- United States

- /

- Healthtech

- /

- NYSE:TDOC

Should Teladoc Health’s (TDOC) AI Workplace Safety Launch Prompt a Closer Look From Investors?

Reviewed by Sasha Jovanovic

- Teladoc Health recently announced the launch of a new artificial intelligence-enabled workplace safety feature within its Clarity monitoring solution, designed to help hospitals and health systems detect and intervene in escalating incidents of workplace violence using real-time video and audio analysis.

- This expansion positions Teladoc Health to address growing safety concerns in healthcare settings and potentially attract new hospital partnerships through its advanced AI-driven capabilities.

- We'll examine how this AI-powered workplace safety innovation could reshape Teladoc Health's investment narrative and future platform opportunities.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

Teladoc Health Investment Narrative Recap

To be a Teladoc Health shareholder, you need to believe in the company’s ability to turn innovation and operational streamlining into accelerating revenue growth and margin improvement, even while unprofitable and under competitive pressure. The recent AI-powered workplace safety feature within Clarity is well-aligned with product innovation catalysts, but its announced rollout beginning in Q1 2026 means it is unlikely to materially impact the upcoming earnings release or address the immediate risk of insecurity in BetterHelp’s user and revenue trends.

Among Teladoc’s latest product-related announcements, the new AI-enabled workplace safety solution stands out for clearly illustrating the company’s ongoing investment in technology-driven offerings. While it strengthens Teladoc’s narrative around innovation and could influence future hospital partnerships, the nearer-term catalysts such as member growth in integrated care remain dependent on broader execution in core segments.

On the flip side, investors should also keep an eye on persistent risks tied to mounting pressure in the BetterHelp segment, where the shift to insurance-based revenue has...

Read the full narrative on Teladoc Health (it's free!)

Teladoc Health's narrative projects $2.7 billion revenue and $235.6 million earnings by 2028. This requires 1.9% yearly revenue growth and a $443 million increase in earnings from -$207.4 million today.

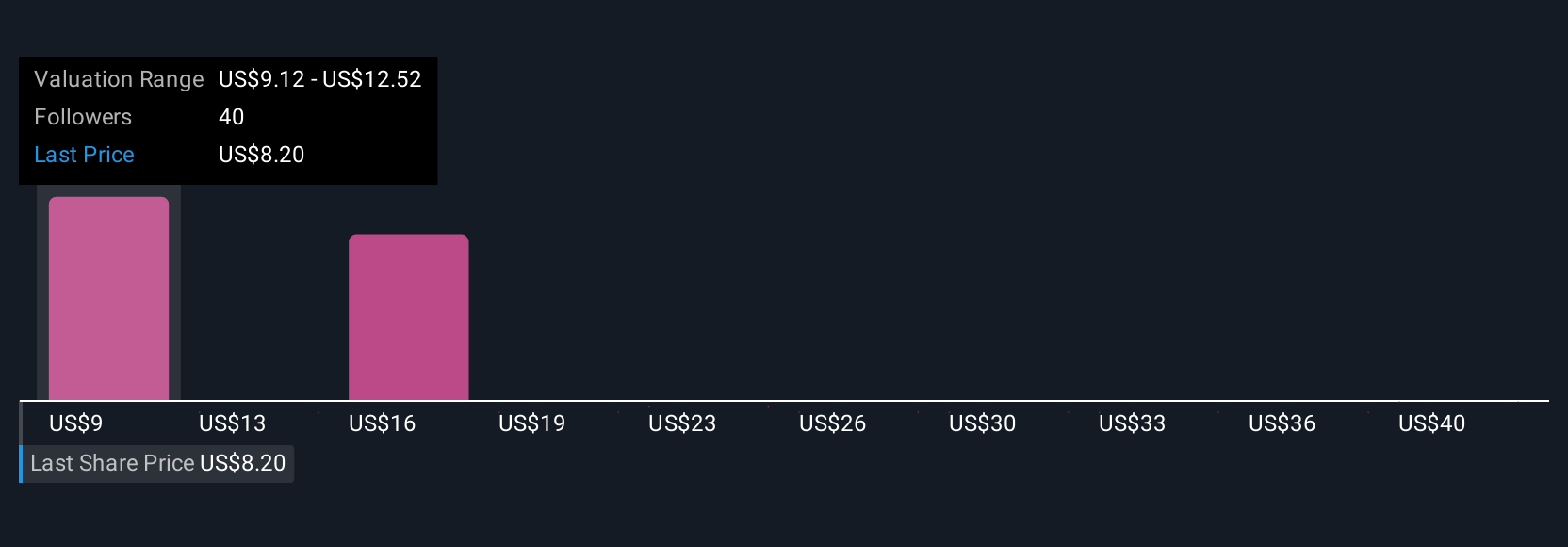

Uncover how Teladoc Health's forecasts yield a $9.12 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Teladoc Health range from US$9.13 to US$42.04, across five distinct viewpoints. With this spectrum of market opinions, consider how ongoing competition and margin pressure in BetterHelp may continue to shape performance, your view may land anywhere on that range if you explore what matters most to you.

Explore 5 other fair value estimates on Teladoc Health - why the stock might be worth just $9.12!

Build Your Own Teladoc Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teladoc Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teladoc Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teladoc Health's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teladoc Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDOC

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives