- United States

- /

- Medical Equipment

- /

- NYSE:ZBH

Should Investors Revisit Zimmer Biomet After Shares Slide and FDA Clearance for Persona IQ?

Reviewed by Bailey Pemberton

If you’re watching Zimmer Biomet Holdings and wondering whether now is the moment to act, you’re not alone. The stock has seen its fair share of ups and downs lately: down 6.0% in the last week, 7.4% over the past month, and off by 9.3% year-to-date. Even stretching out further, the stock has dripped about 7.6% over the past year and is down a notable 30.9% across five years. At first glance, those numbers could make even patient investors question if there’s still a reason to believe in a turnaround or if lingering market doubts are a warning sign.

Yet, here’s where things get interesting. Despite the market’s cooled enthusiasm, Zimmer Biomet Holdings has earned a value score of 5 out of 6, meaning it passes nearly every test for being undervalued. This isn’t just a single metric; it’s a composite based on multiple industry-standard valuation checks. So is the market missing something, or are these numbers sending a signal worth paying attention to?

Let’s break down how each valuation approach stacks up. Stay tuned, because we’ll dig into a smarter way to look at valuation that goes beyond the standard scorecard by the end of this article.

Why Zimmer Biomet Holdings is lagging behind its peers

Approach 1: Zimmer Biomet Holdings Discounted Cash Flow (DCF) Analysis

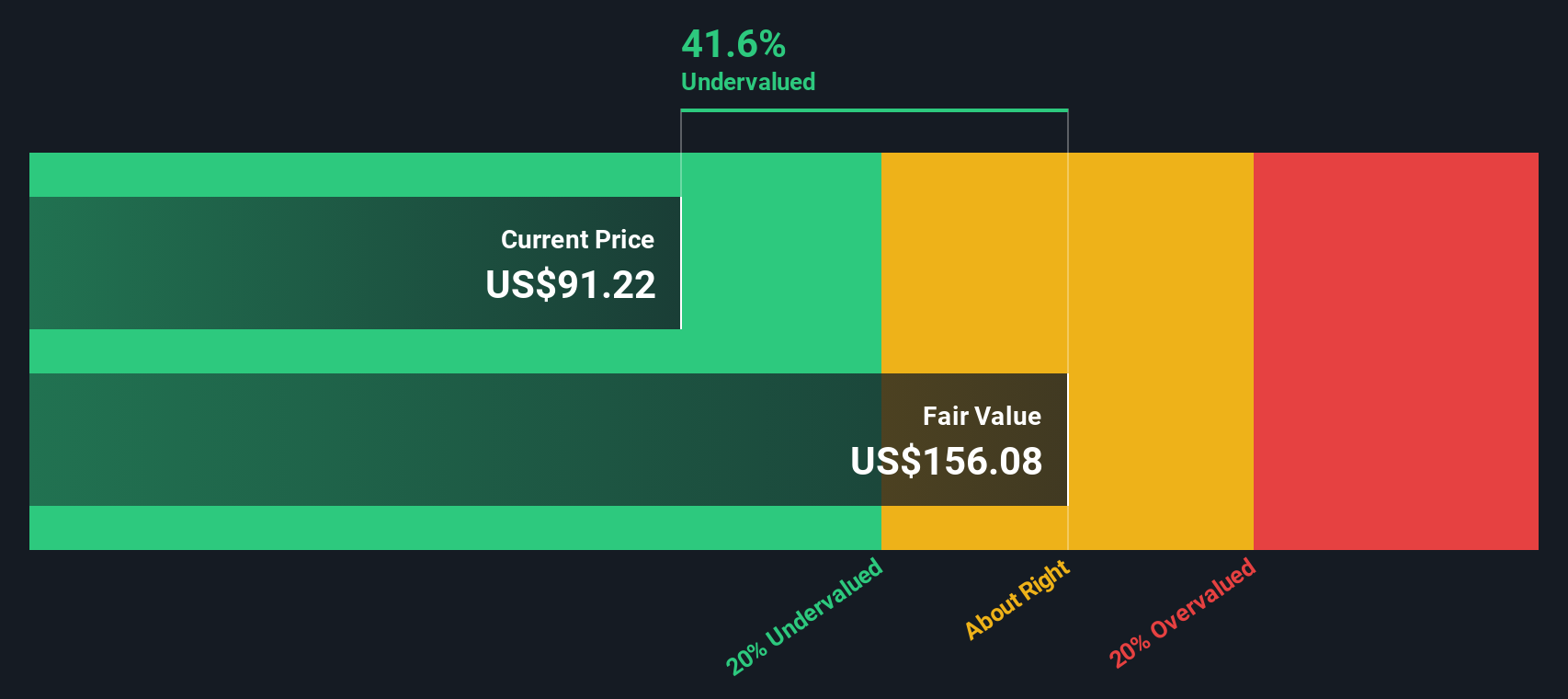

The Discounted Cash Flow (DCF) model estimates a company's true value based on the cash it is expected to generate in the future, all brought back to today’s value. This approach starts with the current Free Cash Flow (FCF), projects this number out over the coming years, and then discounts each year’s estimated cash flows to reflect their present value.

For Zimmer Biomet Holdings, the most recent reported FCF stands at $1.03 billion. Analysts estimate that this number could rise to $1.73 billion by the end of 2027, reflecting a steady, though slightly moderating, growth rate. Beyond that point, Simply Wall St has extended projections up to 2035, using reasonable growth rates that gradually decelerate over time. These longer-term figures are not direct analyst forecasts but are extrapolated to give a sense of the company’s future cash-generating power.

Pushing all these expected cash flows into the model delivers an estimated intrinsic value of $168.82 per share. Based on where shares are currently trading, this suggests Zimmer Biomet Holdings may be undervalued by about 43.9% using the DCF method. This could indicate a potentially attractive opportunity for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zimmer Biomet Holdings is undervalued by 43.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Zimmer Biomet Holdings Price vs Earnings (PE)

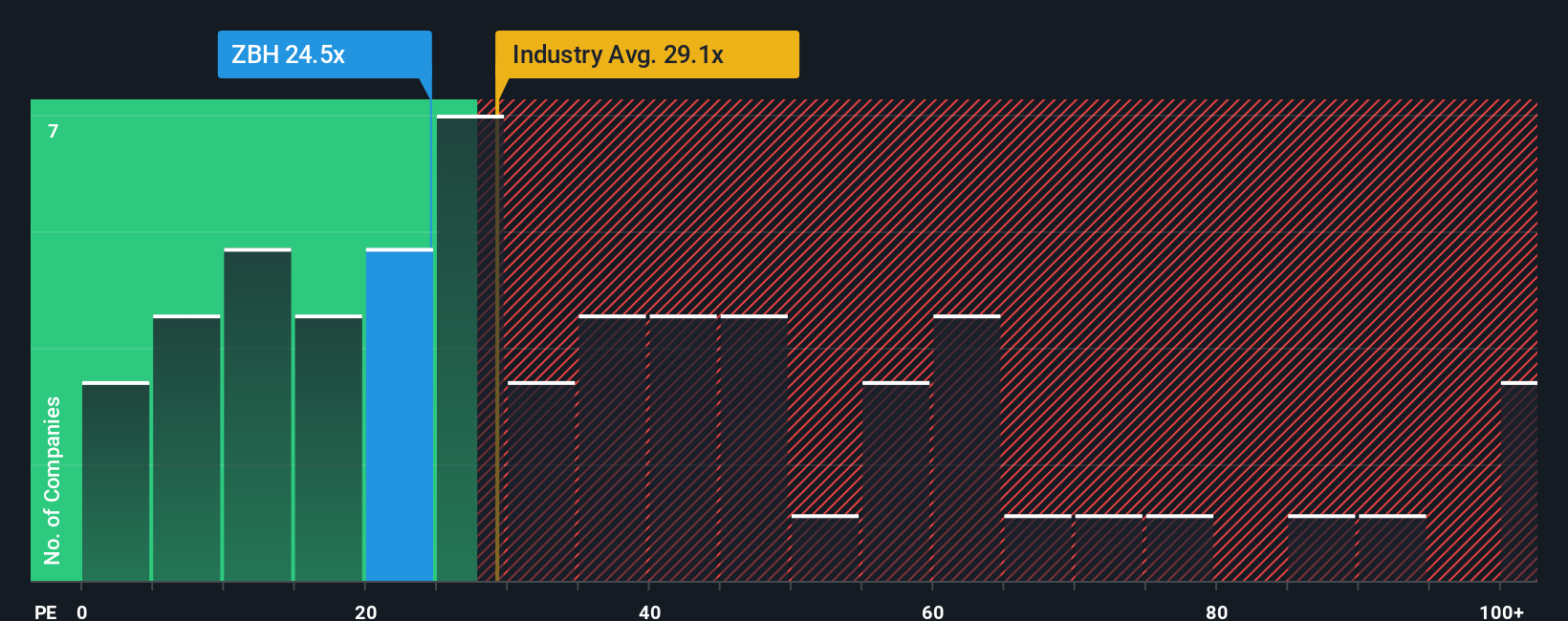

For established, profitable companies like Zimmer Biomet Holdings, the Price-to-Earnings (PE) ratio is a go-to valuation tool. The PE ratio is especially helpful because it directly compares the company’s share price to its earnings, providing a snapshot of how much investors are willing to pay for each dollar of profit. It is most effective when the company generates steady earnings, as is the case here.

What counts as a “normal” or “fair” PE ratio depends on several factors. Companies with strong growth prospects usually trade at higher PE ratios, while those facing more risks or slower growth tend to be assigned lower multiples. Broader industry trends and market sentiment also influence what is considered fair value.

Currently, Zimmer Biomet Holdings is trading at a PE ratio of 22.8x. This sits below the Medical Equipment industry average of 29.5x and is also significantly lower than the peer average of 50.3x. However, relying solely on these benchmarks can be misleading, as they do not consider company-specific factors.

Simply Wall St's "Fair Ratio" seeks to solve this by tailoring the preferred multiple to Zimmer Biomet Holdings’ unique profile, factoring in its growth, profit margins, market cap, and risks along with broader industry dynamics. For Zimmer Biomet Holdings, the Fair Ratio stands at 26.2x, just a few points above its current multiple. This approach provides a more balanced view than simply comparing to industry or peer averages as it reflects the stock’s distinct strengths and challenges.

Given that Zimmer Biomet Holdings' market PE of 22.8x is moderately below its Fair Ratio of 26.2x, the stock appears undervalued based on this analysis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

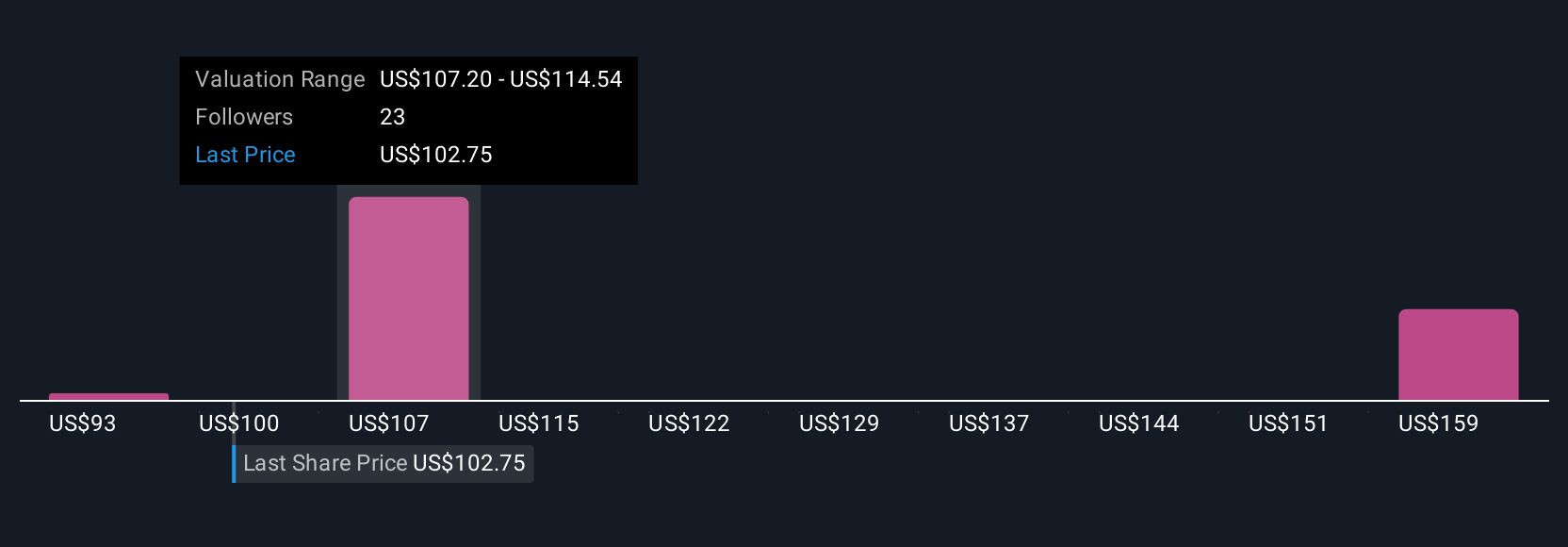

Upgrade Your Decision Making: Choose your Zimmer Biomet Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative on Simply Wall St is a clear, accessible way for investors to connect their personal view of a company’s story to real numbers. This links future revenue, earnings, and profit margins into a financial forecast that drives a Fair Value estimate. Narratives go far beyond standard scores or ratios by letting you factor in the unique catalysts, risks, and industry changes you believe matter most for Zimmer Biomet Holdings, all in the context of your investment logic.

These Narratives are not only easy to create and understand, but are also shared and discussed by millions on Simply Wall St’s Community page, making insights visible and actionable for everyone. Narratives automatically keep up with new developments, so when news or earnings emerge, your Fair Value and buy/sell signals update dynamically. For example, one investor may expect rapid robotics adoption and margin expansion, forecasting a Fair Value of $138. Another might focus on regulatory and integration risks, estimating only $96. Both examples reflect different convictions for Zimmer Biomet Holdings based on changing facts. This empowers you to invest with confidence, grounded in your own evolving narrative rather than just following the crowd.

Do you think there's more to the story for Zimmer Biomet Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zimmer Biomet Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZBH

Zimmer Biomet Holdings

Operates as a medical technology company worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives