- United States

- /

- Banks

- /

- NasdaqCM:ESQ

Undiscovered Gems in the United States for November 2024

Reviewed by Simply Wall St

The United States market has seen a notable upswing, climbing 1.6% in the last week and surging 32% over the past year, with earnings projected to grow by 15% annually in the coming years. In this thriving environment, identifying stocks that offer strong fundamentals and growth potential can be key to uncovering undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Esquire Financial Holdings (NasdaqCM:ESQ)

Simply Wall St Value Rating: ★★★★★★

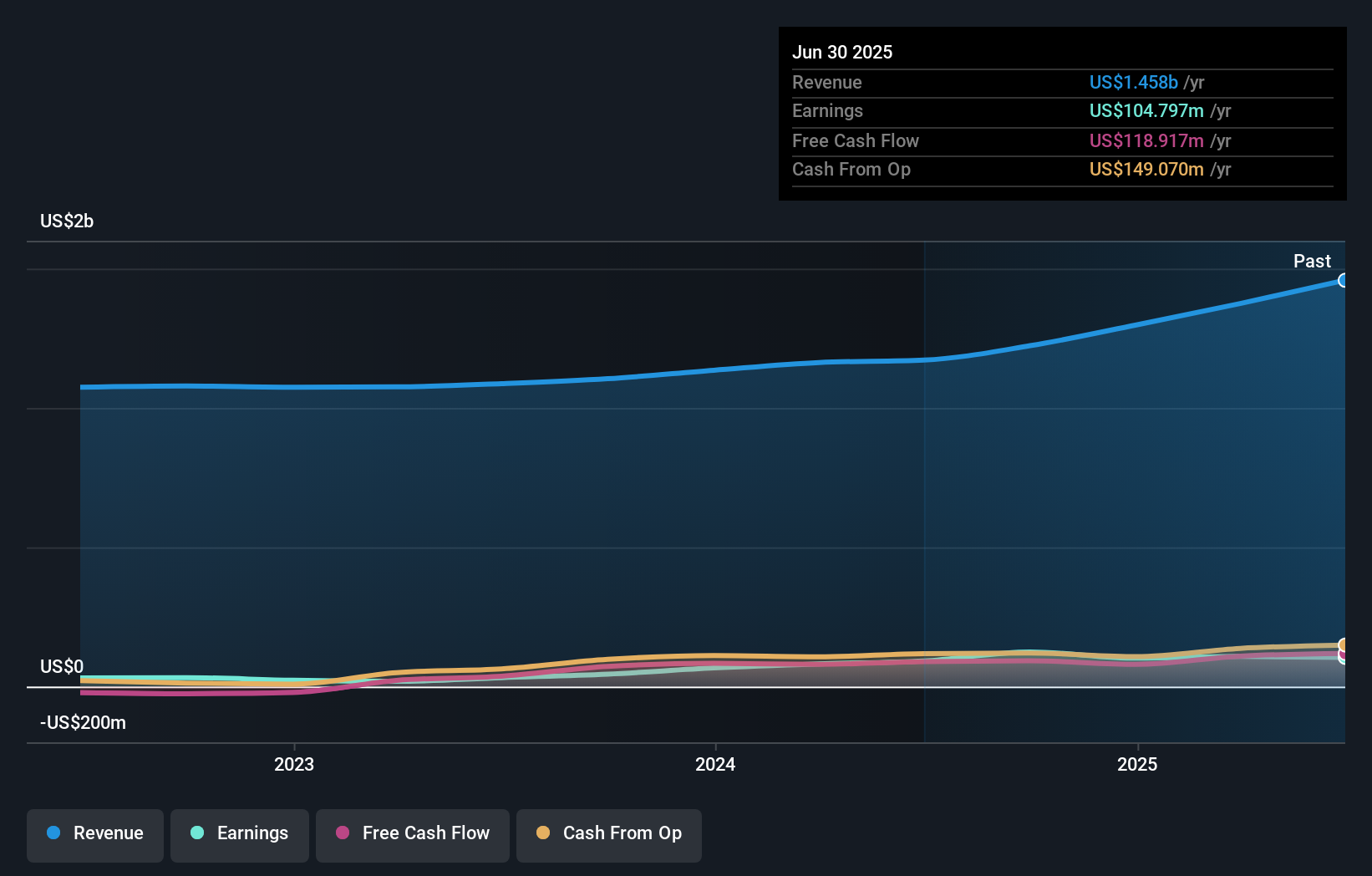

Overview: Esquire Financial Holdings, Inc. is the bank holding company for Esquire Bank, National Association, offering commercial banking products and services primarily to the legal industry, small businesses, and retail customers in the United States with a market cap of $604.55 million.

Operations: Esquire Financial Holdings generates revenue primarily from its community banking segment, amounting to $116.21 million. The company's market capitalization stands at approximately $604.55 million.

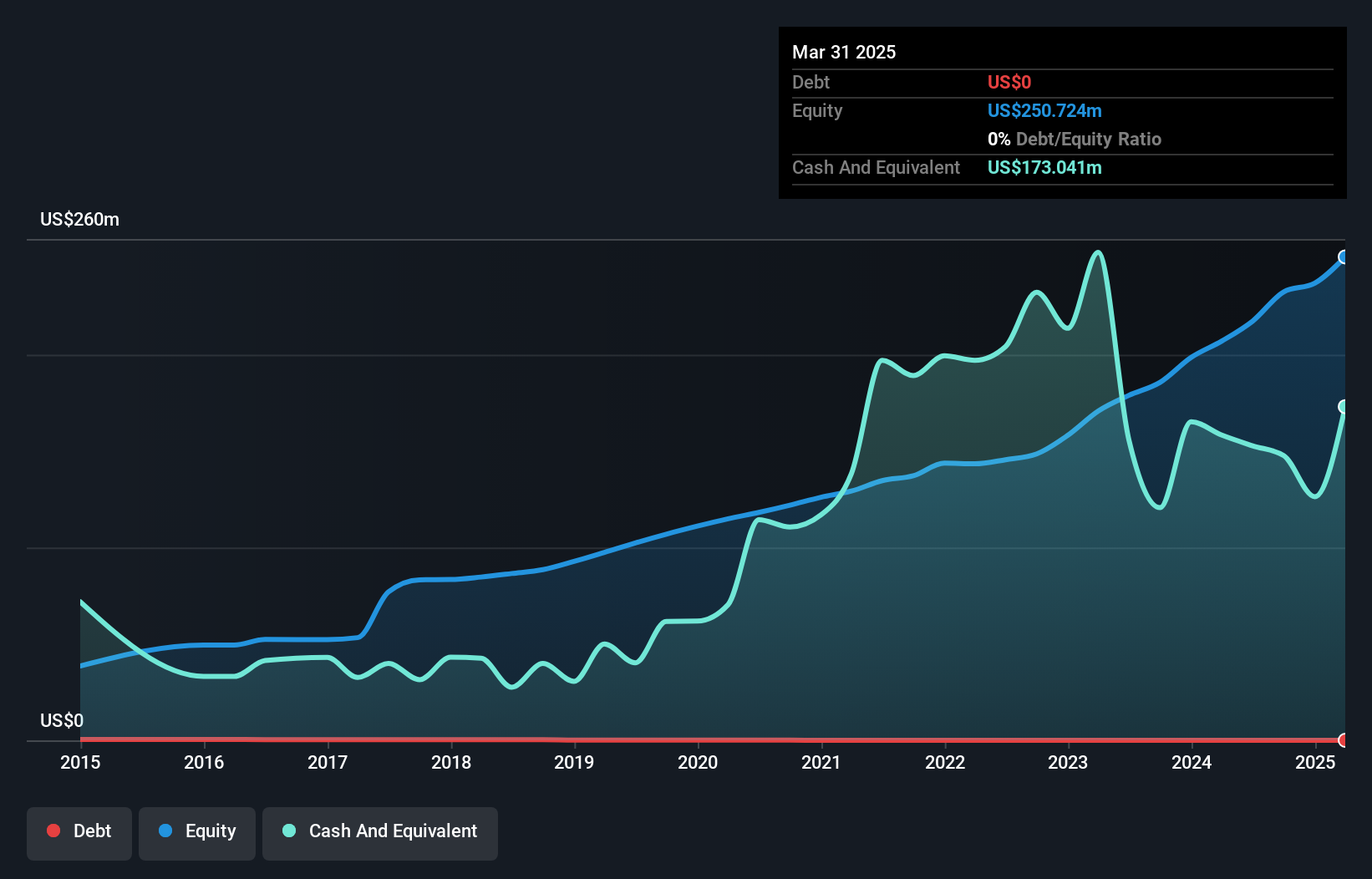

With total assets of US$1.8 billion and equity of US$232.6 million, Esquire Financial Holdings stands out with its strong financial health and prudent management. The company has a sufficient allowance for bad loans at 178%, while non-performing loans are just 0.8% of total loans, underscoring its robust risk management practices. Its liabilities are primarily low-risk customer deposits, accounting for 99% of funding sources, which is less risky than external borrowing. Trading at 58% below estimated fair value and boasting high-quality past earnings, Esquire's net interest margin is a healthy 6.1%, indicating efficient lending operations.

- Click to explore a detailed breakdown of our findings in Esquire Financial Holdings' health report.

Gain insights into Esquire Financial Holdings' past trends and performance with our Past report.

National HealthCare (NYSEAM:NHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: National HealthCare Corporation operates skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals, with a market cap of approximately $1.95 billion.

Operations: National HealthCare Corporation generates revenue primarily from inpatient services, which account for $1.04 billion, and homecare and hospice services, contributing $137.47 million.

National HealthCare, a smaller player in the healthcare sector, has shown impressive financial performance recently. Earnings surged by 177.7% over the past year, significantly outpacing the industry average of 10.3%. A notable one-off gain of US$84.3 million influenced its results for the last 12 months ending September 2024. Despite this, NHC trades at about 53% below its estimated fair value, suggesting potential undervaluation. However, their debt-to-equity ratio rose from 3.9% to 14.9% over five years, indicating increased leverage but remains manageable with more cash than total debt on hand.

Tompkins Financial (NYSEAM:TMP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tompkins Financial Corporation is a financial holding company that offers a range of services including commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services, with a market cap of approximately $1.10 billion.

Operations: Tompkins Financial's primary revenue streams include banking ($229.63 million), insurance ($39.07 million), and wealth management ($19.81 million). The company's net profit margin is a key financial metric to consider when evaluating its profitability.

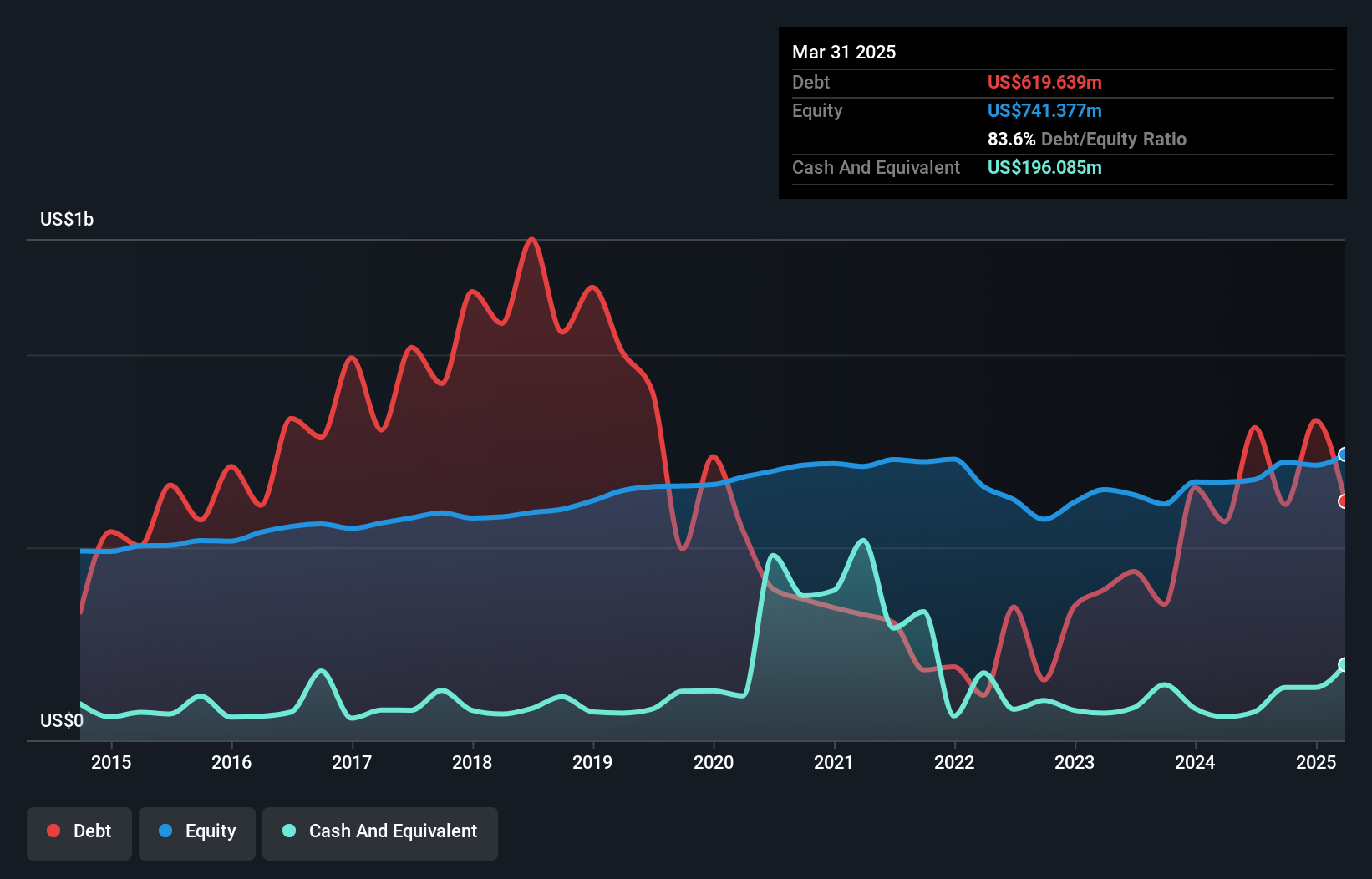

With total assets of US$8.0 billion and equity at US$721.3 million, Tompkins Financial holds a strong position in the market. The company boasts deposits of US$6.6 billion against loans totaling US$5.8 billion, although it has an insufficient allowance for bad loans at 1.1%. Impressively, earnings surged by 373% over the past year, outpacing the banking industry's downturn of -12%. Despite trading 37% below its estimated fair value, Tompkins shows potential with high-quality earnings and primarily low-risk funding sources comprising 90% customer deposits, offering a stable foundation for future growth prospects.

Taking Advantage

- Explore the 230 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Esquire Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESQ

Esquire Financial Holdings

Operates as the bank holding company for Esquire Bank, National Association that provides commercial banking products and services to legal industry and small businesses, and commercial and retail customers in the United States.

Flawless balance sheet with acceptable track record.