- United States

- /

- Healthcare Services

- /

- NYSE:UHS

With Universal Health Services, Inc. (NYSE:UHS) It Looks Like You'll Get What You Pay For

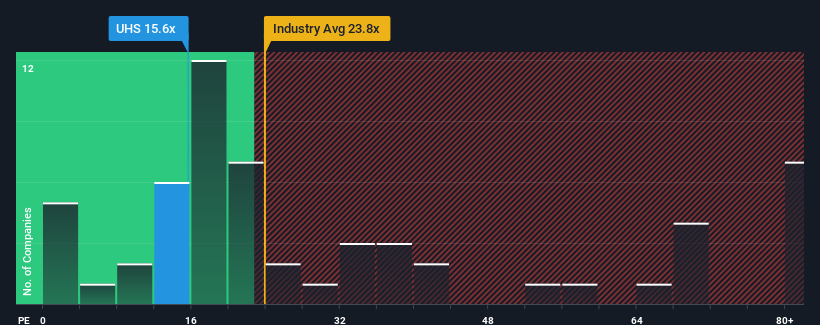

There wouldn't be many who think Universal Health Services, Inc.'s (NYSE:UHS) price-to-earnings (or "P/E") ratio of 15.6x is worth a mention when the median P/E in the United States is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Universal Health Services has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for Universal Health Services

Is There Some Growth For Universal Health Services?

In order to justify its P/E ratio, Universal Health Services would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.2%. The last three years don't look nice either as the company has shrunk EPS by 3.4% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 12% per annum, which is not materially different.

In light of this, it's understandable that Universal Health Services' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Universal Health Services' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Universal Health Services maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Universal Health Services.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UHS

Universal Health Services

Through its subsidiaries, owns and operates acute care hospitals, and outpatient and behavioral health care facilities.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives