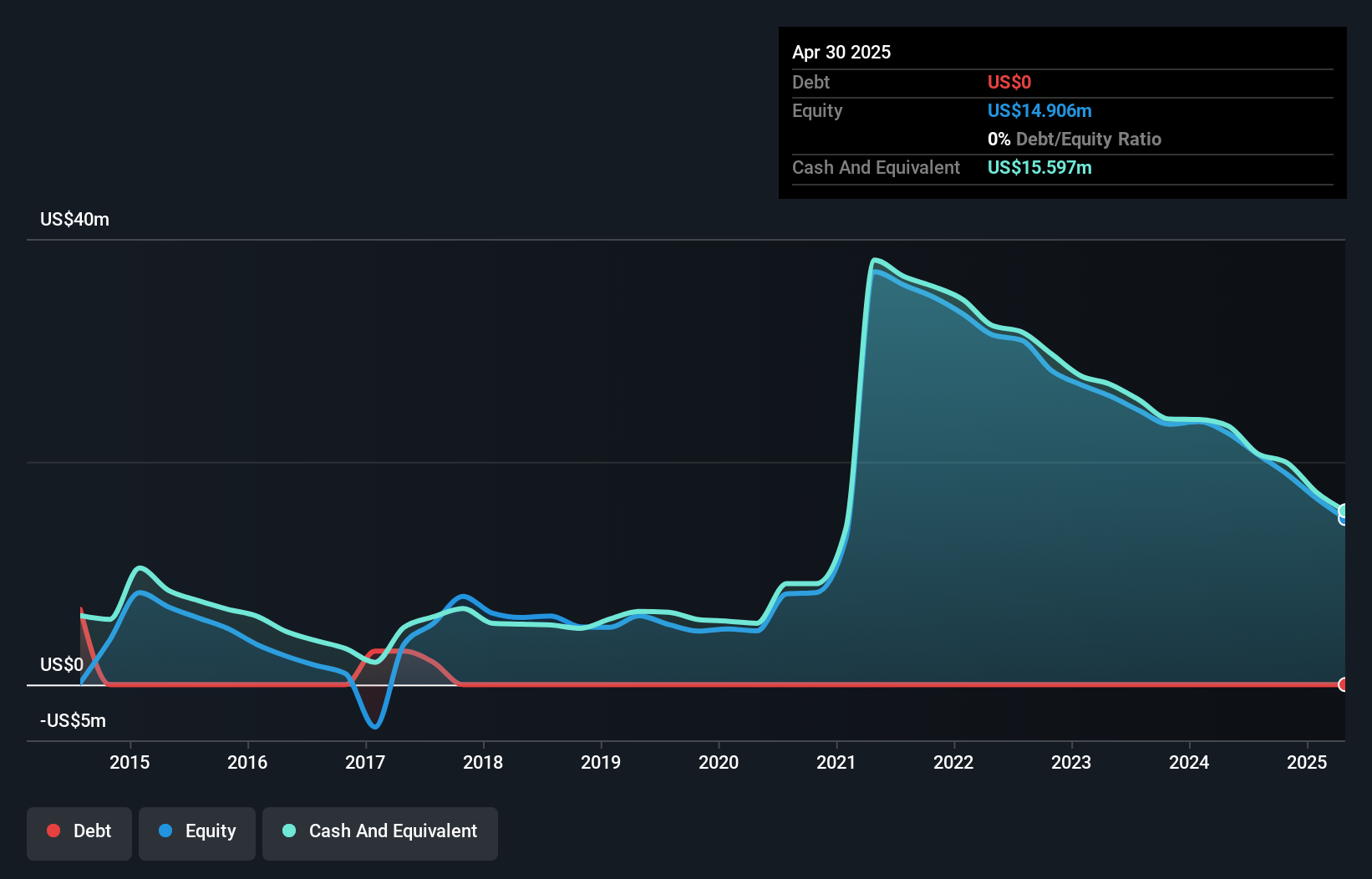

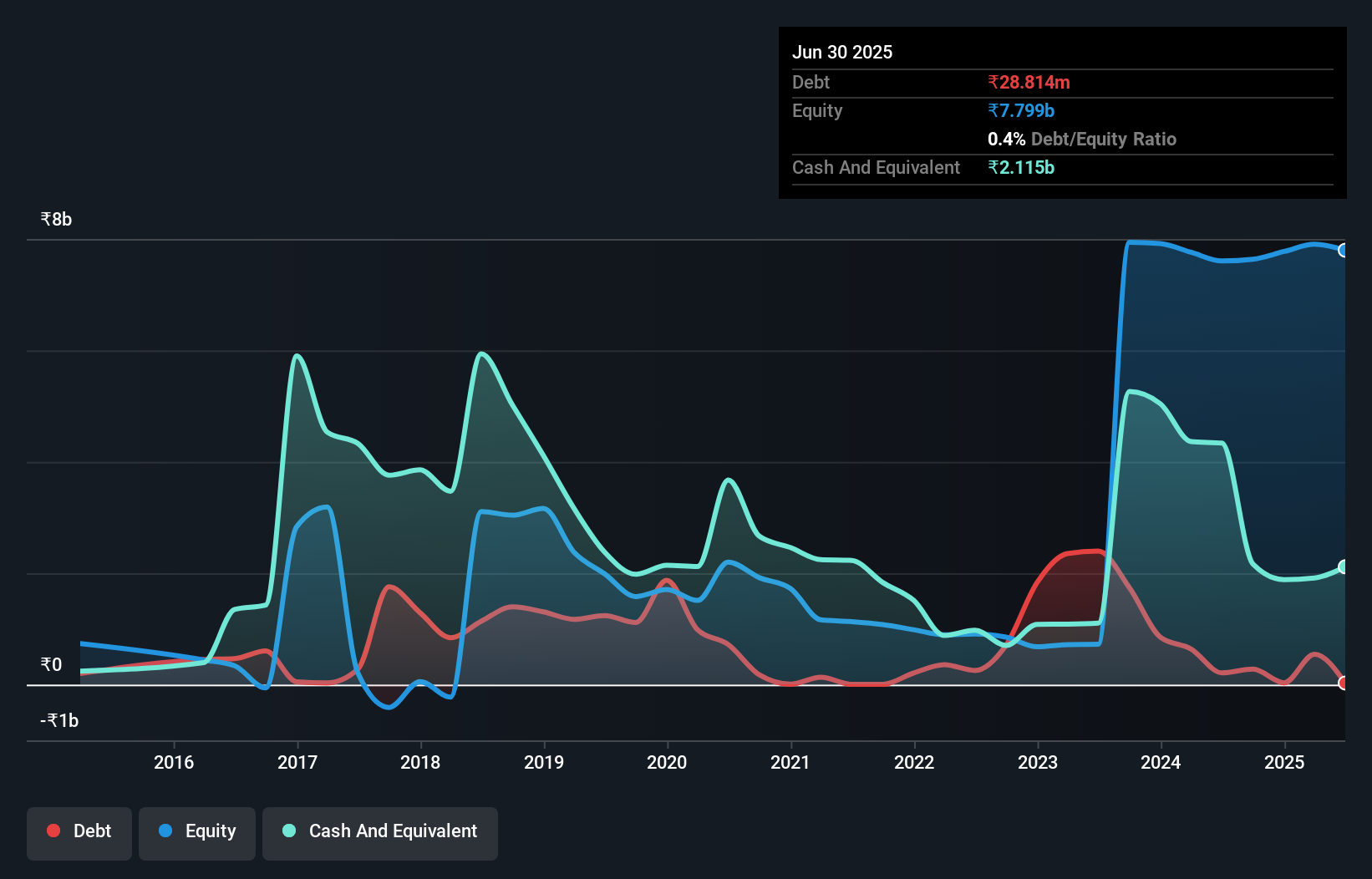

Yatra Online, Inc., with a market cap of $97.74 million, has shown promising financial performance despite being historically unprofitable. Recent earnings for the second quarter ended September 30, 2025, revealed a revenue increase to ₹3.51 billion from ₹2.36 billion the previous year and a net income of ₹47.9 million compared to a loss previously. The company maintains strong liquidity with short-term assets exceeding liabilities and more cash than debt, indicating financial stability. Yatra's management team is experienced with an average tenure of 13 years, supporting strategic growth initiatives in its competitive industry landscape.

- Take a closer look at Yatra Online's potential here in our financial health report.

- Assess Yatra Online's previous results with our detailed historical performance reports.

CS Diagnostics (CSDX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CS Diagnostics Corp. designs, manufactures, and sells wellness and medical products in Germany and internationally, with a market cap of $35.57 million.

Operations: The company's revenue segment includes Internet Software & Services, generating $0.08 million.

Market Cap: $35.57M

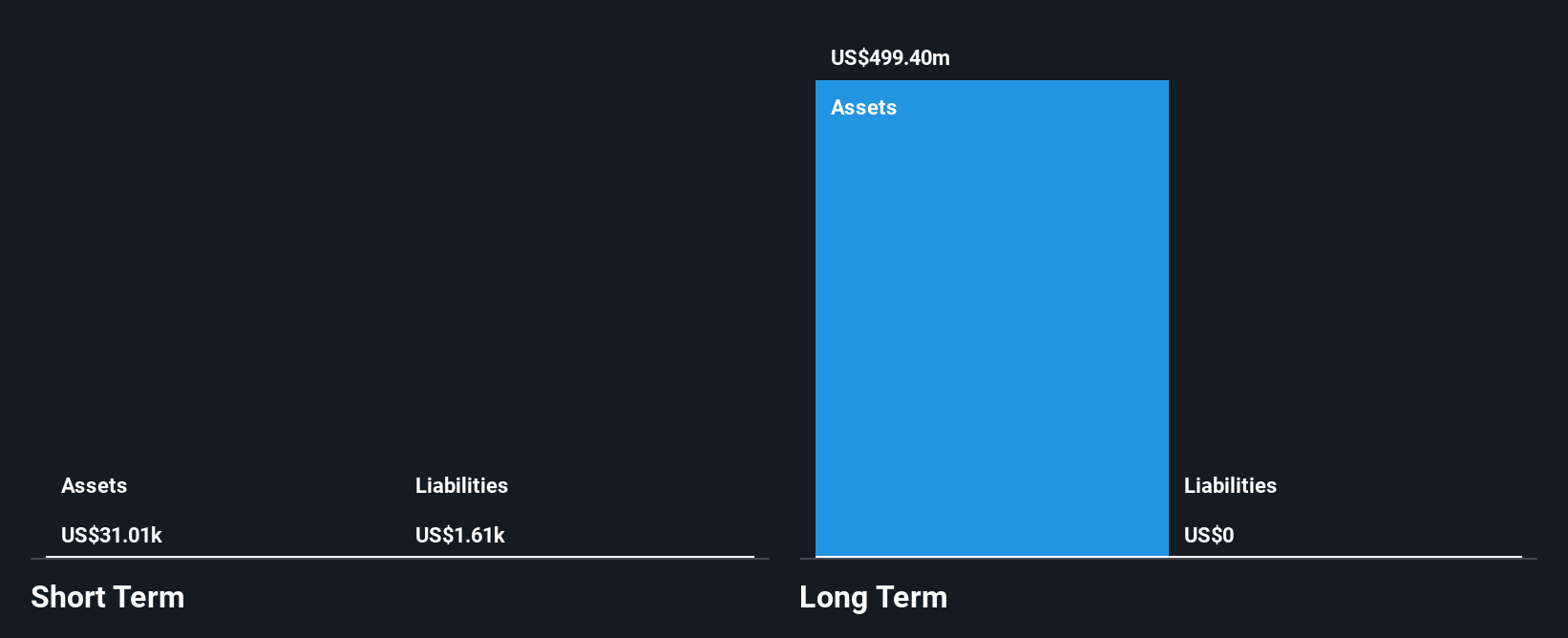

CS Diagnostics Corp., with a market cap of US$35.57 million, is navigating the penny stock landscape with some challenges and opportunities. Despite being pre-revenue, it recently transitioned to profitability, reporting a net income increase for the first half of 2025 compared to the previous year. The company remains debt-free and has no long-term liabilities, which can be appealing in terms of financial stability. However, its revenue has declined significantly over the past year and remains under US$1 million, highlighting potential risks associated with its volatile share price and limited financial history.

- Click here and access our complete financial health analysis report to understand the dynamics of CS Diagnostics.

- Learn about CS Diagnostics' historical performance here.

Key Takeaways

- Unlock our comprehensive list of 357 US Penny Stocks by clicking here.

- Searching for a Fresh Perspective? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:YTRA

Yatra Online

Operates as an online travel company in India and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives