- United States

- /

- Medical Equipment

- /

- NYSE:ZBH

Zimmer Biomet's New Trauma Solutions Could Be a Game Changer for ZBH

Reviewed by Sasha Jovanovic

- Zimmer Biomet Holdings and its subsidiary Paragon 28 recently announced the full US commercial launch of the Gorilla Pilon Fusion Plating System and Phantom TTC Trauma Nail, expanding advanced surgical solutions for challenging foot and ankle trauma cases.

- This product expansion reflects increased collaboration with leading orthopedic surgeons and enhances Zimmer Biomet's portfolio in a complex and clinically significant injury segment.

- We'll explore how the new trauma innovations could influence Zimmer Biomet's investment outlook, particularly through clinical adoption and market expansion.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Zimmer Biomet Holdings Investment Narrative Recap

To be a Zimmer Biomet Holdings shareholder, you need to believe that continuous innovation in orthopedics and an expanding suite of advanced surgical solutions will deliver sustained growth, even as pricing pressures and integration challenges persist. The US launch of the Gorilla Pilon Fusion Plating System and Phantom TTC Trauma Nail strengthens the company’s trauma portfolio, but it is unlikely to move the needle on the most important short-term catalyst: clinical adoption and faster integration of recent acquisitions. The biggest risk remains Zimmer Biomet’s ability to balance integration costs with expected revenue gains, especially as acquisition-related expenses continue to pressure operating margins.

Of the recent announcements, the acquisition and commercial integration of Paragon 28 emerges as most relevant, underpinning the new product launches and broadening Zimmer Biomet’s market reach in foot and ankle trauma. This aligns closely with Zimmer Biomet’s catalyst of unlocking new growth areas through targeted acquisitions, yet highlights that execution risk and potential margin dilution are still front and center for investors focused on near-term returns.

Yet, even as new products hit the market, investors should be alert to the persistent challenge of flat selling prices and ongoing industry-wide pricing pressure…

Read the full narrative on Zimmer Biomet Holdings (it's free!)

Zimmer Biomet Holdings is projected to reach $9.2 billion in revenue and $1.3 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 5.5% and implies an increase in earnings of about $476 million from the current $823.5 million.

Uncover how Zimmer Biomet Holdings' forecasts yield a $110.92 fair value, a 12% upside to its current price.

Exploring Other Perspectives

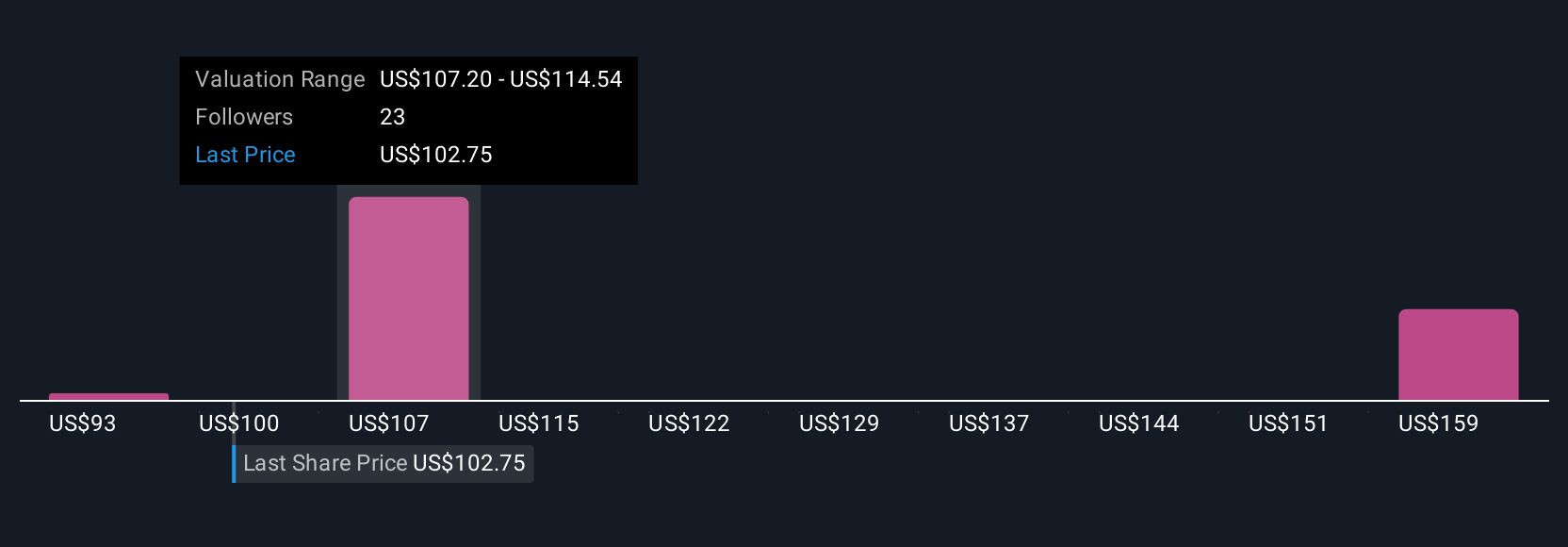

Simply Wall St Community members offer three fair value estimates for Zimmer Biomet ranging from US$95 to US$169.37 per share. While opinions vary widely, many remain focused on how continued innovation and successful acquisition integration could affect the company’s ability to deliver sustainable long-term growth.

Explore 3 other fair value estimates on Zimmer Biomet Holdings - why the stock might be worth just $95.00!

Build Your Own Zimmer Biomet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zimmer Biomet Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zimmer Biomet Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zimmer Biomet Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zimmer Biomet Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZBH

Zimmer Biomet Holdings

Operates as a medical technology company worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives