- United States

- /

- Biotech

- /

- NasdaqGS:GOSS

Gossamer Bio And 2 Other Promising Penny Stocks On US Exchanges

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of uncertainty marked by unchanged interest rates and looming big-tech earnings, investors are keenly observing potential opportunities in various sectors. Penny stocks, often associated with smaller or emerging companies, continue to capture attention due to their affordability and growth potential. Despite being considered a niche area today, these stocks can offer significant value when backed by strong financial health; we'll explore three such promising penny stocks that might align with these criteria.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.14M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.9115 | $6.53M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.27829 | $10.41M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.47 | $48.18M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.54 | $42M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.76 | $82.81M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.09 | $53.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.891 | $80.95M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.29 | $22.88M | ★★★★★☆ |

Click here to see the full list of 710 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Gossamer Bio (NasdaqGS:GOSS)

Simply Wall St Financial Health Rating: ★★★★☆☆

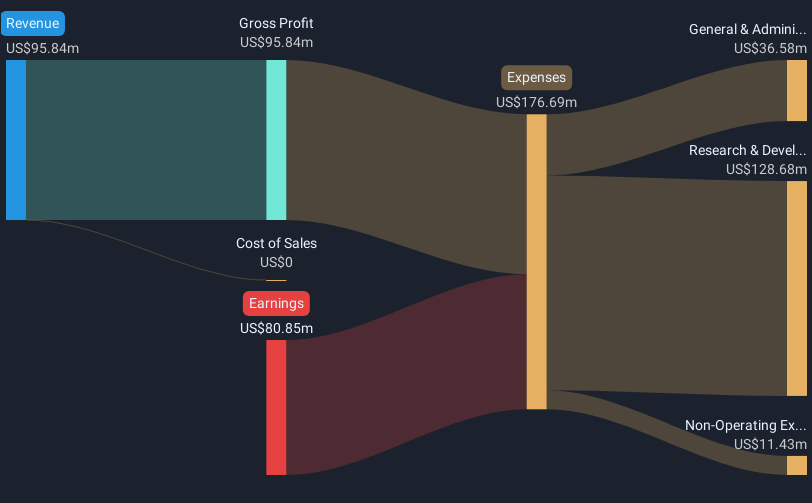

Overview: Gossamer Bio, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing seralutinib for the treatment of pulmonary arterial hypertension in the United States, with a market cap of $208.66 million.

Operations: Gossamer Bio, Inc. currently does not report any revenue segments as it is focused on the clinical development of seralutinib for pulmonary arterial hypertension in the United States.

Market Cap: $208.66M

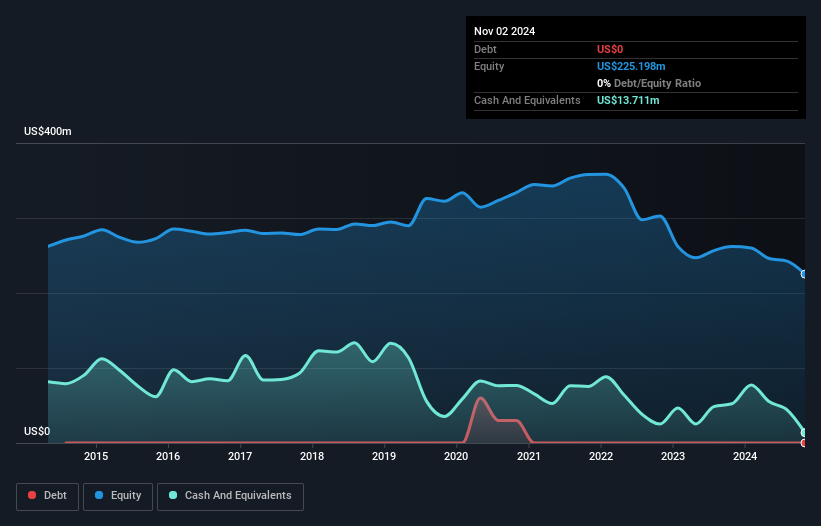

Gossamer Bio, Inc. has recently reported revenue of US$9.48 million for the third quarter of 2024, marking a significant improvement from its pre-revenue status. Despite being unprofitable, the company reduced its net loss to US$30.8 million and improved its cash runway to over three years with sufficient short-term assets (US$344.3M) covering liabilities. The stock remains highly volatile compared to peers, yet it is trading at a substantial discount relative to estimated fair value and shows potential revenue growth at 27.51% per year according to forecasts, though profitability remains elusive in the near term.

- Dive into the specifics of Gossamer Bio here with our thorough balance sheet health report.

- Examine Gossamer Bio's earnings growth report to understand how analysts expect it to perform.

Vera Bradley (NasdaqGS:VRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vera Bradley, Inc., along with its subsidiaries, designs, manufactures, and sells women's handbags, luggage and travel items, fashion and home accessories, and gifts; it has a market cap of $102.87 million.

Operations: The company's revenue is derived from three segments: Pura Vida with $63.76 million, Vera Bradley Direct with $274.13 million, and Vera Bradley Indirect with $67.38 million.

Market Cap: $102.87M

Vera Bradley, Inc. is trading significantly below its estimated fair value and offers good relative value compared to peers, yet it remains unprofitable with a negative return on equity of -7.58%. The company has no debt and strong short-term assets ($184.8M) covering liabilities, reflecting financial stability despite recent losses. Recent earnings reveal a net loss of US$12.8 million for Q3 2024, contrasting with the previous year's profit; however, management's strategic buyback program aims to bolster shareholder value using available cash resources up to US$30 million over three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Vera Bradley.

- Gain insights into Vera Bradley's future direction by reviewing our growth report.

Milestone Scientific (NYSEAM:MLSS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Milestone Scientific Inc. is a biomedical technology company that patents, designs, develops, and commercializes diagnostic and therapeutic injection technologies for medical, dental, and cosmetic use globally, with a market cap of $100.48 million.

Operations: The company's revenue is primarily derived from its Dental segment, which accounts for $8.75 million, while the Medical segment contributes $0.13 million.

Market Cap: $100.48M

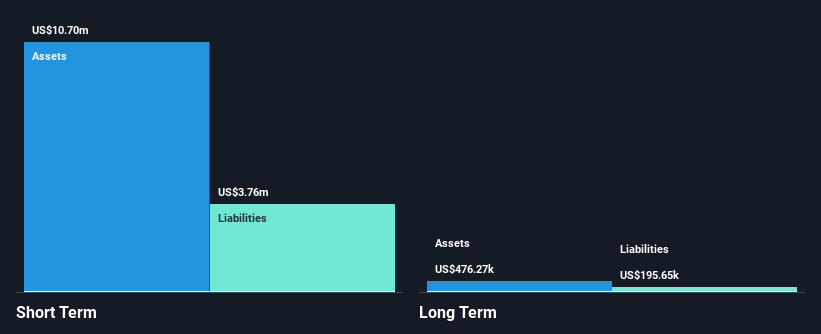

Milestone Scientific Inc., a biomedical technology company, has secured a Federal Supply Schedule contract for its CompuFlo Epidural System, opening significant opportunities within federal healthcare systems. Despite being unprofitable with negative return on equity and recent executive changes, the company is debt-free and has reduced losses over five years. Its short-term assets of US$10.7 million cover liabilities, ensuring financial stability. The commercial rollout of the CompuFlo system at Hudson Specialty Care indicates promising market expansion potential as Milestone continues to grow its sales pipeline through strategic partnerships and pilot programs across several states.

- Take a closer look at Milestone Scientific's potential here in our financial health report.

- Understand Milestone Scientific's earnings outlook by examining our growth report.

Where To Now?

- Navigate through the entire inventory of 710 US Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOSS

Gossamer Bio

A clinical-stage biopharmaceutical company, focuses on developing and commercializing seralutinib for the treatment of pulmonary arterial hypertension (PAH) in the United States.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives