- United States

- /

- Healthtech

- /

- NYSE:TDOC

Teladoc Health (TDOC): Ongoing Losses Persist, Testing Value Narrative at 0.6x Price-to-Sales

Reviewed by Simply Wall St

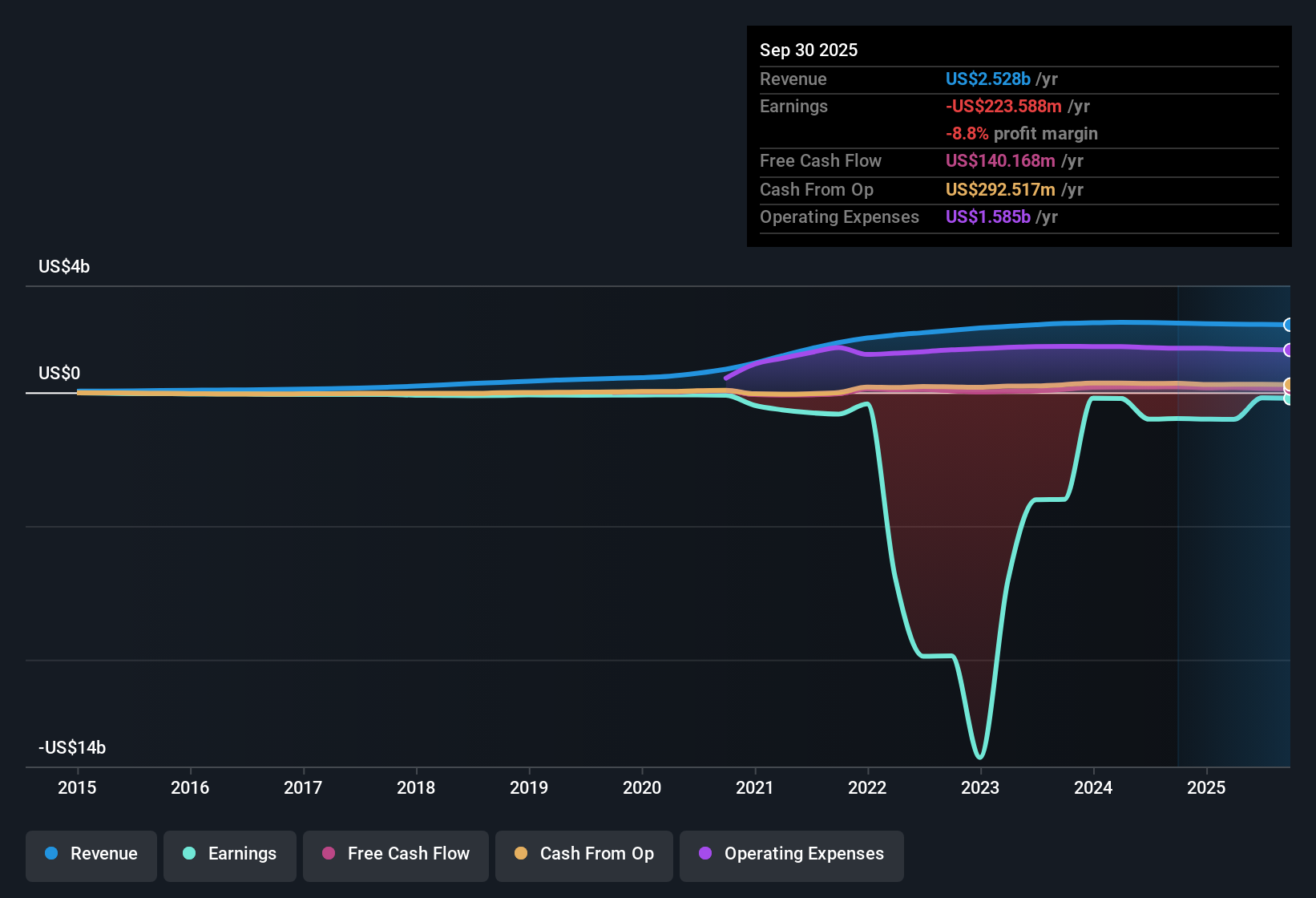

Teladoc Health (TDOC) remains unprofitable, with forecasts indicating no expectation of profitability over the next three years. The company has narrowed its losses at a 12% annual rate over the past five years, while revenue is projected to increase by 2.3% per year. This revenue growth rate trails the US market average of 10.3%. Despite ongoing net losses and a stagnant profit margin, shares currently trade at a Price-to-Sales Ratio of 0.6x. This is well below both the US Healthcare Services industry average of 3.4x and the peer average of 3.8x. These factors may signal potential value for investors focused on sales-based metrics.

See our full analysis for Teladoc Health.Next, we will see how the earnings results measure up against the main stories circulating in the market and test which investor narratives hold up and which might be challenged by the data.

See what the community is saying about Teladoc Health

International Expansion Brings Double-Digit Growth

- Teladoc’s international integrated care unit achieved double-digit growth, standing out as a key driver even as overall group revenue is projected to grow at just 2.3% per year, slower than the US market average of 10.3%.

- According to the analysts' consensus narrative, expanding into new global markets and launching localized services is expected to strengthen membership growth and diversify revenue:

- The company’s ability to access underserved markets with its enhanced digital chronic care and mental health offerings is presented as supporting long-term topline growth.

- However, despite these gains abroad, the lack of anticipated profit improvement and continued high operating costs may offset some benefits from these international efforts.

- See how bulls and bears clash on Teladoc's global strategy in the full consensus narrative. 📊 Read the full Teladoc Health Consensus Narrative.

BetterHelp Transition Squeezes Gross Margins

- Management flags that the move from high-margin cash pay users to lower-margin insurance-based revenue in the BetterHelp segment is expected to depress overall gross margins, with no clear timeline for recovery.

- Analysts' consensus narrative points to both near-term pain and possible strategic payoffs:

- Shifting to insurance-backed care could help restore BetterHelp’s user and revenue growth trajectory over the next 12 to 18 months by addressing consumer demand for covered care.

- However, margins on insurance revenue are notably lower, so while top-line may stabilize, overall earnings quality could remain under pressure absent significant cost improvements.

Analyst Price Target Offers a Slim Premium

- With Teladoc shares at $8.74, analysts’ consensus price target is $9.30, representing only a 6% potential upside, despite the stock’s Price-to-Sales Ratio of 0.6x being well below peers and industry averages.

- The analysts' consensus narrative highlights that for the price target to be met by 2028, the company would need to reach $2.7 billion in revenue, $235.6 million in earnings, and trade at a 9.7x PE, a stretch from the current loss position:

- This relatively modest premium suggests the market price already reflects skepticism about a rapid turnaround, even as some value investors may view the low valuation multiples as attractive for a potential rebound.

- How Teladoc narrows losses and capitalizes on operational streamlining will likely determine whether today’s discount justifies optimistic projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Teladoc Health on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a unique take on the numbers? Take a few moments to share your insights and craft a narrative in just minutes. Do it your way

A great starting point for your Teladoc Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Teladoc Health’s limited revenue growth, ongoing losses, and uncertain margin recovery highlight its struggle to deliver consistent performance compared to peers.

If you want to focus on companies that reliably grow both sales and earnings regardless of the cycle, use our stable growth stocks screener (2108 results) to identify investments with a steadier track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teladoc Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDOC

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)