- United States

- /

- Medical Equipment

- /

- NYSE:TFX

DUBSTENT DIABETES Trial Launch Could Be a Game Changer for Teleflex (TFX)

Reviewed by Simply Wall St

- Teleflex Incorporated recently announced that the first patient has been enrolled in the DUBSTENT DIABETES trial, a randomized clinical study comparing dual-device and single-device strategies for percutaneous coronary intervention in diabetic patients using its Pantera Lux Drug-Coated Balloon Catheter and Orsiro Mission Drug-Eluting Stent.

- This trial addresses a significant challenge in cardiovascular care, as diabetic patients continue to face higher rates of stent failure despite medical advances.

- We'll explore how this clinical trial enrollment underscores Teleflex's innovation in interventional cardiology and its potential to shape investor outlooks.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Teleflex Investment Narrative Recap

To be a Teleflex shareholder today, you need confidence in the company's ability to regain momentum through innovation and operational improvement, particularly as it works to integrate recent acquisitions and overcome persistent headwinds in legacy product lines. The DUBSTENT DIABETES trial signals fresh progress in interventional cardiology but is unlikely to materially impact the most important near-term catalyst: achieving sustained, margin-accretive revenue growth after recent declines, while the biggest risk remains ongoing weakness in key segments like UroLift.

Among recent announcements, the acquisition of BIOTRONIK’s Vascular Intervention business stands out as most relevant. This move has the potential to expand Teleflex’s presence in high-growth cardiovascular markets. The DUBSTENT DIABETES trial will leverage products from both companies, making clinical validation and successful integration vital to capturing market share and improving financial performance.

In contrast, investors should be alert to the possibility that continued sluggishness in core product lines could limit the benefits from…

Read the full narrative on Teleflex (it's free!)

Teleflex's narrative projects $3.9 billion revenue and $553.0 million earnings by 2028. This requires 8.9% yearly revenue growth and a $361.1 million increase in earnings from $191.9 million today.

Uncover how Teleflex's forecasts yield a $132.62 fair value, in line with its current price.

Exploring Other Perspectives

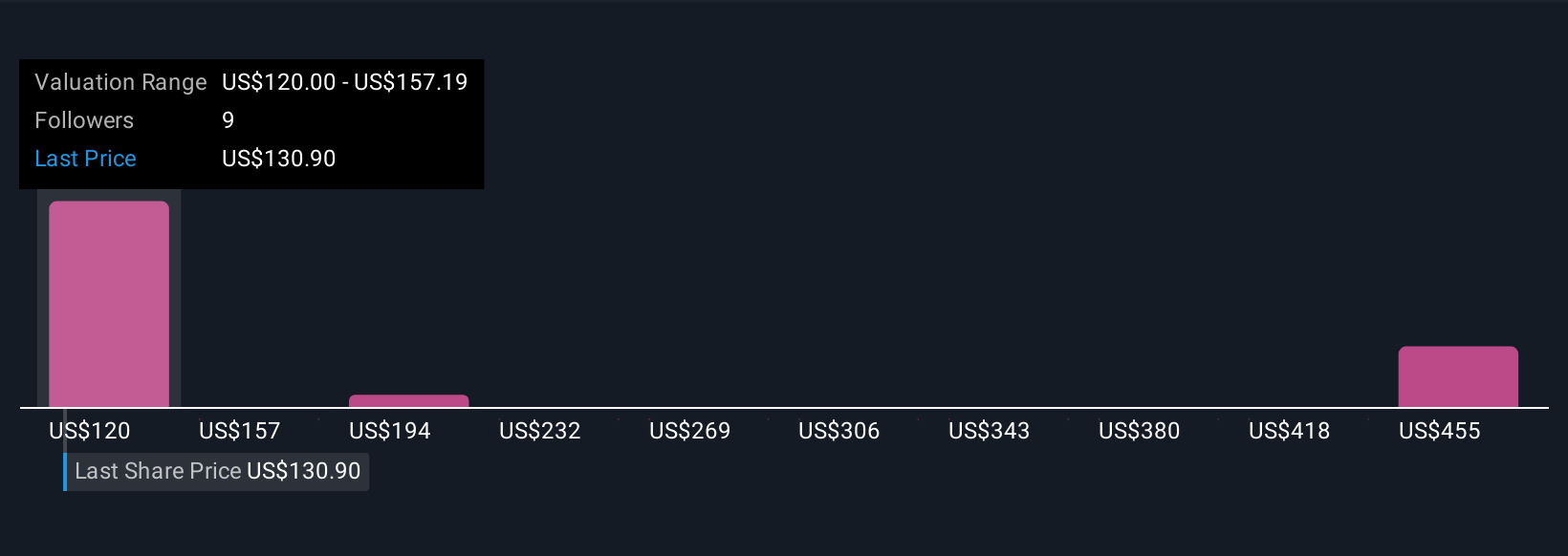

Simply Wall St Community members assigned fair values between US$120 and US$490, using five independent forecasts. While opinions vary widely, key future results may hinge on whether Teleflex’s product innovation can offset persistent margin risks.

Explore 5 other fair value estimates on Teleflex - why the stock might be worth 8% less than the current price!

Build Your Own Teleflex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teleflex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Teleflex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teleflex's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teleflex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFX

Teleflex

Designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives